Dollar/CAD was on the rise as NAFTA talks did not bear fruit. What’s next? A light calendar keeps the focus on politics. Here are the highlights and an updated technical analysis for USD/CAD.

NAFTA talks resumed in Washington and both the US and Canada expressed optimism about reaching a deal. The Bank of Canada left the interest rates unchanged as expected and maintained the hawkish bias. The BOC’s Wilkins said they considered removing the word “gradual” from the statement. A rate hike is projected for October, but it all depends on NAFTA. Canada disappointed with a loss of 51.6K jobs in August, far worse than expected. Moreover, wage growth decelerated to 2.6%. The silver lining came from the composition of job changes: full-time positions were gained. The US report a better-than-expected increase of 201K jobs and wages jumped by 0.4% m/m and 2.9% y/y, supporting the greenback. Elsewhere, the greenback also moved on US-Chinese trade relations.

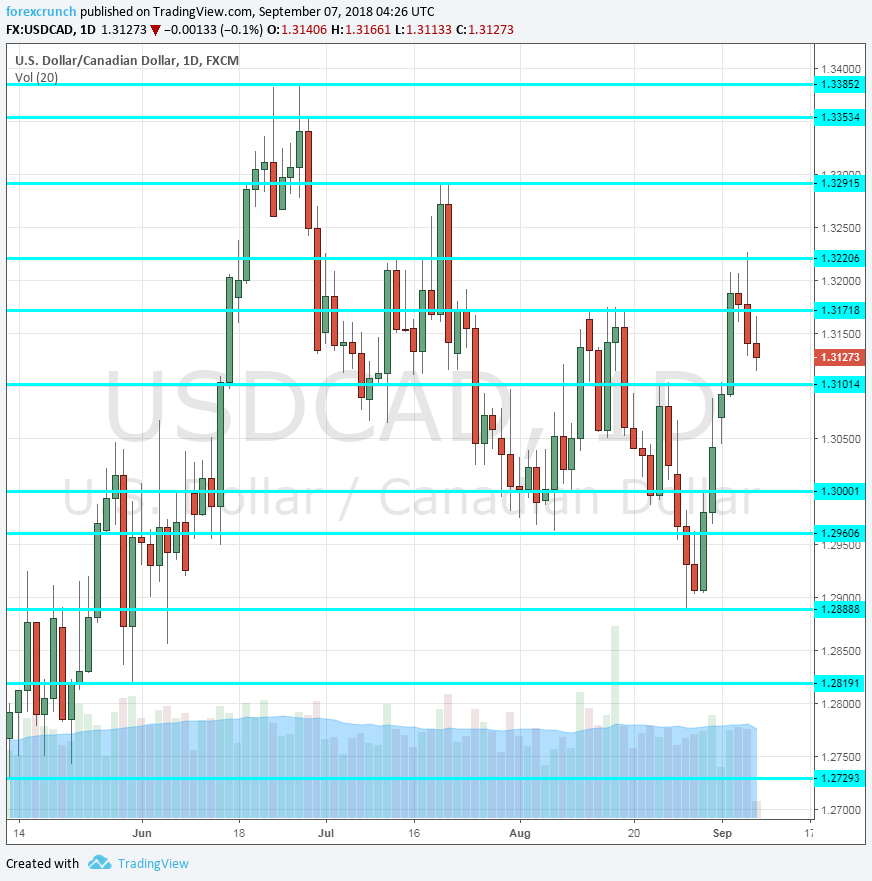

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Housing Starts: Tuesday, 12:15. Canada’s housing sector has seen quite a few twists and turns as high prices triggered curbs on foreign buying. The number of housing starts dropped to 206K annualized in July. The figure for August could be higher: 218K is projected.

- Capacity Utilization Rate: Wednesday, 12:30. Canada has a relatively high utilization rate of its capacity, which is easier to measure in the oil and gas industry. It stood at 86.1% in Q1, slightly below expectations but still at a high rate. 86.9% is on the cards now.

- NHPI: Thursday, The New House Price Index edged up by 0.1% in June after several flat months. Will July see another positive surprise? A repeat of 0.1% is on the cards.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD extended its gains, tackling the 1.3100 level (mentioned last week) and hit the 1.3220 area before retreating.

Technical lines from top to bottom:

1.3295 held the pair down in mid-July. 1.3220 capped it earlier in the month.

1.3170 served as resistance in mid-August. 1.3100 is a round number that also capped the pair several times in August.

Below 1.3000 we find the mid-August trough of 1.2960. 1.2890 is the initial low seen in late August.

1.2820 was a stepping stone on the way up in late May. 1.2730 provided support earlier in May. Lower, 1.2630 held the pair down back in April.

I am neutral on USD/CAD

Everything depends on NAFTA. It is hard to predict the mood of US President Donald Trump. A deal will send the loonie higher and USD/CAD way down. A total breakup of the talks will send the C$ plunging and USD/CAD shooting higher. It’s quite binary.

Our latest podcast is titled Brexit summer blues, trade troubles

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!