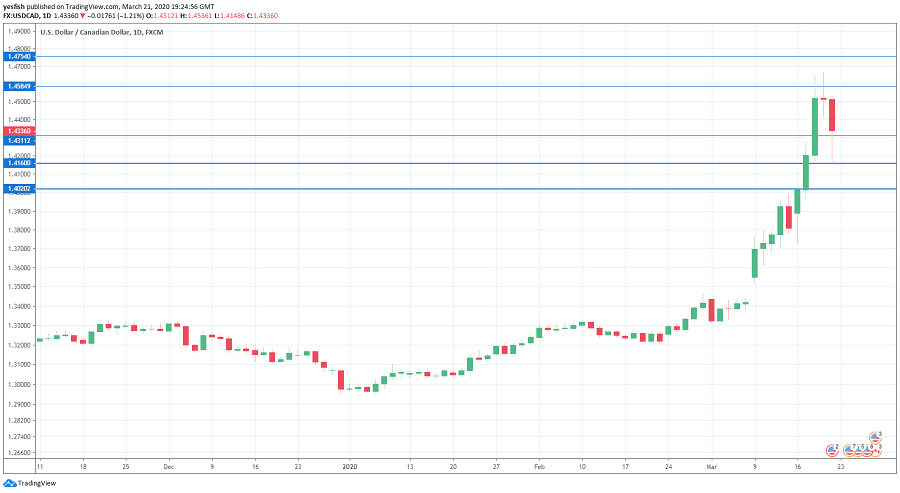

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Wholesale Sales: Monday, 12:30. Wholesale sales is a leading indicator of consumer spending. After two straight declines, the indicator rebounded with a strong gain of 0.9%, above the estimate of 0.5%. We now await the January data.

USD/CAD Technical Analysis

Technical lines from top to bottom:

With USD/CAD climbing sharply last week, we start at higher levels:

We begin with resistance at 1.4754. This line was a cushion back in May 2000.

1.4584 is next.

1.4480 was an important cushion in April 2000.

1.4310 was tested last week. It is currently an immediate support level.

1.4159 (mentioned last week) has switched to a support role for the first time since January 2016.

1.4019 is protecting the symbolic 1.400 level. It is the final support line for now.

I remain bullish on USD/CAD

The meltdown in the financial markets is not showing any signs of easing up, which means that minor currencies like the Canadian dollar will likely remain under pressure.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar projections.

- AUD/USD forecast – analysis for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!