Dollar/CAD traded lower as the Canadian dollar enjoyed mostly upbeat figures. Will this continue? There are no Canadian economic releases scheduled for the holiday week, but low liquidity could result in outsized moves Here are the highlights and an updated technical analysis for USD/CAD.

Canadian inflation is finally picking up. The rise of headline CPI by 0.3% m/m was accompanied by advanced on almost all the core measures. In addition, retail sales advanced more than expected. This double-feature publication sent USD/CAD lower. GDP disappointed by remaining flat m/m in October, but it did stop the loonie. In the US, the tax bill was signed into law by Trump, but this positive news for the greenback was already priced in. GDP growth was slightly revised to the downside, but other figures are OK and the economy looks good.

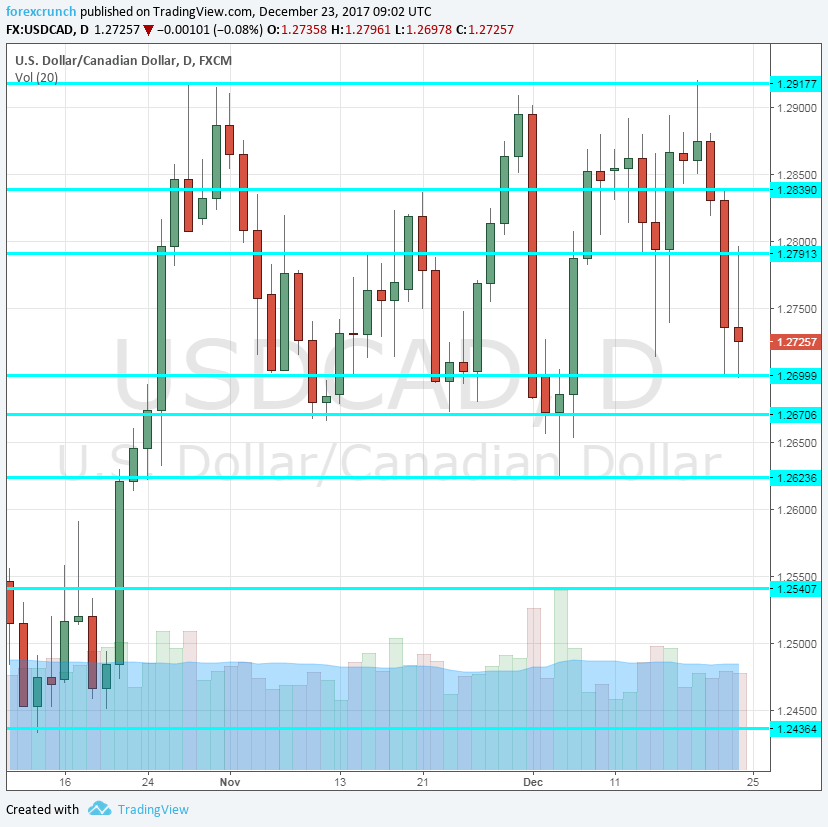

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

: :* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD initially challenged the highs, hitting resistance at 1.2920 (mentioned last week). However, it made a full reversal and eventually met support at 1.27.

Technical lines from top to bottom:

1.3160 provided support back in June. 1.3020, just above the round level of 1.30, worked as resistance back in July.

1.2920 capped the pair in late October and turned into a double-top in No. It is followed by 1.2840 capped the pair in mid-November and also had a role in the past.

1.2790 was the high in mid-November and serves as resistance. 1.2665 was a was a double-bottom in November and works as strong support.

It is followed by 1.26, a round number that worked as resistance in October. 1.2540 capped the pair in early October when it traded in a narrow range.

1.2435 was a cushion for the pair during the month of October. 1.2335 gave support to the pair in late September.

I am neutral on USD/CAD

The pick up in inflation could lead the BOC to a less neutral stance in 2018 and even for rate hikes. Yet for the holiday week, we could see some consolidation before the next moves.

Our latest podcast is titled What does 2018 have in store for financial markets?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!