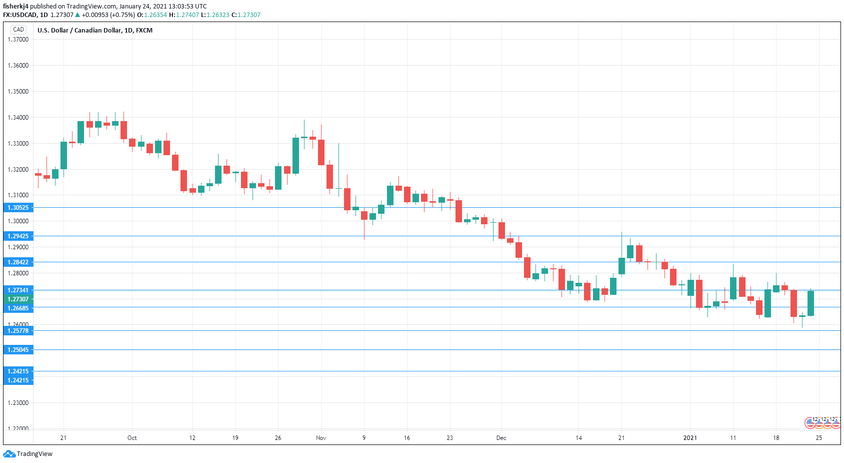

USD/CAD daily graph with resistance and support lines on it. Click to enlarge:

- Building Permits: Thursday, 13:30. This construction index rebounded in December, with a strong gain of 12.9%. We now await the January data.

- GDP: Friday, 13:30. Canada releases GDP on a monthly basis. In November, the economy slowed to 0.4% down from 0.8% beforehand. Will we see a rebound in GDP in December?

- RMPI: Friday, 13:30. The Raw Materials Price Index edged up to 0.6% in December, up from 0.5% beforehand. Will the upturn continue in January?

Technical lines from top to bottom:

We start with resistance at 1.3052.

1.2943 switched to resistance at the start of December, when USD/CAD started its slide.

1.2842 is next.

1.2733 is an immediate resistance line.

1.2669 (mentioned last week) is the first support level.

1.2578 is next.

1.2505 is protecting the round number of 1.2500.

1.2422 is the final support level for now.

.

I am neutral on USD/CAD

With the US presidential inauguration behind us, the markets will be able to focus on fundamental releases. Investors will be keeping a close eye on GDP releases in both the US and Canada, as well as the FOMC rate statement.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!