Dollar/CAD gained some ground on the dovish decision by the BOC. Will it continue rising? The BOC has another opportunity to move the markets with a speech by BOC Governor Stephen Poloz. Here are the highlights and an updated technical analysis for USD/CAD.

The Bank of Canada left the interest rate unchanged at 1% as expected but surprised markets by remaining quite cautious on the outlook. It seems like Poloz and his colleagues in Ottawa are not very keen on raising interest rates in the near future. This certainly hurt the loonie in a week which mostly saw positive figures in the trade balance report, housing figures and more. In the US, the greenback enjoyed the significant progress made on tax cuts while dropping a little on the mixed NFP.

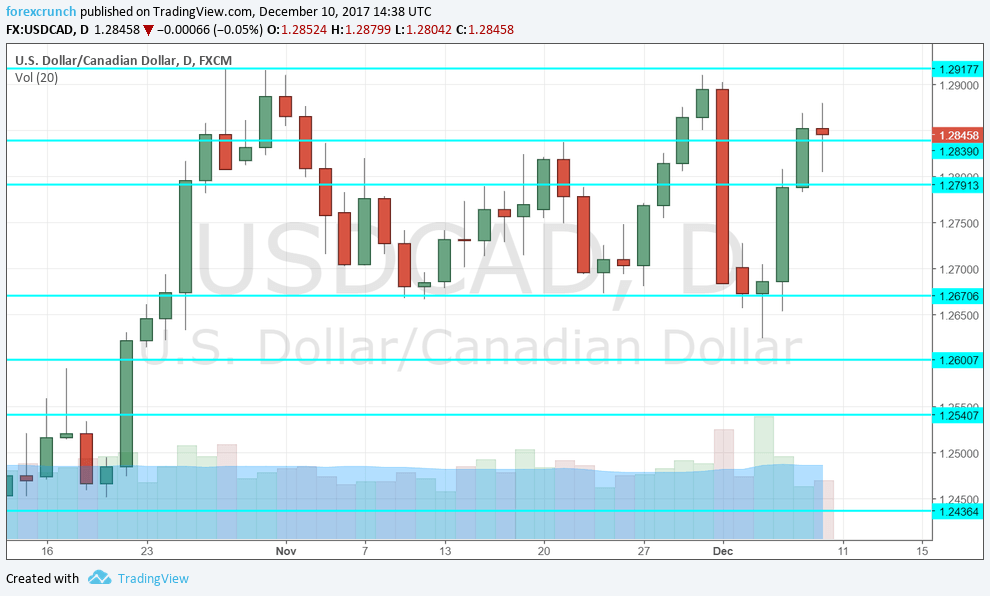

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- NHPI: Thursday, 13:30. The New House Price Index rose by 0.2% in September, despite some jitters in some housing markets, notably Vancouver and Toronto. A rise of the same scale is expected also for October.

- Stephen Poloz talks: Thursday, 17:25. The Governor of the BOC will deliver an interesting speech in Toronto, titled “Three Things Keeping Me Awake at Night”. Will he lay out deep concerns about lower inflation? He may express some worries and the Canadian dollar could be in a “tin-hat mode”. The text of the speech is released some 15 minutes before he talks.

- Manufacturing Sales: Friday, 13:30. This important indicator rose by 0.5% in September. It has a tendency to move the Canadian dollar more than the parallel figure in other countries. This time, an increase of 0.3% is forecast.

: :* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD initially dipped but never went too far. It then took an upswing and reached above 1.2840 (mentioned last week), a bullish sign.

Technical lines from top to bottom:

1.3160 provided support back in June. 1.3020, just above the round level of 1.30, worked as resistance back in July.

1.2920 capped the pair in late October and turned into a double-top in No. It is followed by 1.2840 capped the pair in mid-November and also had a role in the past.

1.2790 was the high in mid-November and serves as resistance. 1.2665 was a was a double-bottom in November and works as strong support.

It is followed by 1.26, a round number that worked as resistance in October. 1.2540 capped the pair in early October when it traded in a narrow range.

1.2435 was a cushion for the pair during the month of October. 1.2335 gave support to the pair in late September.

I remain neutral on USD/CAD

The better than expected data counters the dovishness of the BOC. This trend could continue for a while longer. The Fed is unlikely to rock the boat. All in all, things could remain balanced for yet another week.

Our latest podcast is titled A December to remember for EUR/USD

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!