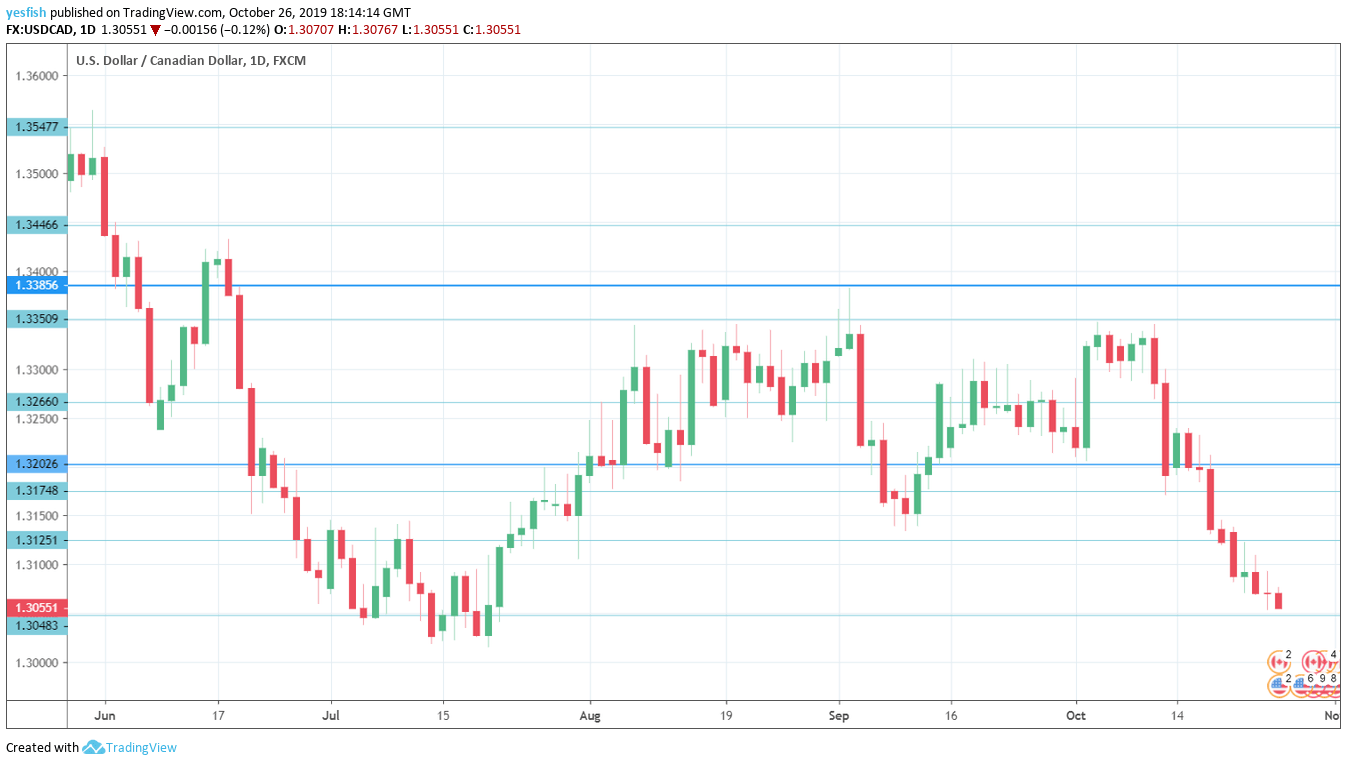

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- BoC Rate Decision: Wednesday, 14:00. The BoC is expected to maintain rates at 1.75%, where they have pegged since last October. The upcoming rate decision also consists of new forecasts and a press conference by BoC Governor Stephen Poloz and Deputy Carolyn Wilkins. An upbeat message from rate-setters is bullish for the Canadian dollar.

- GDP: Thursday, 12:30. Canada’s GDP reports are released monthly and should be treated as a market-mover. The economy was stagnant in July, with a GDP of 0.0%. Investors are expecting better news in August, with a forecast of 0.2%.

- RMPI: Tuesday, 14:30. Inflation remains subdued, and this inflation indicator has struggled, with three declines in the past four months. The August release came in at -1.8%, Will we see a rebound in September?

- Manufacturing PMI: Friday, 13:30. Markit’s purchasing managers’ index for the manufacturing sector improved in September to 51.0, which indicates stagnation. Still, this was the index’s strongest reading since February.

USD/CAD Technical Analysis

Technical lines from top to bottom:

We start with resistance at 1.3445. This line has remained intact since the first week of June.

1.3350 has held since early September. 1.3265 is next.

1.3175 has some breathing room following further losses by USD/CAD this week.

1.3125 (mentioned last week) has switched to a resistance role. It had provided support since the end of July.

1.3048 is an immediate support line. It is protecting the round number of 1.3000, which has psychological significance.

1.2916 has held firm since October.

1.2830 is next.

1.2730 is the final support line for now.

I am neutral on USD/CAD

The Canadian dollar has posted strong gains in recent weeks, but this trend is more a case of weakness of the U.S. dollar rather than strong Canadian numbers. If risk appetite weakens due to geopolitical instability, the Canadian dollar could weaken.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex+ weekly forecast – Outlook for the major events of the week.

Safe trading!