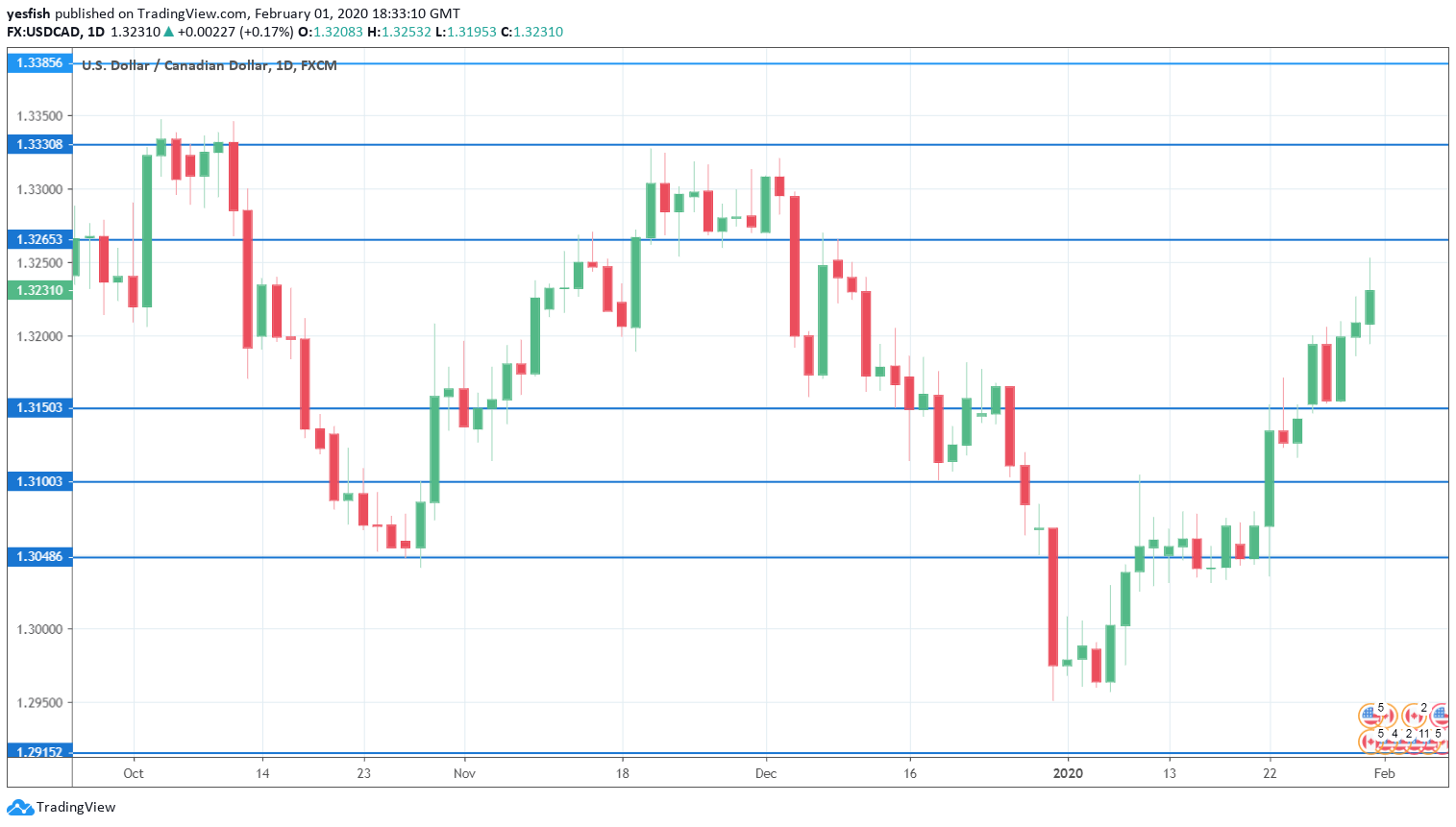

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMI: Monday, 13:30. The index slowed to 50.4 in December, just above the 50-level which separates contraction from expansion. We now await the January release.

- Trade Balance: Wednesday, 13:30. Canada continues to record trade deficits. In December, the deficit was unchanged at C$1.1 billion, larger than the estimate of a deficit of C$0.8 billion. Will we see an improvement in January?

- Employment Reports: Friday, 13:30. The economy created 35.2 thousand in December, rebounding from a sharp loss of 71.2 thousand a month earlier. The unemployment rate dropped to 5.6%, down from 5.9% in November. Strong numbers in January could boost the Canadian dollar.

- Ivey PMI: Friday, 15:00. The index has been showing sharp swings of late. In November, the PMI soared to 60.0, up from 48.2 a month earlier. However, the PMI fell back down to 51.9 in December, shy of the forecast of 60.2 points. The January estimate stands at 52.3 points.

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 1.3550.

1.3445 has remained intact since June 2019. 1.3385 is next.

The round number of 1.3300 has served in a resistance role since early December.

1.3265 is an immediate resistance line.

1.3150 has some breathing room in support after gains by USD/CAD last week.

1.3100 (mentioned last week) is next.

1.3048 is the next support level.

1.2916 has provided support since October 2018.

1.2830 is the final support line for now.

I am bullish on USD/CAD

The recent outbreak of the coronavirus in China continues to spread and has dampened investor risk appetite. Oil prices have also fallen, so the Canadian dollar will have a tough time holding its own against the greenback.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!