Dollar/CAD had a turbulent week but eventually closed at similar levels to the previous one. Trade issues weigh on the loonie. What’s next? A light economic calendar leaves the focus on Trump’s trade tariffs and NAFTA negotiations. Here are the highlights and an updated technical analysis for USD/CAD.

The steel and aluminum tariffs that the US imposed on Canada, Mexico and the EU continued aggravating relations between the US and Canada and hurt the Canadian dollar. Things became worse when the US suggested splitting NAFTA and striking separate deals with Canada and Mexico. The break up of the G-7 talks over the weekend could further exacerbate the situation. On the other hand, the US Dollar lost some ground on a better market mood earlier in the week. Canada ´s jobs report was mixed: it showed a second consecutive month of job losses, which was very disappointing, but wages shot up by 3.9% YoY, better than had been predicted.

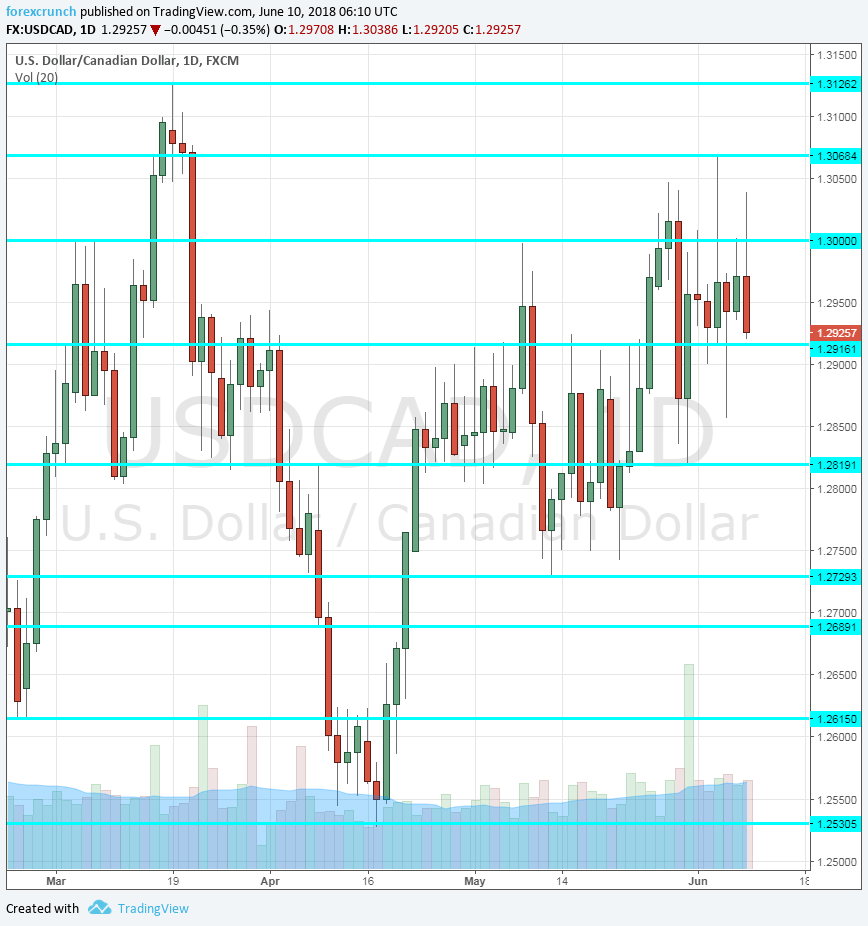

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- NHPI: Thursday, 12:30. The New House Price Index is of interest as doubts grow about house prices in Canada. The NHPI stalled in March and is projected to show an increase of 0.2% in April.

- Foreign Securities Purchases: Friday, 12:30. Purchases of securities by foreigners reflect flows into Canada. Back in March, the figure increased to 6.15 billion, above expectations. Similar numbers are likely in the report for April.

- Manufacturing Sales: Friday, 12:30. The volume of sales at the manufacturing level is watched by the BOC and could move the C$. The previous report was upbeat with a rise of 1.4% for March and an upwards revision for February. We will now get the figures for April.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD tackled the 1.30 level (mentioned last week) but struggled to make a meaningful break in a very choppy week.

Technical lines from top to bottom:

1.3180 was a support line in 2017 and now turns into resistance. 1.3125 is the high point for 2018 so far. 1.3065 was the high point in May and also earlier in the year.

1.30 is a round number that is eyed by many. 1.2920 capped the pair in late April and early May as well. 1.2820 served as support in early May.

1.2730 was a swing low seen mid-May. It is followed by 1.2690 which was a swing high back in February. Further down, 1.2615 and 1.2535 where the top and bottom of a range seen in early April.

I remain bullish on USD/CAD

The acrimonious break up of the G-7 talks is the latest blow to international trade relations and could weigh heavily on the atmosphere in markets and on the Canadian Dollar in particular. In addition, the Fed is set to raise rates and keep the upward pressure on the US Dollar.

Our latest podcast is titled Truce in trade and dollar domination

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!