USD/CAD showed movement in both directions and was almost unchanged over the week. The data calendar for the upcoming week is very light, with only one minor event. Here is an outlook for the highlights and an updated technical analysis for USD/CAD.

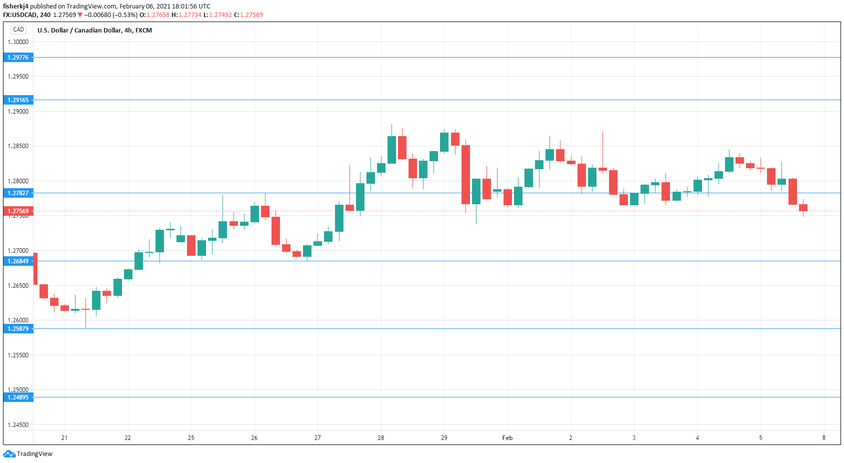

USD/CAD daily graph with resistance and support lines on it. Click to enlarge:

- Wholesale Sales: Monday, 14:30. This consumer spending indicator slowed to 0.7% in November, down from 1.0%. We now await the December data.

Technical lines from top to bottom:

We start with resistance at 1.3074.

1.2977 is protecting the symbolic 1.30 level.

1.2916 (mentioned last week) was last tested in resistance in mid-December.

1.2782 is next.

1.2684 is the first support level.

1.2587 is next.

1.2489 is the final support level for now.

.

I am neutral on USD/CAD

The Canadian dollar escaped a bullet last week, as it managed to hold its own despite dismal job numbers. With the Canadian economy showing strains due to strict Covid lockdowns, the Canadian dollar could face some pressure.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!