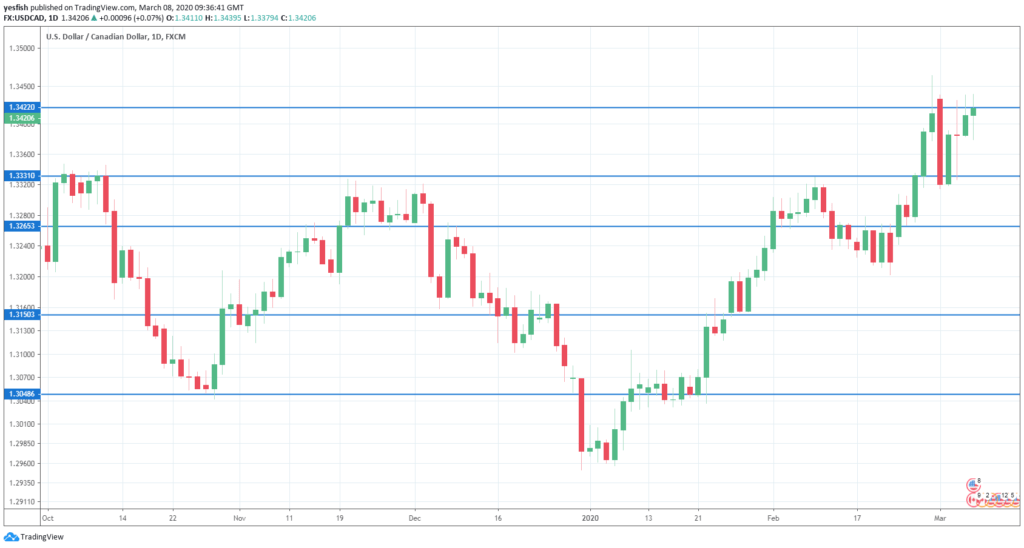

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Housing Starts: Monday, 12:15. Housing Starts jumped to 213 thousand in January, up from 197 thousand. This marked a 4-month high. The upward trend is expected to continue in February, with an estimate of 217 thousand.

- Building Permits: Monday, 12:30. This indicator rebounded in December with a strong gain of 7.4%, above the estimate of 3.5%. This ended a nasty streak of three consecutive declines. We now await the January data.

- Annual Budget Release: Wednesday, 20:00. Canada will release its annual budget, which outlines the government’s projected borrowing and spending levels and financial objectives.

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 1.3660, which held since December 2018. 1.3550 is next.

1.3420 was tested in resistance, June 2019.

1.3330 is providing support.

1.3150 has strengthened in support.

1.3100 (mentioned last week) is the next support level.

1.3048 is protecting the symbolic 1.3000 level. It is the final support level for now.

I remain bullish on USD/CAD

Investor risk appetite remains weak as the coronavirus has now spread to Europe and the United States. This means that minor currencies like the Canadian dollar are likely to remain under pressure.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!