Dollar/CAD had an interesting week amid jobs reports from both the US and Canada, as well as other events, such as the fall in oil prices which pushed limited the gains from the risk-on atmosphere. Housing figures stand out in the first full week of November. Here are the highlights and an updated technical analysis for USD/CAD.

Both Governor Stephen Poloz and Deputy Governor Carolyn Wilkins expressed optimism about the economy. Wilkins went forward and said that it is the best time to raise rates. In the US, Trump talked with Chinese President Xi and also asked his cabinet to draft a trade deal. The optimism about a deal pushed the greenback lower but the Canadian dollar was limited in its gains as oil prices fell sharply. Canada’s critical export is already trading at a discount in comparison to American crude.

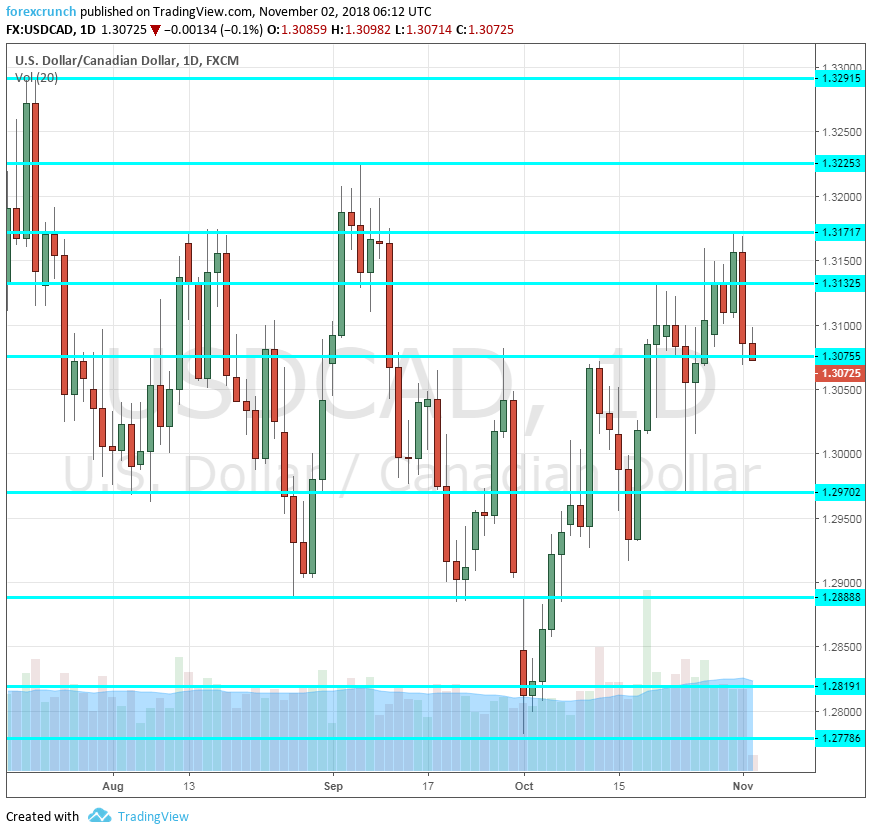

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Building Permits: Tuesday, 13:30. The number of building consents advanced by 0.4% in August, as expected. The fresh figures for October may be similar. Figures are usually more volatile in this housing sector measure. An increase of 0.3% is expected.

- Ivey PMI: Wednesday, 15:00. The Richard Ivey School of Business reported a considerable drop in business confidence back in September, with a plunge from 61.9 to 50.4. That was related to the lack of progress in trade talks. We may see a bounce back this time, after Canada and the US reached an agreement, the USMCA. However, official projections stand at 50.9 points.

- Housing Starts: Thursday, 13:15. This housing sector indicator disappointed in the past three publications, falling to 189K annualized in September. Will the gauge fall short of expectations for a fourth consecutive time? A level of 195K is on the cards.

- NHPI: Thursday, 13:15. The New Home Price Index remained flat in August, below expectations. We could see it rise this time: 0.1% is forecast for the upcoming publication.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD moved up above the 1.3080 level (discussed last week). It reached a high of 1.3170 before ticking down.

Technical lines from top to bottom:

1.3350 and 1.3380 are highs last seen in the summer. 1.3295 held the pair down in mid-July. 1.3220 capped it earlier in the month.

1.3170 capped the pair in mid-August and also in late October / early November. 1.3115 held USD/CAD down on its way up in late October.

1.3075 was a stepping stone on the way up in late October and a swing high beforehand.

Below 1.3000 we find the late-October trough of 1.2970. 1.2880 was a double-bottom in September and in August.

1.2820 was a stepping stone on the way up in late May. 1.2780 was the low point in October 2018.

1.2730 provided support earlier in May. Lower, 1.2630 held the pair down back in April.

Further down, 1.25 is a critical round number and also 0.80 on CAD/USD.

I remain bearish on USD/CAD

Canada’s jobs report is good enough for further rate hikes by the BOC. The good news from the USMCA and the potential trade deal that the US is set to strike with China is also not full priced in. Once oil prices stabilize, the loonie has room to rise.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!