Dollar/CAD advanced to higher ground but dropped sharply on excellent Canadian data. The highlight of the week is clearly the rate decision, but there are quite a few other events. Here are the highlights and an updated technical analysis for USD/CAD.

Canada gained no less than 79.5K jobs in November and alongside a small beat on GDP, the C$ made a big jump. OPEC decided to extend the production cuts for yet another 9 months, not an earth-shattering decision, and oil consolidated the previous gains. In the US, a mix of hopes for tax reform, excellent data, and also upbeat comments from Fed officials supported the greenback.

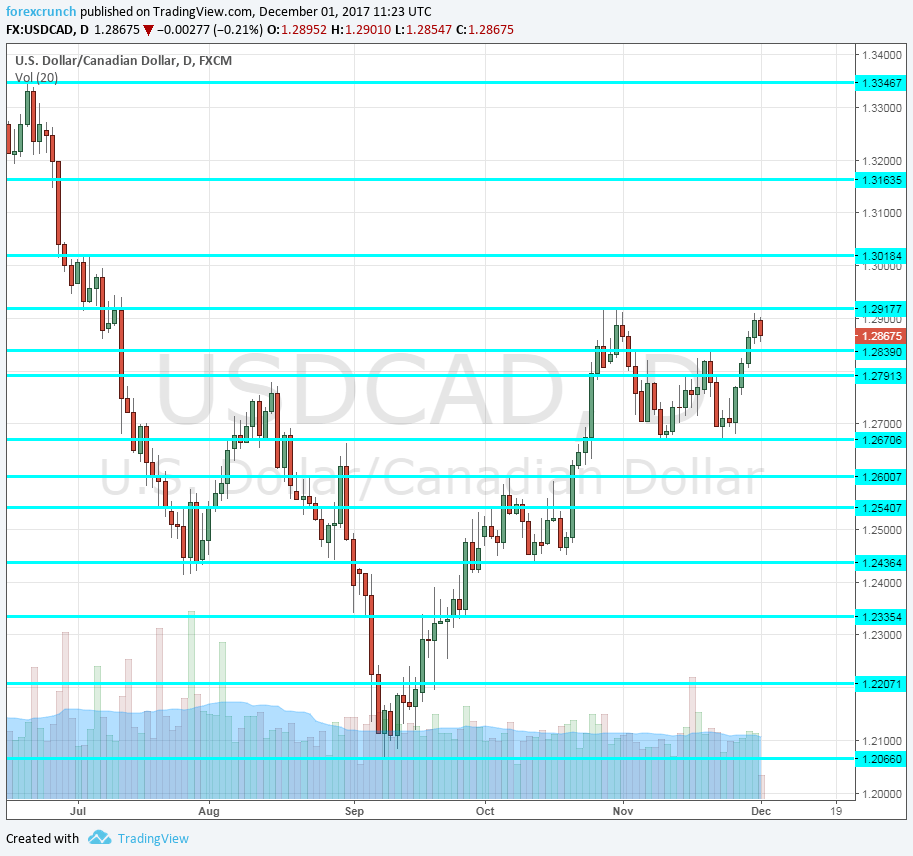

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Trade Balance: Tuesday, 13:30. Canada’s trade balance turned negative early in the year and the deficit reached 3.2 billion in September, worse than had been expected. We will now get the figures for November, which will probably be similar. A deficit of 2.3 billion is predicted.

- Labor Productivity: Wednesday, 13:30. Productivity growth is an issue all over the developed world. In Canada, productivity fell by 0.1% in Q2 2017. A bounce may be seen in Q3.

- Rate decision: Wednesday, 15:00. The Bank of Canada signaled a long pause after raising rates twice in a row. Stephen Poloz and his colleagues are not expected to change course this time. In the previous meeting, they were quite dovish, expressing worries about a slowdown. Since then, the economic figures have not been that convincing. Will they be even more dovish? Markets still expect the BOC to hike in 2018, but nothing is certain.

- Building Permits: Thursday, 13:30. The number of building permits jumped by 3.8% in September, beating expectations and with an upwards revision. However, the numbers are quite volatile and a drop cannot be ruled out now.

- Ivey PMI: Thursday, 15:00. The Richard Ivey Business School showed a lot of optimism among the purchasing managers’ surveyed. A score of 63.8 represents robust growth, the highest since early 2016.

- Housing Starts: Friday, 13:15. Canada’s housing sector is looking good in recent months, with the number of starts beating expectations in the past few months. A level of 223K was recorded in October. A similar level of 221K is on the cards.

- Capacity Utilization Rate: Friday, 13:30. The utilization rate is advancing very nicely and reached a high of 85% in Q2, the highest in many years. Will it slide from the highs now?

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD traded under 1.2790 (mentioned last week) early in the trading week.

Technical lines from top to bottom:

1.3160 provided support back in June. 1.3020, just above the round level of 1.30, worked as resistance back in July.

1.2920 capped the pair in late October and turned into a double-top in No. It is followed by 1.2840 capped the pair in mid-November and also had a role in the past.

1.2790 was the high in mid-November and serves as resistance. 1.2665 was a was a double-bottom in November and works as strong support.

It is followed by 1.26, a round number that worked as resistance in October. 1.2540 capped the pair in early October when it traded in a narrow range.

1.2435 was a cushion for the pair during the month of October. 1.2335 gave support to the pair in late September.

I turn from bullish to neutral on USD/CAD

The data coming out of Canada is certainly encouraging but the negative bias against the loonie may need time to disappear. In addition, OPEC’s decision was not bold enough to push oil prices much higher. The US has its own issues, but also enjoys robust growth. All in all, the picture is more balanced now.

Our latest podcast is titled A December to remember for EUR/USD

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!