Dollar/CAD moved higher in a week that saw lots of ups and down on the BOC decision and Trump’s new China tariffs. What’s next? Inflation and retail sales stand out in the Canadian calendar. Here are the highlights and an updated technical analysis for USD/CAD.

The Bank of Canada raised rates and left the bullish bias, signaling more rate hikes. The loonie initially soared on the hawkish hike. However, Stephen Poloz and co. are worried about trade, as it was clearly seen in the statement and in the press conference. On the trade front, the US is readying a tariffs list of no less than $200 billion worth of Chinese goods. Nevertheless, a relatively moderate response by China and hopes for talks helped the atmosphere. Markets stabilized but the loonie remained on the back foot.

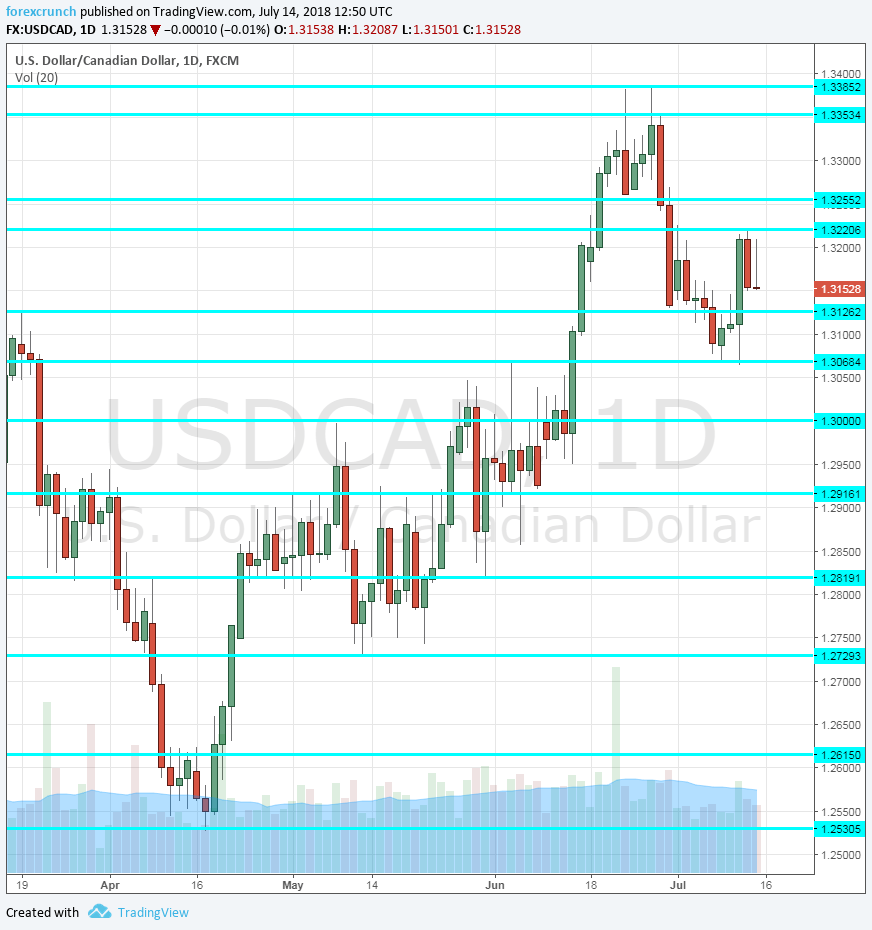

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Foreign Securities Purchases: Monday, 12:30. Purchases of foreign securities rose by a net of 9.13 billion last time. Flows into Canada support the C$.

- Manufacturing Sales: Tuesday, 12:30. This volatile measure of sales at the manufacturing level dropped by 1.3% last time and may bounce back.

- ADP Non-Farm Payrolls: Thursday, 12:30. ADP reports on private sector jobs. Contrary to the publication in the US, Canada’s ADP report is released after the official one, thus not providing a hint. Nevertheless, it may move the loonie. An increase of 2.9K was reported for May. A bigger gain could be seen now after the official figures showed a rise of over 30K.

- CPI: Friday, 12:30. Canada’s double-feature Friday always move the Canadian Dollar even if the figures offset each other. Headline CPI rose by 0.1% in May, a modest increase. While topline prices may advance at a faster clip in June, core prices may lag behind. These fell by 0.1% in May. Common CPI, the MEdian CPI, and Trimmed CPI all stood at 1.9% in May.

- Retail sales: Friday, 12:30. Retail sales fell sharply in April: 1.2% and may rebound now. A greater focus will be on core sales, which fell by 0.1% and may see more modest changes now. Sales are likely to have risen in the spring.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD started the week with a downwards move and challenged the 1.3065 level mentioned last week. It then turned higher.

Technical lines from top to bottom:

1.3795 capped the pair last April. 1.3560 capped the pair back in May 2017 and is a high point.

1.3385 was the high point on two occasions in late June. 1.3350 follows close by after serving in both directions in July 2017.

1.3255 was a line of support when the pair traded on high ground in late June. 1.32220 capped the pair in mid-July.

1.3125 is the high point for 2018 until it was broken. 1.3065 was the high point in May and also earlier in the year.

1.30 is a round number that is eyed by many. 1.2920 capped the pair in late April and early May as well. 1.2820 served as support in early May.

I remain bullish on USD/CAD

Canada is heavily dependent on exports to the US and the worsening relations certainly weigh. NAFTA negotiations are unlikely to resume in the near future. It is hard to see the C$ recovering and USD/CAD falling.

Our latest podcast is titled Festive Fed, Dovish Draghi, and a global trade war

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!