- Housing Starts: Monday, 12:15. Housing Starts fell to 246 thousand in February, down sharply from 282 thousand. The consensus for March stands at 254 thousand.

- Budget Release: Tentative. The Trudeau government releases its first budget in two years. The government is expected to pledge tens of billions of dollars in spending to boost the economic recovery, as the government eyes a possible election later in the year.

- Inflation Report: Wednesday, 12:30. The recovery is gaining traction, but CPI remains well below the BoC target of 2 percent. We await the headline and core inflation releases for March.

- BoC Rate Decision: Wednesday, 14:00. With the economic outlook improving more quickly than anticipated, the BoC could announce a tapering of QE at the upcoming meeting. If so, the BoC would be the first G-7 central bank to tighten policy since the Covid-19 pandemic.

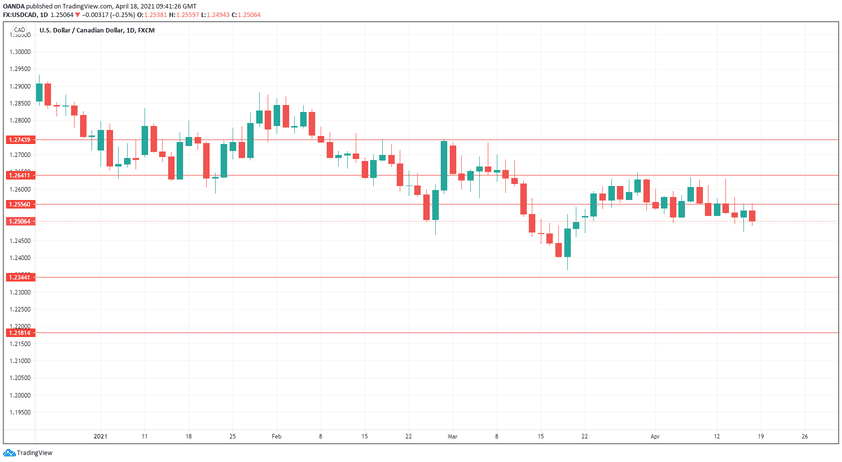

Technical lines from top to bottom:

We start with resistance at 1.2744.

1.2640 was tested at the end of March.

1.2555 (mentioned last week) is next.

1.2345 is the first support level.

1.2181 is the final line for now.

.

I remain bearish on USD/CAD

The Canadian economy is finding its footing, and employment numbers continue to impress. If the BoC sends a hawkish message to the market at this week’s meeting, then the Canadian dollar could gain ground.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!