Dollar/CAD had a mixed week on high ground but it did not pick a new direction. The upcoming week is quite busy with inflation, retail sales and also GDP that is released early. What’s next for the pair? Here are the highlights and an updated technical analysis for USD/CAD.

BOC governor Stephen Poloz did not tell us we didn’t know, but the notion that interest rates are not going anywhere fast remained unchanged. Oil prices eventually provided support to the loonie. In the US, the dollar was supported by a stronger than expected retail sales report and an advance towards approving the tax bill. However, the greenback struggled amid falling inflation and a second dissenter at the Fed.

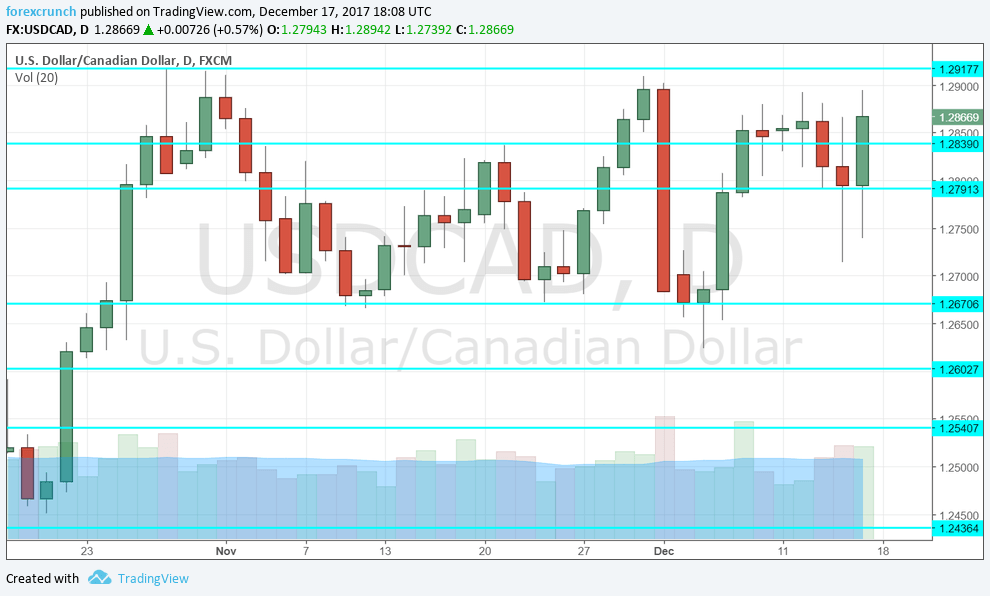

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Foreign Securities Purchases: Monday, 13:30. Flows of funds into Canada rose to 16.81 billion in September, better than had been expected. This supports the loonie. A surplus is likely again, but probably not at the same rate.

- Wholesale Sales: Wednesday, 13:30. Sales at the wholesale level fell short of expectations in the past two months, with a big drop of 1.2% in September, a significant fall.

- Inflation report: Thursday, 13:30. After expecting inflation to pick up, Canada’s central bank is not that certain anymore. Recent data have been mixed. Back in October, headline CPI rose by only 0.1% and core CPI by 0.3%. The BOC has additional measures of core inflation: Common CPI was up 1.6% y/y, the Median CPI came out at 1.6%, and Trimmed CPI at 1.5%. Similar figures are likely now.

- Retail Sales: Thursday, 13:30. The retail sales report for September competes with the inflation data. The volume of sales increased by only 0.1% in the previous month, below predictions. Core retail sales did not shine either, with 0.3%. Pre-Christmas sales probably helped boost sales in October.

- ADP Non-Farm Payrolls: Thursday, 13:30. ADP’s report is quite known in the US but was released for the first time in Canada only last month. Back then, they showed a fall of 5.7K, worse than the official jobs numbers. A bump up is likely now.

- GDP: Friday, 13:30. Canada publishes its growth estimates once per month. After a few disappointing publications, the economy grew by 0.2% in September, cushioning a relatively weak Q3. We now get the first publication for Q4: the GDP report for October.

: :* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD started the week by hovering above 1.2790, a level mentioned last week. It then dropped but never went too far.

Technical lines from top to bottom:

1.3160 provided support back in June. 1.3020, just above the round level of 1.30, worked as resistance back in July.

1.2920 capped the pair in late October and turned into a double-top in No. It is followed by 1.2840 capped the pair in mid-November and also had a role in the past.

1.2790 was the high in mid-November and serves as resistance. 1.2665 was a was a double-bottom in November and works as strong support.

It is followed by 1.26, a round number that worked as resistance in October. 1.2540 capped the pair in early October when it traded in a narrow range.

1.2435 was a cushion for the pair during the month of October. 1.2335 gave support to the pair in late September.

I am bullish on USD/CAD

After a week of consolidation, the loonie could come under renewed pressure. The inflation report could serve as a reminder that the BOC is not ready to hike anytime soon. In addition, oil prices have limited room to the upside.

Our latest podcast is titled What does 2018 have in store for financial markets?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!