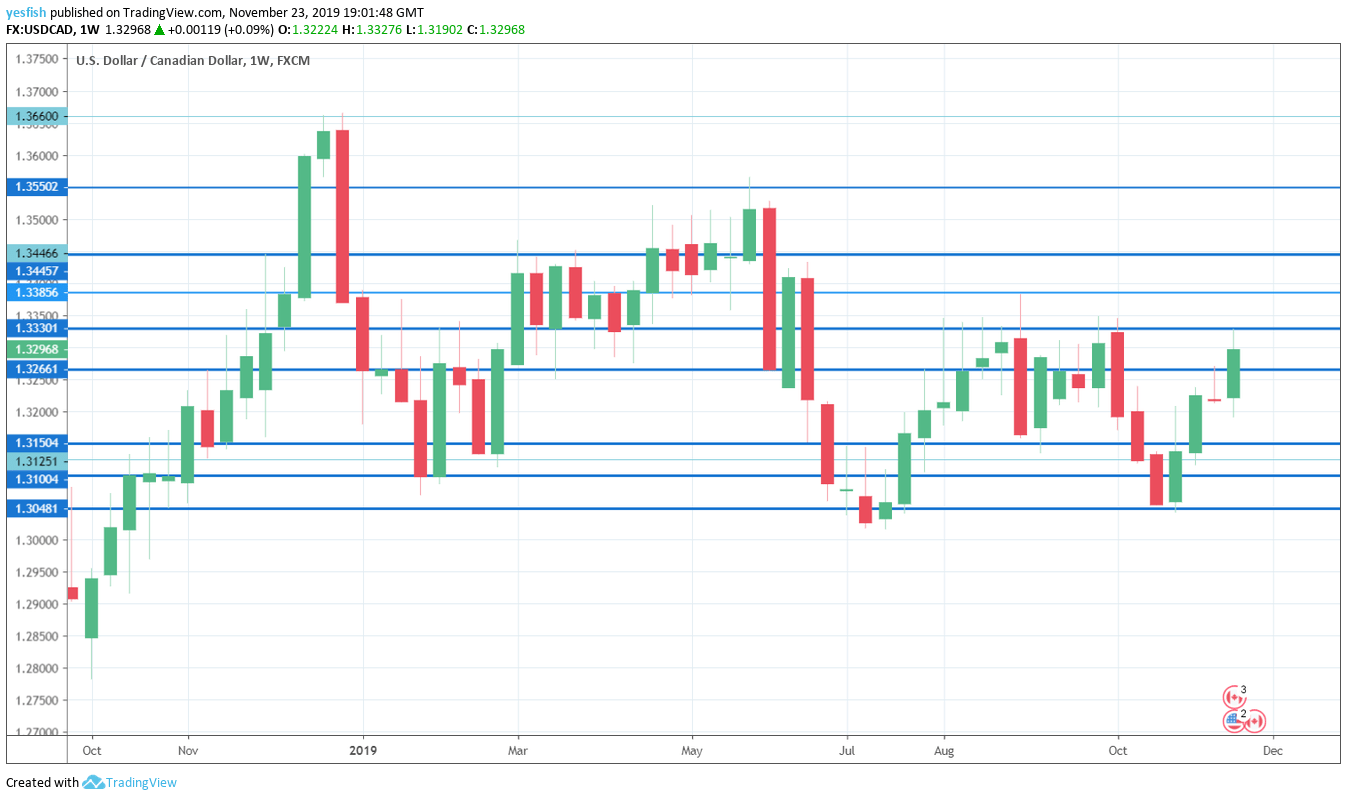

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Wholesale Sales: Monday, 13:30. This indicator is related to consumer spending, as wholesale sales increase when consumer demand is stronger. The indicator declined by 1.2% in August, well below the estimate of +0.3%. Will we see a rebound in the September release?

- Corporate Profits: Tuesday, 13:30. Canadian corporations enjoyed an increase of 5.2% in profits during Q2, after two consecutive declines. Data for Q3 is due now.

- Current Account: Thursday, 13:30. Canada continues to post current account deficits. There was significant improvement in Q3, with a reading of C$-6.4 billion. This was better than the estimate and the lowest deficit since 2008. We now await the Q3 release.

- GDP: Friday, 13:30. Canada releases its GDP on a monthly basis. The economy posted a weak gain of 0.1% in August, shy of the estimate of 0.2%. Will we see an improvement in September?

- RMPI: Friday, 13:30. In September, the Raw Materials Price Index improved to 0.0%. but this fell short of the forecast of 2.5%. We will now receive the October release.

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 1.3660. This is followed by 1.3550.

1.3445 has remained intact since the first week of June. 1.3385 is next.

1.3330 has held since early October.

1.3265 remains relevant. Currently, it is an immediate support level.

1.3150 is next.

1.3100 has held in support since the end of October, when USD/CAD started an extensive rally.

1.3048 (mentioned last week) is protecting the round number of 1.3000, which has psychological significance.

1.2916 was last tested in October 2018. It is the final support for now.

I am bullish on USD/CAD

The trend has been positive for USD/CAD in recent weeks, and the pair hit a 6-week high during the week. With a U.S-China trade deal still elusive, investors remain cautious, which could weigh on minor currencies like the Canadian dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!