Dollar/CAD advanced to higher ground as everything went against the loonie. A relatively light week regarding events leaves the focus on stocks, oil, and NAFTA. Here are the highlights and an updated technical analysis for USD/CAD.

The stock market collapse hurt the Canadian dollar, a risk currency. Oil prices suffered from the sell-off in stocks and also from rising US production. To top it off, Canada lost no less than 88K jobs in January, although this came after two excellent months beforehand and wages increased nicely. All in all, the Canadian dollar had everything against it.

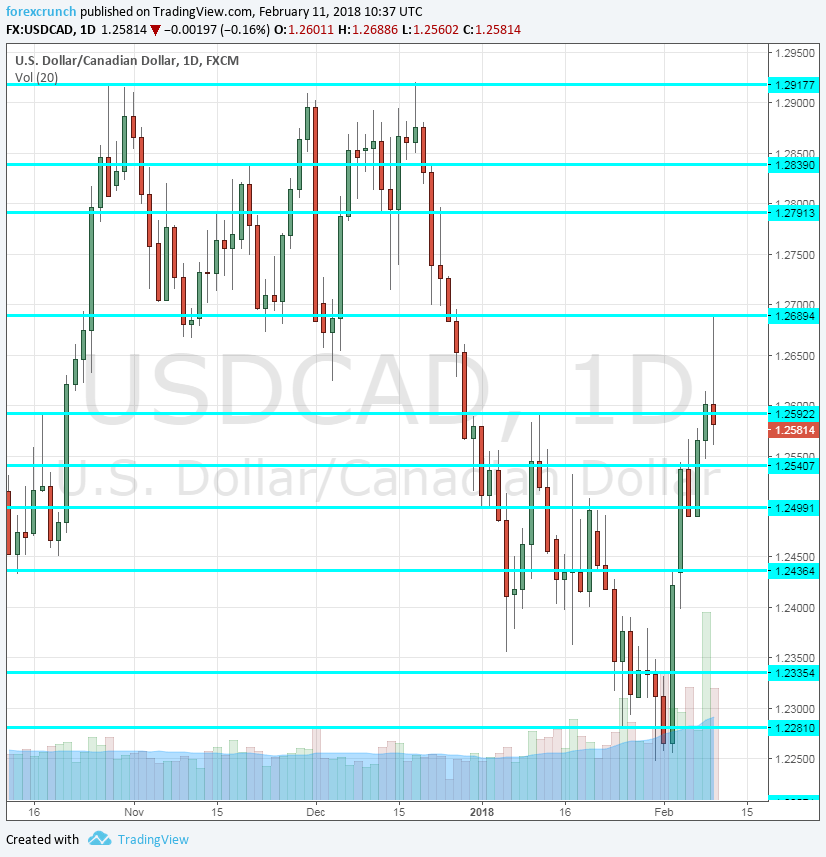

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- ADP Non-Farm Payrolls: Thursday, 13:30. The numbers provided by ADP for Canada’s private sector vary from the official statistics. In December, they showed a drop of 7.1K positions after a big gain beforehand. It will be interesting to see if ADP also reports a big loss of jobs or provides a more optimistic outcome.

- Lawrence Schembri talks: Thursday, 18:30. The BOC Deputy Governor speaks in Winnipeg and may trigger some action if he speaks about the next moves of his institution. He does not speak very often.

- Foreign Securities Purchases: Friday, 13:30. This indicator, often seen as a reflecting trust in the economy, has beat expectations in the past three months, hitting 19.56 billion in November. Another rise is on the cards for December.

- Manufacturing Sales: Friday, 13:30. Sales of manufactured goods increased by 3.4% in November, beating expectations. A slide could be seen this time.

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD initially moved lower, breaching the 1.2280 level mentioned last week. It then made a bit turnaround but stalled beneath 1.2435.

Technical lines from top to bottom:

1.2790 was the high in mid-November and serves as resistance. 1.2665 was a was a double-bottom in November and works as strong support.

It is followed by 1.26, a round number that worked as resistance in October. 1.2540 capped the pair in early October when it traded in a narrow range.

1.2435 was a cushion for the pair during the month of October. 1.2335 gave support to the pair in late September and it worked well in January 2018.

Even lower, 1.2250 cushioned the pair on its fall in February 2018. It is closely followed by 1.22

Strong support only awaits at 1.2070. The round number of 1.20 is next. And below there, only 1.18.

I am bullish on USD/CAD

The excellent US jobs report could continue supporting the greenback while the loonie could suffer from its own report. In addition, oil prices seem to have peaked. These factors could push USD/CAD higher in the short term. Once the worries about NAFTA subside, things could change.

Our latest podcast is titled When everything sells off, where is the money going to?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!