USD/CAD showed little movement for a second successive week. There are four releases in the upcoming week, including the Bank of Canada rate decision. Here is an outlook at the highlights and an updated technical analysis for USD/CAD.

Canada’s manufacturing sales increased 10.7% in May, after a record 28.5% drop beforehand. As expected, the Bank of Canada maintained monetary policy. The bank held its main lending rate at 0.25%, where it has been pegged since March. The Canadian dollar received a boost on after the bank said that it expects “a sharp rebound in economic activity”. At the same time, BoC Governor Tiff Macklem said that the bank would not raise interest rates until inflation rose to the bank’s target of 2 percent, On the employment front, ADP nonfarm payrolls showed a gain of 1.042 million jobs from May to June. This follows the official Employment Change release, which showed that the economy created 953 thousand jobs.

- Retail Sales: Tuesday, 8:30. The headline reading fell by 26.4% in April, after a decline of 10.0% beforehand. Core retail sales plunged in April, with a reading of -22.0 percent. The indicator has failed to post a gain in 2020, as consumer spending is yet to recover from severe economic conditions. Will we see an improvement in the May data?

- Inflation report: Wednesday, 8:30. After back-to-back declines, consumer inflation posted a gain of 0.3%. Still, this fell short of the forecast of 0.8%. The core reading fell by 0.1%, after a decline of 0.4% beforehand. We now await the June releases.

.

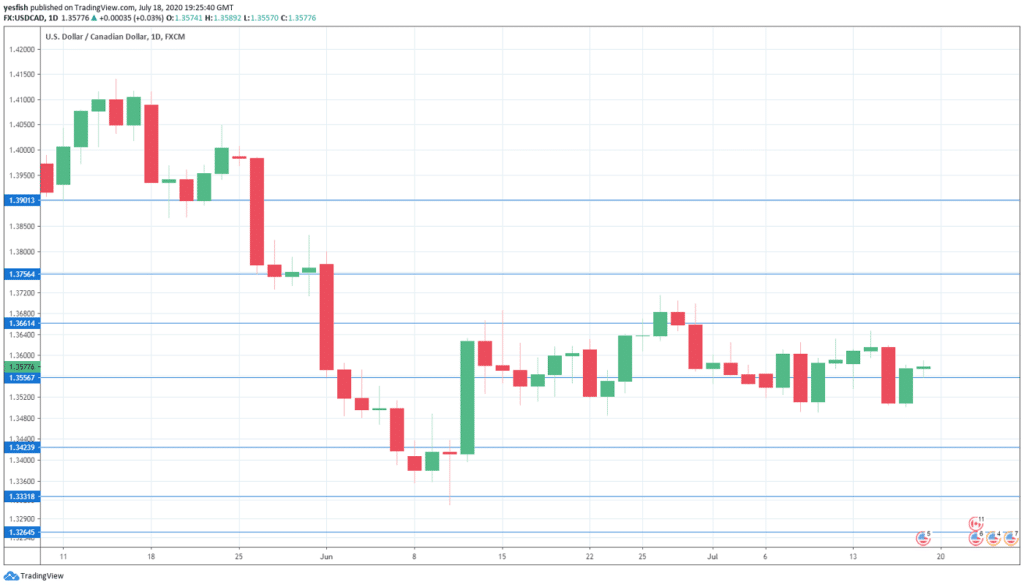

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at the round number of 1.39. This line has been a resistance line since late May. 1.3757 is next.

1.3661 (mentioned last week) continues to be a resistance line.

1.3550 is an immediate support level.

1.3420 has provided support since mid-June.

1.3330 is next.

1.3265 is the final support level for now.

.

I am neutral on USD/CAD

The Canadian economy is showing tentative steps towards recovery in the wake of Covid-19. At the same time, lower oil prices are weighing on the Canadian dollar, so we could continue to see a subdued Canadian dollar this week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!