USD/CAD dipped lower but recovered late in the week, as the pair showed little change for a second straight week. There is only one release in the upcoming week. Here is an outlook at the highlights and an updated technical analysis for USD/CAD.

Canada’s manufacturing sector continues to show improvement, as Manufacturing PMI punched into expansion territory, with a reading of 52.9 in July. Back in April, the PMI dropped to a miserable 33.0. Canada posted some strong data at the end of the week, but the Canadian dollar still lost ground. The economy created an impressive 418.5 thousand, beating the estimate of 395.0 thousand. The unemployment rate fell to 10.9%, down from 12.3% beforehand.

- Housing Starts: Monday, 12:15. Housing starts punched past the 200K-level in June, for the first time in four months. The indicator improved to 212 thousand, up from 193 thousand beforehand. This marked a 5-month high. The forecast for July stands at 201 thousand.

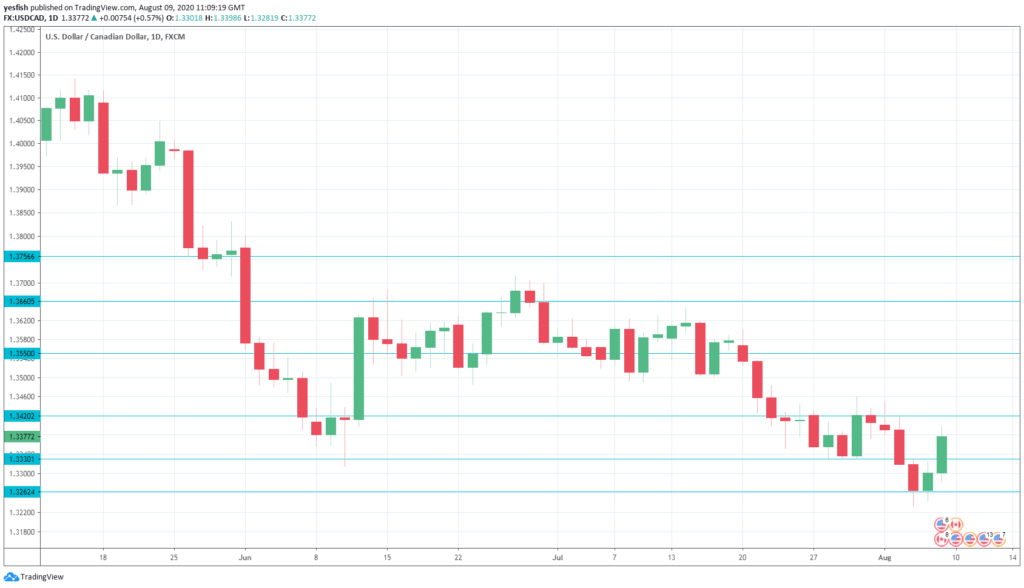

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 1.3757.

1.3661 (mentioned last week) is next.

1.3550 has held in resistance since mid-July.

1.3420 was tested in resistance early in the week.

1.3330 is a weak support line.

1.3265 is next.

1.3078 is the final support level for now.

.

I am neutral on USD/CAD

The Canadian dollar continues to hold its own against the greenback, but wasn’t able to make any inroads last week. Both the US and Canada posted strong job numbers on Friday, so there wasn’t much volatility from the pair at the end the week. The lack of activity could continue in the upcoming week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!