Dollar/CAD had a choppy week amid falling oil prices and the US Mid-Terms. What’s next? A mix of Canadian events awaits the pair. Here are the highlights and an updated technical analysis for USD/CAD.

The US approved waivers to some countries in buying Iranian oil, as expected. However, fresh data showed US oil production reached a record high and sent crude prices lower, weighing on the Canadian Dollar. BOC Governor Stephen Poloz repeated the same messages and did not impact the loonie too much. The Ivey PMI bounced back. In the US, the next Congress will be split, as projected, and the USD lost a bit of ground.

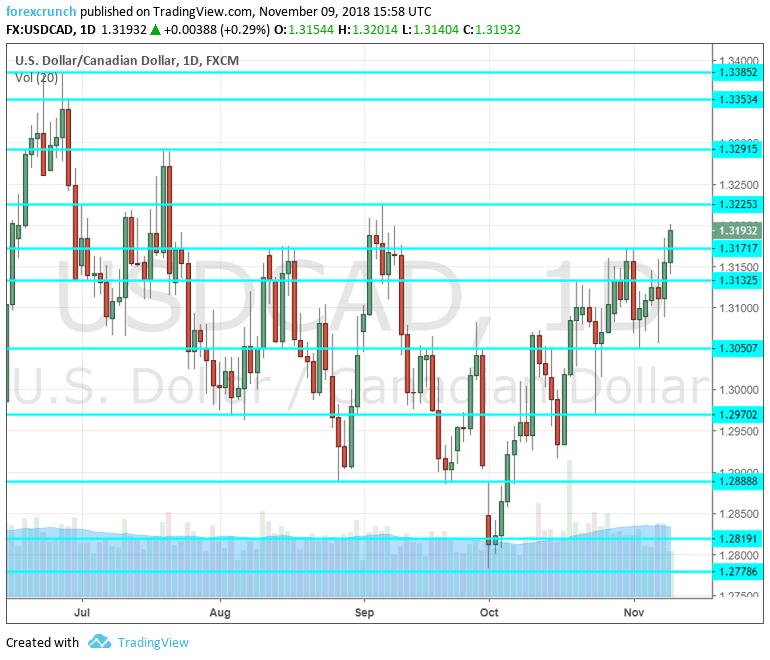

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- ADP Non-Farm Payrolls: Thursday, 13:30. ADP is a provider of payroll software and has a lot of data on employment. While the numbers are reported after the official jobs report is out, it is of interest to the loonie. Private Non-Farm Payrolls rose by 28.8K in September, better than expected. We may see a more moderate increase now.

- Crude Oil Inventories: Thursday, 16:00. The C$ has been more and more sensitive to petrol prices. The figures are published on Thursday this time due to the bank holiday on Monday. Another increase in inventories and production in the US can push the price of the black gold lower.

- Foreign Securities Purchases: Friday, 12:30. The indicator provides insights into the flows of funds in and out of the economy. A surplus of 2.82 billion was seen in August. We will now receive data for September.

- Manufacturing Sales: Friday, 12:30. Sales at the manufacturing level dropped by 0.4% in August, ending three consecutive months of increases in this gauge. An increase may be seen in September.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD wobbled and “hugged” the 1.3115 level (mentioned last week).

Technical lines from top to bottom:

1.3350 and 1.3380 are highs last seen in the summer. 1.3295 held the pair down in mid-July. 1.3220 capped it earlier in the month.

1.3170 capped the pair in mid-August and also in late October / early November. 1.3115 held USD/CAD down on its way up in late October.

1.3050 was a low point in early November and replaces previous lines.

Below 1.3000 we find the late-October trough of 1.2970. 1.2880 was a double-bottom in September and in August.

1.2820 was a stepping stone on the way up in late May. 1.2780 was the low point in October 2018.

1.2730 provided support earlier in May. Lower, 1.2630 held the pair down back in April.

Further down, 1.25 is a critical round number and also 0.80 on CAD/USD.

I remain bearish on USD/CAD

While oil prices weigh on the loonie, the new trade deal (USMCA) and the hawkishness of the Bank of Canada support the Canadian Dollar. The upbeat message from the Fed may not be enough to push the greenback higher.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!