Dollar/CAD drifted back up in a week that was mostly about a risk-off atmosphere. What’s next? The BOC’s Business Outlook and a double-feature Friday stand out. Here are the highlights and an updated technical analysis for USD/CAD.

Stock markets tumbled down and the ensuing risk-off atmosphere weighed on the loonie, a risk currency. The Canadian Dollar also struggled with falling oil prices and some profit-taking in the aftermath of the new NAFTA deal. The greenback pared back some of its gains later in the week as inflation and consumer confidence fell short of expectations.

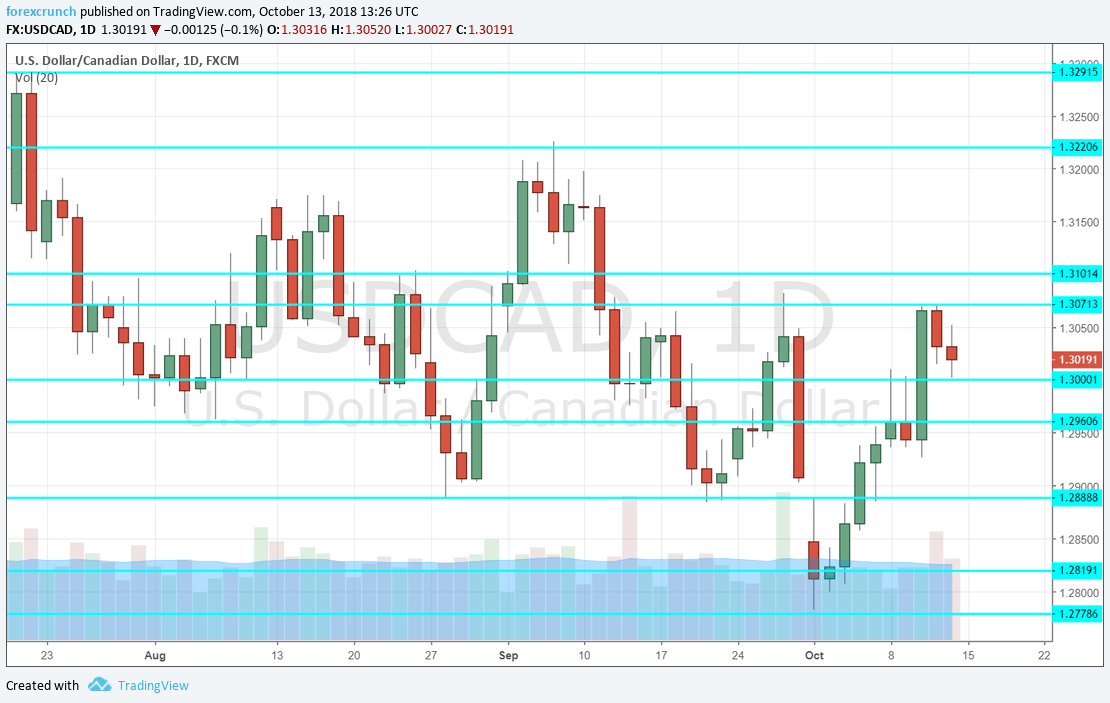

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- BOC Business Outlook Survey: Monday, 14:30. The Bank of Canada’s quarterly survey has proved to be very impactful in some past occasions. The Ottawa-based institutions used this report to hint about changes in monetary policy. They may certainly cement the upcoming rate hike in this event. The decision is due in the following week.

- Foreign Securities Purchases: Tuesday, 12:30. This publication relates to the money flowing into Canada. In the past few months, the figures exceeded expectations. Back in July, the surplus was 12.65 billion. A similar figure is likely now.

- Manufacturing Sales: Wednesday, 12:30. Sales at the manufacturing level have implications for the broader economy. Sales were quite upbeat in the past three months, climbing by 0.9% in July. We may see worse data in August.

- ADP Non-Farm Payrolls: Thursday, 12:30. The payrolls software provider publishes the employment report after the official figure, but it still serves as useful information. A modest increase of 13.6K was reported after three strong months. Another rise is likely in the publication for September. Significant upward revisions were seen in recent months.

- Inflation: Friday, 12:30. The Consumer Price Index report for August mediocre: headline CPI fell by 0.1% while core CPI advanced by only 0.1%. The Common CPI stood at 2%, the Trimmed at 2.2%, and the Median CPI at 2.1%, all stable. We will now get the data for September, which is the last set of figures before the BOC decision in the following week.

- Retail Sales: Friday, 12:30. This publication competes with the inflation report and can steal the show. Back in July, retail sales moved up by 0.3%. More importantly, core retail sales enjoyed a robust rise of 0.9%. We will now get the numbers for August, somewhat belated, but that does not imply a lack of impact on USD/CAD.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD had a slow start to the week, clinging to the 1.30 level (mentioned last week). It then moved higher and did not overcome 1.3070.

Technical lines from top to bottom:

1.3295 held the pair down in mid-July. 1.3220 capped it earlier in the month.

1.3100 is a round number that also capped the pair several times in August. 1.3070 held the pair down in mid-October.

Below 1.3000 we find the mid-August trough of 1.2960. 1.2880 was a double-bottom in September and in August.

1.2820 was a stepping stone on the way up in late May. 1.2780 was the low point in October 2018.

1.2730 provided support earlier in May. Lower, 1.2630 held the pair down back in April.

Further down, 1.25 is a critical round number and also 0.80 on CAD/USD.

I remain bearish on USD/CAD

The Canadian Dollar does not reflect the good news from the recent trade deal. In addition, the upcoming rate hike by the BOC should keep the C$ bid.

Our latest podcast is titled Too hot or too cold? The world is watching the Fed

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!