The Canadian dollar enjoyed a strong week, as USD/CAD dropped by 1.3%, its sharpest decline since the first week of June. There are just two releases in the upcoming week, including GDP. Here is an outlook at the highlights and an updated technical analysis for USD/CAD.

Retail sales rebounded nicely in May, after sustaining a decline of over 20% beforehand. The headline reading climbed 18.7%, while the core figure gained 10.6%. There was more good news from the consumer inflation front, as the headline reading climbed from 0.8%, up from 0.3%. This was the strongest reading since January 2017. Core CPI improved to 0.4%, after two straight declines.

- GDP: Friday, 12:30. Canada’s GDP nosedived in April, with a decline of 11.6%. However, there have been signs that the economy is recovering and the May forecast stands at 3.3%. A solid gain could give the Canadian dollar a boost.

- Raw Materials Price Index: Friday, 12:30. After two consecutive declines, the index bounced back with a strong gain of 16.4% in May. We now await the June release.

USD/CAD Technical Analysis

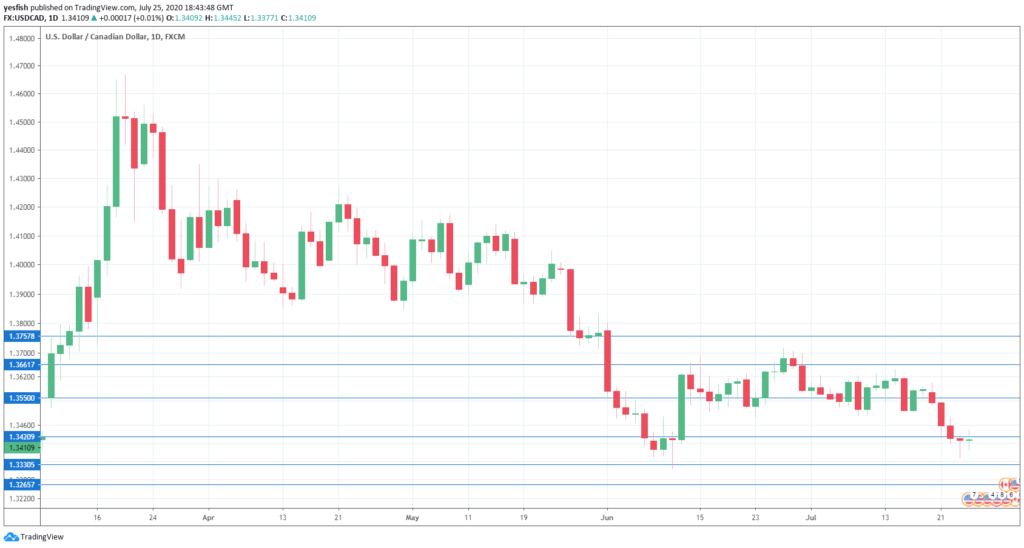

Technical lines from top to bottom:

We start with resistance at 1.3757.

1.3661 (mentioned last week) continues to be a resistance line.

1.3550 has some breathing room in resistance after sharp losses by USD/CAD last week.

1.3420 has switched to resistance. It is a weak line.

1.3330 is providing support.

1.3265 is next.

1.3078 is the final support level for now.

.

I am neutral on USD/CAD

The Canadian economy is showing tentative steps towards recovery in the wake of Covid-19. The Canadian dollar has taken advantage of broad US dollar weakness. If this week’s Canada GDP is strong, the Canadian dollar rally could continue.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!