Dollar/CAD finally dropped to lower ground on the weakness of the USD and rising oil prices. Fears of NAFTA are still with us. The upcoming week features the GDP release. Here are the highlights and an updated technical analysis for USD/CAD.

Canadian data was mixed: retail sales missed expectations with a minor rise of 0.2% but core sales jumped by 1.6%. The same happened with core CPI: the headline missed with -0.4% but core figures ticked higher. The US dollar tumbled down on trade worries that are also related to the NAFTA agreement and also on the comments by Treasury Secretary Mnuchin that endorsed a weak dollar. Attempts to stem the fall failed. USD/CAD dropped below the previous lows also thanks to rising oil prices, that continued higher after a pause.

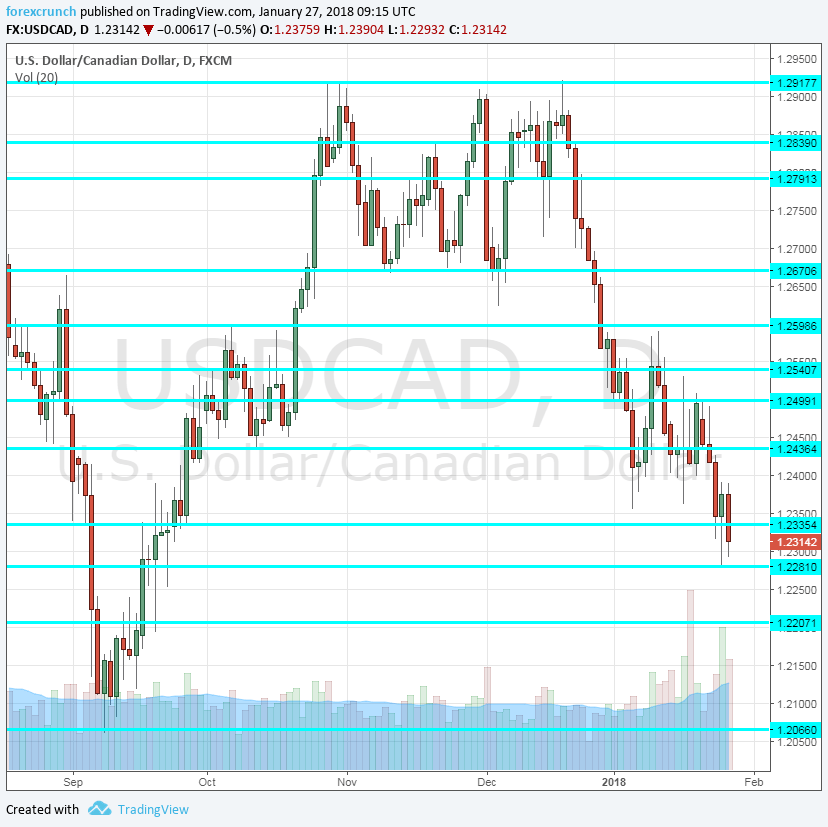

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- GDP: Wednesday, 13:30. The Canadian economy remained flat in October, but expectations for November are already much higher, thanks to an excellent growth in jobs that month. The report should confirm the renewed upswing in the economy.

- RMPI: Wednesday, 13:30. The Raw Materials Price Index rose by 5.5%, the second beat in a row. Rising commodity prices are good for Canadian exports and for pushing domestic inflation higher.

- Manufacturing PMI: Thursday, 14:30. Markit’s purchasing managers’ index for the manufacturing sector was quite steady in recent months, standing at 54.7 in December. This reflects OK growth. A similar print is likely for January.

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD kicked off the week above the 1.2440 level mentioned last week, but it soon fell and dipped under 1.23.

Technical lines from top to bottom:

1.2790 was the high in mid-November and serves as resistance. 1.2665 was a was a double-bottom in November and works as strong support.

It is followed by 1.26, a round number that worked as resistance in October. 1.2540 capped the pair in early October when it traded in a narrow range.

1.2435 was a cushion for the pair during the month of October. 1.2335 gave support to the pair in late September and it worked well in January 2018.

Even lower, 1.2280 cushioned the pair on its fall in January 2018, while strong support only awaits at 1.2070. The round number of 1.20 is next. And below there, only 1.18.

I remain bearish on USD/CAD

Despite ongoing worries about NAFTA, the rising price of oil and the robust Canadian economy will likely push the loonie forward. It is also important to note that the Canadian dollar did not fully take advantage of the USD weakness so far due to worries about the trade agreement. We could see it playing catch-up now.

Our latest podcast is titled Dollar downfall and America’s economy

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!