Dollar/CAD finally dropped to lower ground on the weakness of the USD and rising oil prices. Fears of NAFTA are still with us. The upcoming week features the GDP release. Here are the highlights and an updated technical analysis for USD/CAD.

NAFTA negotiations didn’t blow up, but Canada’s PM Trudeau said his country could abandon it. Canadian GDP came out at 0.4% as expected in November but the biggest driver came from the US: the impressing rise in wages alongside 200K new positions sent the US dollar higher, especially against commodity currencies.

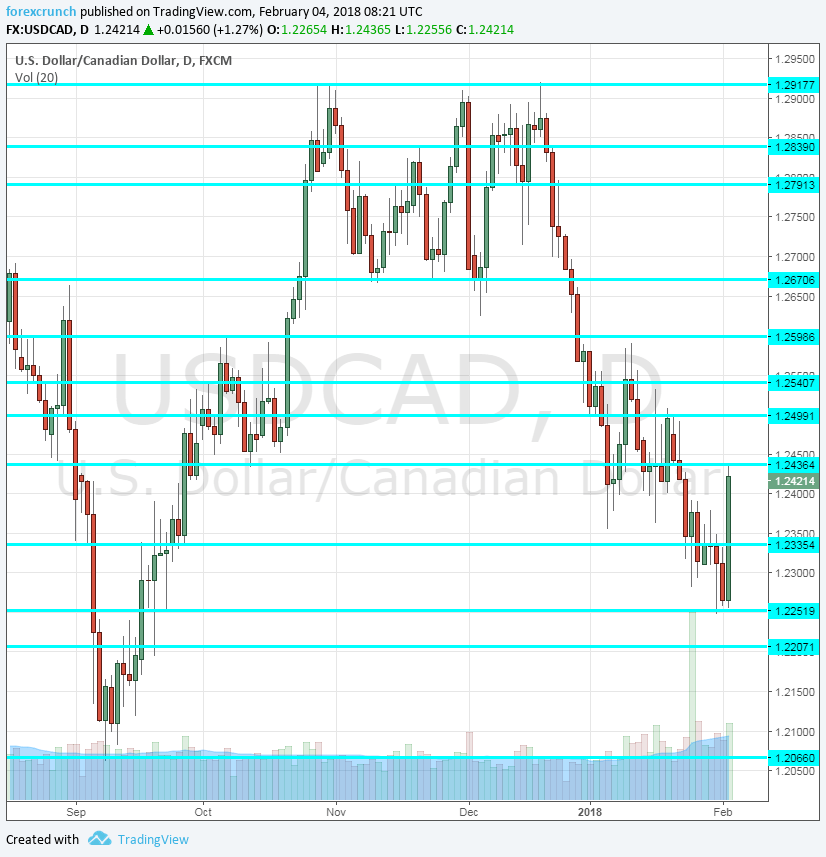

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Trade Balance: Tuesday, 13:30. Canada had trade deficits of varying degrees in recent months with a wider deficit of 2.5 billion in November. A narrower deficit of 2.3 billion of 2.3 billion is expected.

- Ivey PMI: Tuesday, 15:00. The Richard Ivey Business School’s forward-looking index remained on high ground in December, standing at 60.4 points, well above the 50-point threshold that separates expansion from contraction.

- Building Permits: Wednesday, 13:30. The number of construction consents is quite volatile and it dropped by 7.7% in November. We could see a bounce now.

- Housing Starts: Thursday, 13:15. The second housing figure also disappointed in the most recent publication: 218K annualized starts in December. Another drop to 211K is predicted.

- NHPI: Thursday, 13:30. The third housing measure is all about the prices of new homes: these edged up by 0.1% in November and a slight acceleration to 0.2% is projected now.

- Carolyn Wilkins talks: Thursday, 17:45. The Senior Deputy Governor was the first one to hint about a rate hike in the early days of last summer. She will deliver a speech in Quebeq and may certainly rock the loonie.

- Jobs report: Friday, 13:30. Canada gained around 79K jobs in both December and November, outstanding figures. This time, no big changes are expected. IT will not be surprising to see a drop in jobs and that could trigger a sell-off of the Canadian dollar. A small slide of 2K is on the cards. The unemployment rate is projected to rise from 5.7% to 5.8%. The Canadian jobs report is published after the US Non-Farm Payrolls, allowing for reaction to the jobs report in USD/CAD.

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD initially moved lower, breaching the 1.2280 level mentioned last week. It then made a bit turnaround but stalled beneath 1.2435.

Technical lines from top to bottom:

1.2790 was the high in mid-November and serves as resistance. 1.2665 was a was a double-bottom in November and works as strong support.

It is followed by 1.26, a round number that worked as resistance in October. 1.2540 capped the pair in early October when it traded in a narrow range.

1.2435 was a cushion for the pair during the month of October. 1.2335 gave support to the pair in late September and it worked well in January 2018.

Even lower, 1.2250 cushioned the pair on its fall in February 2018. It is closely followed by 1.22

Strong support only awaits at 1.2070. The round number of 1.20 is next. And below there, only 1.18.

I am bullish on USD/CAD

The excellent US jobs report could continue supporting the greenback while the loonie could suffer from its own report. In addition, oil prices seem to have peaked. These factors could push USD/CAD higher in the short term. Once the worries about NAFTA subside, things could change.

Our latest podcast is titled When everything sells off, where is the money going to?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!