Dollar/CAD continued moving higher amid the BOC decision and falling oil prices. The jobs report stands out in a busy week. Here are the highlights and an updated technical analysis for USD/CAD.

The Bank of Canada put on its rosy glasses by removing warnings about raising rates and also removing the need for accommodative monetary policy. In addition, they were optimistic about wages and also Q1 growth. The Q1 growth hopes proved wrong as quarterly GDP rose by only 1.3% annualized. The C$ rose on the BOC and fell on GDP. And then came Trump with the implementation of tariffs on steel and aluminum. This angered Canada which retaliated immediately. The Canadian dollar extended its falls. Oil prices fell following the hints from OPEC and non-OPEC members that they will increase production. This weighed on the loonie.

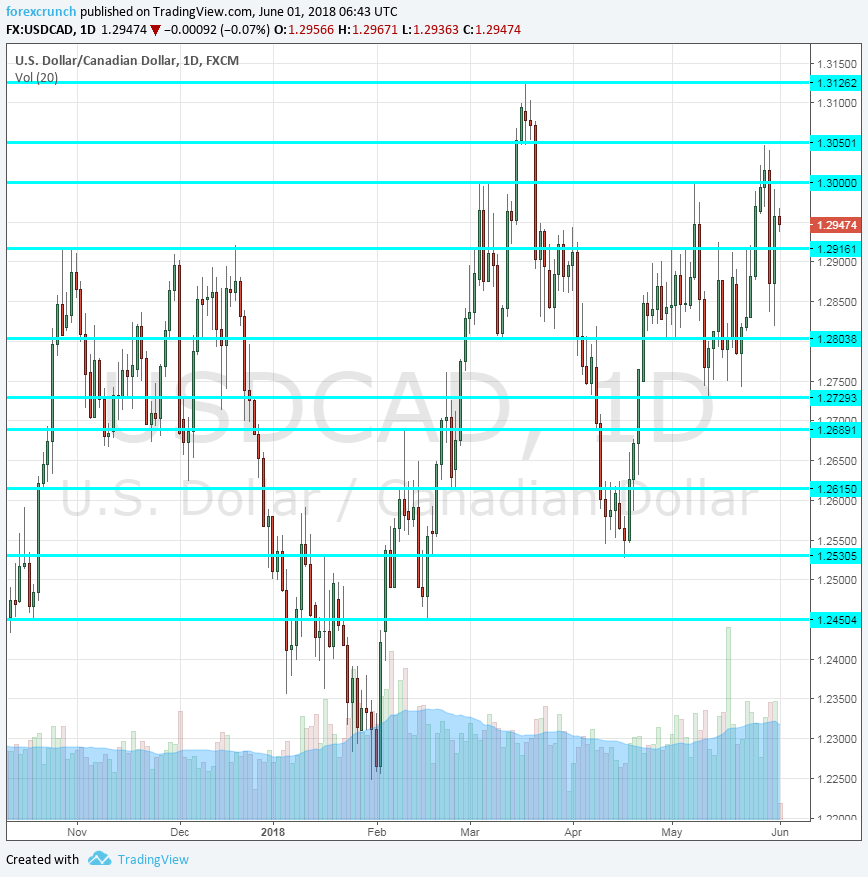

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Labor Productivity: Tuesday, 12:30. High productivity is good for the economy but lower inflation prospects and therefore keeps the central bank on hold. A meager rise of 0.2% was seen in productivity in the last quarter of 2017. We will now get the figures for Q1. A small rise of 0.3% is on the cards.

- Ivey PMI: Tuesday, 14:00. The Richard Ivey School of Business surveys around 175 purchasing managers for its monthly survey. For April, they reported a jump to 71.5 points, reflecting very strong growth. A fall from these highs is likely: 69.7 is expected.

- Trade Balance: Wednesday, 12:30. Canada has a growing trade deficit that reached 4.1 billion in March, a multi-year high. Another deficit is likely for April.

- Building Permits: Wednesday, 12:30. The figure is quite volatile, but can still provide an indication about the housing sector. After a drop of 2.8% in February, the number of starts bounced back 3.1% in March. Recent figures have been quite solid.

- Housing Starts: Thursday, 12:15. Contrary to the prior figure, this one is more stable. Annualized starts of new homes fell short of expectations in April and stood at 214K. The fresh figures for May may see an increase. A small increase to 217K is projected.

- BOC Financial System Review: Thursday, 14:30. The Bank of Canada reports on the stability of the financial system twice a year. The report was closely watched just after the financial crisis which Canadian banks weathered quite well. Nevertheless, with growing concerns about elevated house prices, any concerns raised here may weigh on the loonie.

- Canadian jobs report Friday, 12:30. Canada’s labor market report will be in the limelight, having an exclusive influence on USD/CAD as the US Non-Farm Payrolls report has already been published. Back in April, Canada lost 1,100 jobs, a disappointing outcome. A bounce back is likely now. The unemployment remained at 5.8% for the third month in a row.

- Capacity Utilization Rate: Friday, 12:30. Overshadowed by the jobs report, the figure matters nonetheless as the BOC cares about the level of slack in the economy. The level of utilization reached a peak of 86% in Q4 2017, indicating less slack than predicted. A similar figure is likely for Q1.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD tackled the 1.30 level (mentioned last week) but struggled to make a meaningful break in a very choppy week.

Technical lines from top to bottom:

1.3180 was a support line in 2017 and now turns into resistance. 1.3125 is the high point for 2018 so far. 1.3050 was the high point in May and also earlier in the year.

1.30 is a round number that is eyed by many. 1.2920 capped the pair in late April and early May as well. 1.2810 served as support in early May.

1.2730 was a swing low seen mid-May. It is followed by 1.2690 which was a swing high back in February. Further down, 1.2615 and 1.2535 where the top and bottom of a range seen in early April.

I remain bullish on USD/CAD

The trade war could bury NAFTA negotiations. Even if it doesn’t, trade wars could weigh on the Canadian economy which is dependent on the US.

Our latest podcast is titled Truce in trade and dollar domination

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!