Dollar/CAD traded up and down around the 1.3000 level, looking for a new direction in a mixed week for both the US and Canadian dollars. What’s next? The rate decision by the BOC is the primary event of the week for the loonie. Here are the highlights and an updated technical analysis for USD/CAD.

The BOC Business Outlook Survey was relatively upbeat, lifting expectations for the rate decision in the upcoming meeting. There is little doubt about a rate increase, but the publication served as a warm-up. On the other hand, Canadian inflation surprisingly dropped in September while retail sales badly disappointed with significant drops. Will it stop the BOC? Probably not. In the US, retail sales fell short of expectations but the greenback remained resilient thanks to upbeat meeting minutes by the Federal Reserve.

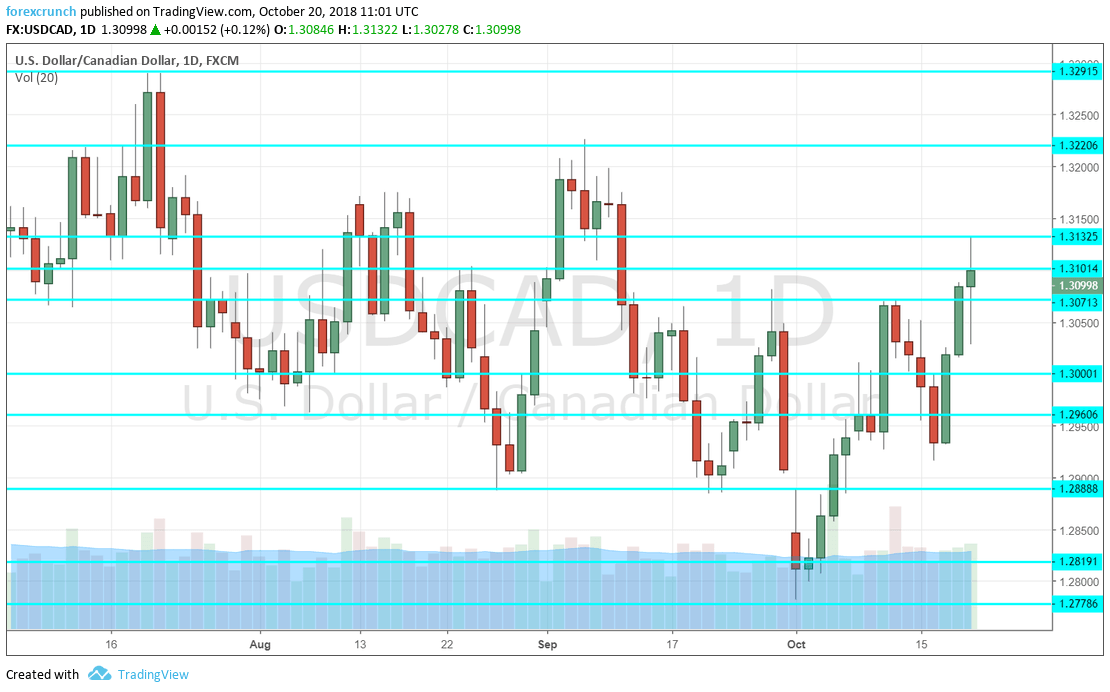

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Wholesale Sales: Monday, 12:30. Sales at the wholesale level provide an indication for future retail sales. After dropping in June, wholesale sales leaped by 1.5% in July. We will now receive figures for August, which may see a more moderate change. An advance of 0.1% is on the cards.

- BOC rate decision: Wednesday 14:00, press conference at 15:15. The Bank of Canada is set to raise interest rates from 1.50% to 1.75%. The Ottawa-based institution provided thick hints about the move in recent public appearances by officials and the recent BOC Business Outlook Survey was upbeat. Moreover, the positive conclusion of the new trade deal lifts a significant cloud of uncertainty from the Canadian economy. This October rate decision also consists of new forecasts and a press conference by BOC Governor Stephen Poloz and Deputy Carolyn Wilkins. Markets will pay close attention to their words as well. The BOC has been relatively upbeat in previous decisions.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD initially dropped below 1.3000 but continued hugging this level (mentioned last week). The pair took a clearer direction on Friday, rising to higher ground.

Technical lines from top to bottom:

1.3295 held the pair down in mid-July. 1.3220 capped it earlier in the month. 1.3115 was a high point in mid-October.

1.3100 is a round number that also capped the pair several times in August. 1.3070 held the pair down in mid-October.

Below 1.3000 we find the mid-August trough of 1.2960. 1.2880 was a double-bottom in September and in August.

1.2820 was a stepping stone on the way up in late May. 1.2780 was the low point in October 2018.

1.2730 provided support earlier in May. Lower, 1.2630 held the pair down back in April.

Further down, 1.25 is a critical round number and also 0.80 on CAD/USD.

I remain bearish on USD/CAD

The Bank of Canada is usually optimistic and with the new trade deal, the USMCA, they have good reasons to be so. A hint about further hikes can push the C$ higher.

Our latest podcast is titled Too hot or too cold? The world is watching the Fed

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!