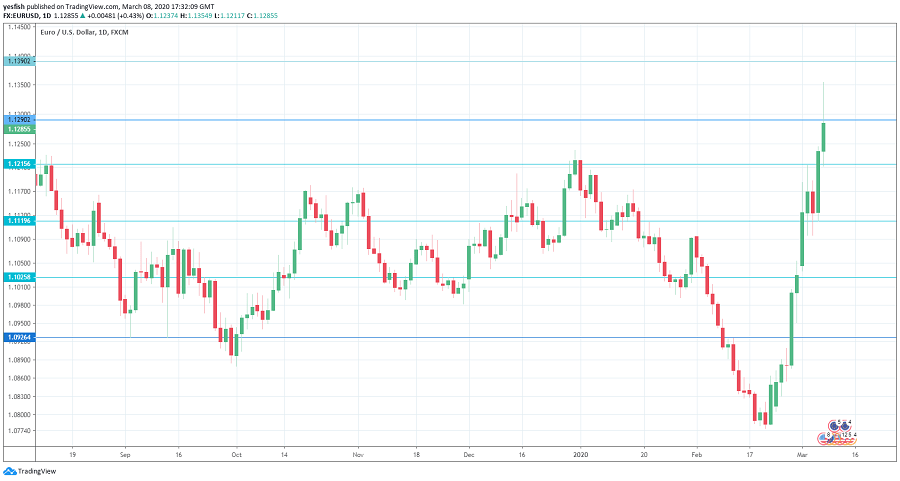

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing Sales: Tuesday, 12:30. This key manufacturing indicator has sputtered, with four consecutive declines. The December reading of -0.7% was well off the forecast of 0.8%. Will we see a rebound in January?

- Inflation: Wednesday, 12:30. Consumer inflation improved to 0.3% in January, up from 0.0% a month earlier. This figure beat the estimate of 0.2%. Trimmed CPI, which excludes the most volatile items in CPI, has posted two straight readings of 2.1%. We now await the February data.

- ADP Non-Farm Employment Change: Thursday, 12:30. The ADP reading slipped to 25.9 thousand in January, down from 46.2 thousand a month earlier. Investors will be hoping for a stronger reading in February.

- Retail Sales: Friday, 12:30. Retail sales reports were mixed in December. The headline figure slipped to 0.0%, down sharply from 0.9% in the previous release.This reading was shy of the forecast of 0.1%. Core retail sales improved to 0.5%, up from 0.2% in November and above the estimate of 0.4%. We will now receive the January readings.

USD/CAD Technical Analysis

Technical lines from top to bottom:

We begin with resistance at 1.4159.

1.4019 has held since January 2016.

The round number of 1.39 is next.

1.3757 is a weak support level.

1.3660 (mentioned last week) has switched to a support role for the first time since December 2018.

1.3550 is next.

1.3420 is the final support level for now.

I remain bullish on USD/CAD

Investor risk appetite remains weak as the coronavirus continues to take its toll on the global economy. With the BoC slashing a staggering 1.0% from the benchmark rate in just 9 days, the Canadian dollar has become less attractive to investors.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!