Dollar/CAD had a somewhat wild week: rising on NAFTA worries but dropping back down on upbeat Canadian GDP. The first week of October features the all-important jobs report. Where will the C$ go next? Here are the highlights and an updated technical analysis for USD/CAD.

The US wants to move forward with the agreement with Mexico, excluding Canada. They want to ratify the deal before Lopez Obrador takes over as Mexico’s President. The news sent the loonie lower. On the other hand, Canadian GDP came out at 0.2% m/m in July, slightly above expectations, allowing a recovery. BOC Governor Stephen Poloz repeated the message of gradual rate hikes while saying that Canada is less dependent on the US than 15 years ago. US data was OK, with few surprises.

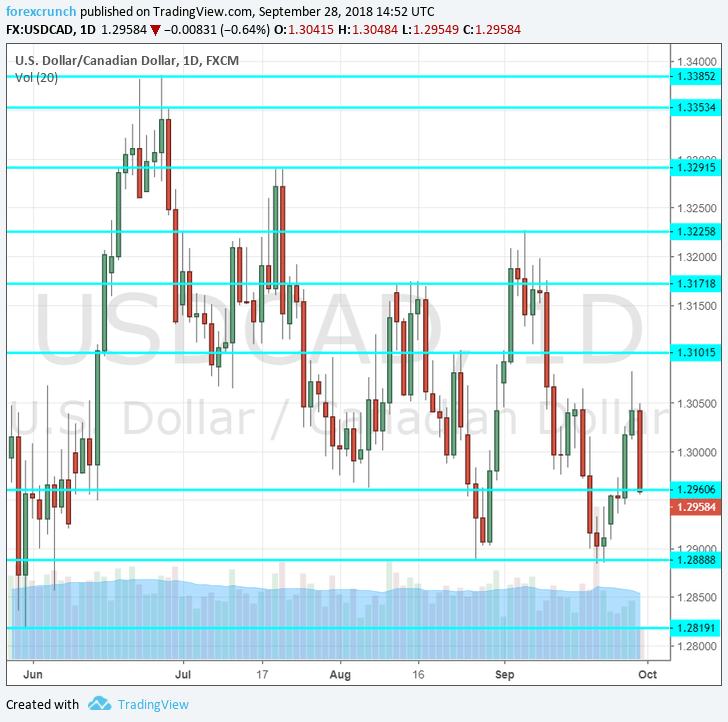

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMI: Monday, 13:30. Markit’s forward-looking survey came out at 56.8 points in August, reflecting a satisfactory level of growth. A similar figure is likely now.

- Ivey PMI: Thursday, 14:00. The Richard Ivey School of Business published a few upbeat figures of late. The recent score of 61.9 points represents rapid growth. An increase to 62.3 points is on the cards now.

- Jobs report Friday, 12:30. Canada”s recent jobs report was awful with a drop of 51.6K positions but it came after a gain of 54.1K beforehand. Will we see a stable number this time. The unemployment rate increased to 6%, worse than had been expected. We could see a slide here. A gain of 32.5K positions is not the cards while the unemployment is expected to slide to 5.9%.

- Trade balance: Friday, 12:30. Canada reported a minor deficit of 0.1 billion in July, better than had been expected. Another near-balanced trade balance is likely for the month of August.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD started the week with an upside move but dropped and found itself around 1.2960 (mentioned last week).

Technical lines from top to bottom:

1.3295 held the pair down in mid-July. 1.3220 capped it earlier in the month.

1.3170 served as resistance in mid-August. 1.3100 is a round number that also capped the pair several times in August.

Below 1.3000 we find the mid-August trough of 1.2960. 1.2890 is the initial low seen in late August.

1.2820 was a stepping stone on the way up in late May. 1.2730 provided support earlier in May. Lower, 1.2630 held the pair down back in April.

I am bullish on USD/CAD

The US Dollar may resume its rises amid a hawkish Fed and upbeat economic data. NAFTA worries could continue weighing on the Canadian Dollar.

Our latest podcast is titled Too hot or too cold? The world is watching the Fed

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!