- USD/CAD bears keep control of the pair.

- US Dollar remains under pressure after FOMC and GDP data.

- WTI prices and upbeat Canadian CPI support the Canadian Dollar

The USD/CAD weekly analysis states a strong bearish momentum in the pair. The Canadian Dollar is up 1.0% this week. As a result, we can see a strong bearish trend in the USD/CAD pair by the end of the week.

–Are you interested to learn more about buying cryptocurrencies? Check our detailed guide-

The US Dollar is still under pressure after the FOMC meeting. Jerome Powell agrees with his message that the annual inflation increase is temporary. Powell did not have to attend the fall and was able to compete before the race in September.

US GDP, expected demand fell short.

The data from the US is disappointing, and the owners of the big dollars have generally lowered them. Developed GDP in the second quarter grew by 6.5%. This is undoubtedly a big win, but well below the 8.5% consensus. There is also a consensus on unemployment if the current demand was slightly higher than expected. The soft data is in line with the Fed’s view that there is no threat of economic recovery and the need for monetary stimulus in the current economic environment.

The Canadian CPI posted upbeat figures, lending more support to the Canadian Dollar. Moreover, the WTI prices are rising and helping the CAD stay upbeat against the US Dollar and other peers.

Key events to watch next week

The most important event ahead is the US NFP report due on Friday. The US employment report on Friday is critical for the US Dollar. The nonfarm labor market is expected to grow to 926,000 in July, reducing unemployment by two clicks to 5.7 percent. It seems like many people are now returning to the labor market after the generous unemployment benefits have expired.

The US economy needs about 6.7 million jobs to fully recover. However, many people have decided to retire after the pandemic broke out. Some estimates put it at around 3 million. As a result, America could need about 4 million jobs to fully recover, which means we could be at full employment by the end of the year.

–Are you interested to learn more about forex robots? Check our detailed guide-

USD/CAD weekly technical analysis: Where to find bulls?

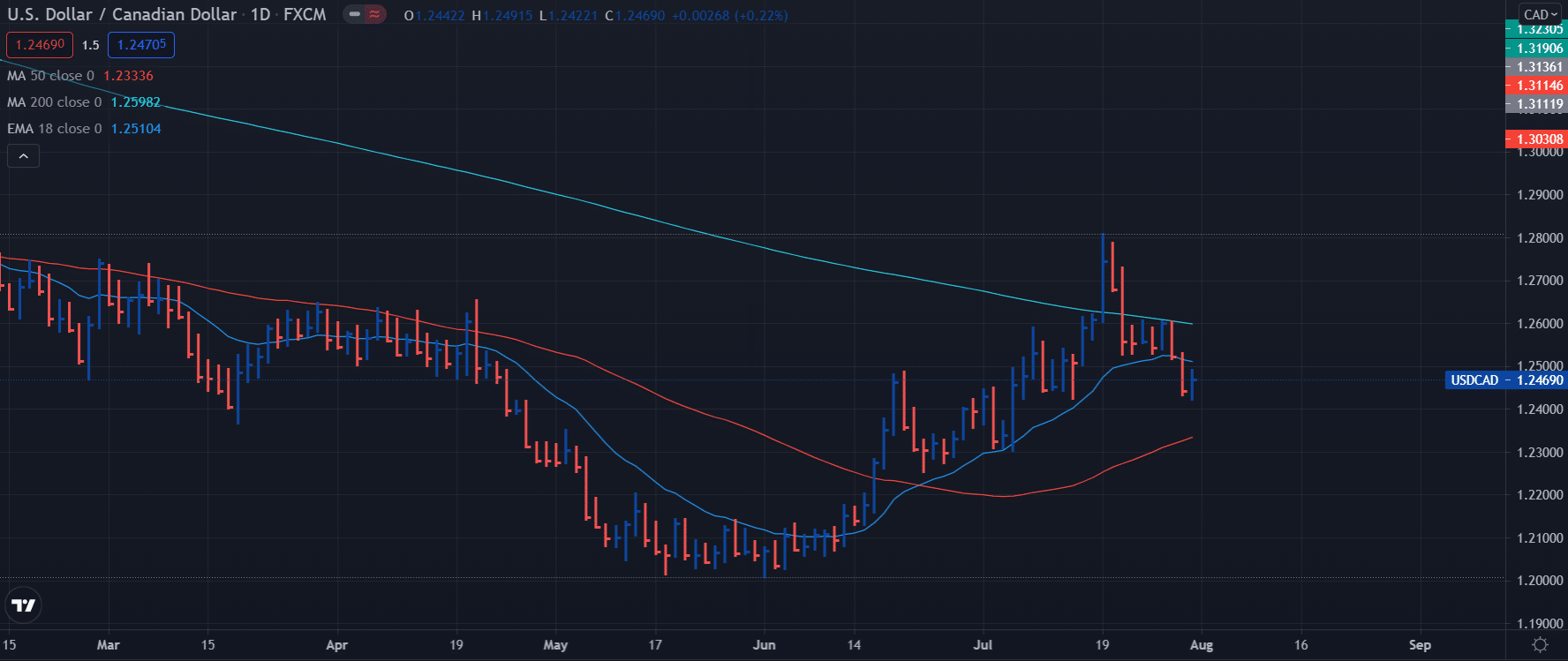

The daily chart reveals that the USD/CAD is in a strong downtrend. The price is well below the 50-day and 18-day SMAs. However, the price is still above the 200-day SMA. The strong bearish trend may drag the price towards 1.2335 (200-day SMA) ahead of the 1.2265 support level and finally the double bottom at 1.2000.

Although the price attempted a corrective recovery, it is still capped by the 18-day SMA. The volume was encouraging on Friday but not strong enough to battle with the previously prevailing bearish pressure. Any upside recovery needs to break above 1.2600 to find a change in the trend.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.