- USD/CAD price falls and closes the week in red after Powell’s speech.

- US economic data is better than that of Canadian data. Yet, the pair falls.

- Recovery in crude oil prices is also weighing on the pair.

- The daily chart trendline is decisive for the pair to find a breakout or reversal.

The weekly forecast for the USD/CAD pair is bearish as the US dollar is on the backfoot after Powell’s speech. The pair may find directional bias on Friday at the release of the US NFP report.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

In a turnaround from last week’s new annual highs, the USD/CAD pair fell below critical support levels. However, based on fundamental as well as technical factors that have led to the recent pullback in the pair from the highs marked in August, the USD/CAD remains capped at trendline support for the time being.

Although the US economic data has been more optimistic than Canadian data in recent months, the slightly more restrictive tone in the July FOMC minutes that supported the strengthening of the US dollar has faded.

As the dollar lost its gains, the Canadian dollar, which benefited from the rise in crude oil prices, gained momentum, triggering the USD/CAD pair to fall as bears pushed prices back to the lows near 1.2600.

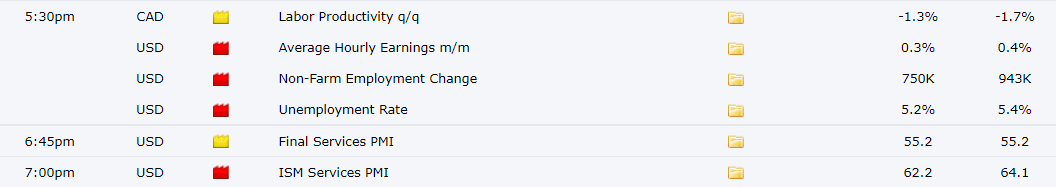

Key data from Canada during Aug 30 – Sep 03

The economic calendar is light next week. The monthly GDP figures of Canada may provide some stimulus to the market. The rest of the events are low impact.

–Are you interested to learn more about making money in forex? Check our detailed guide-

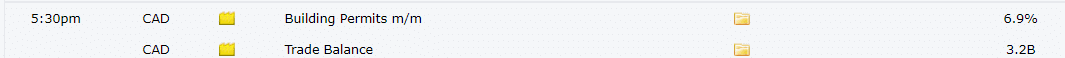

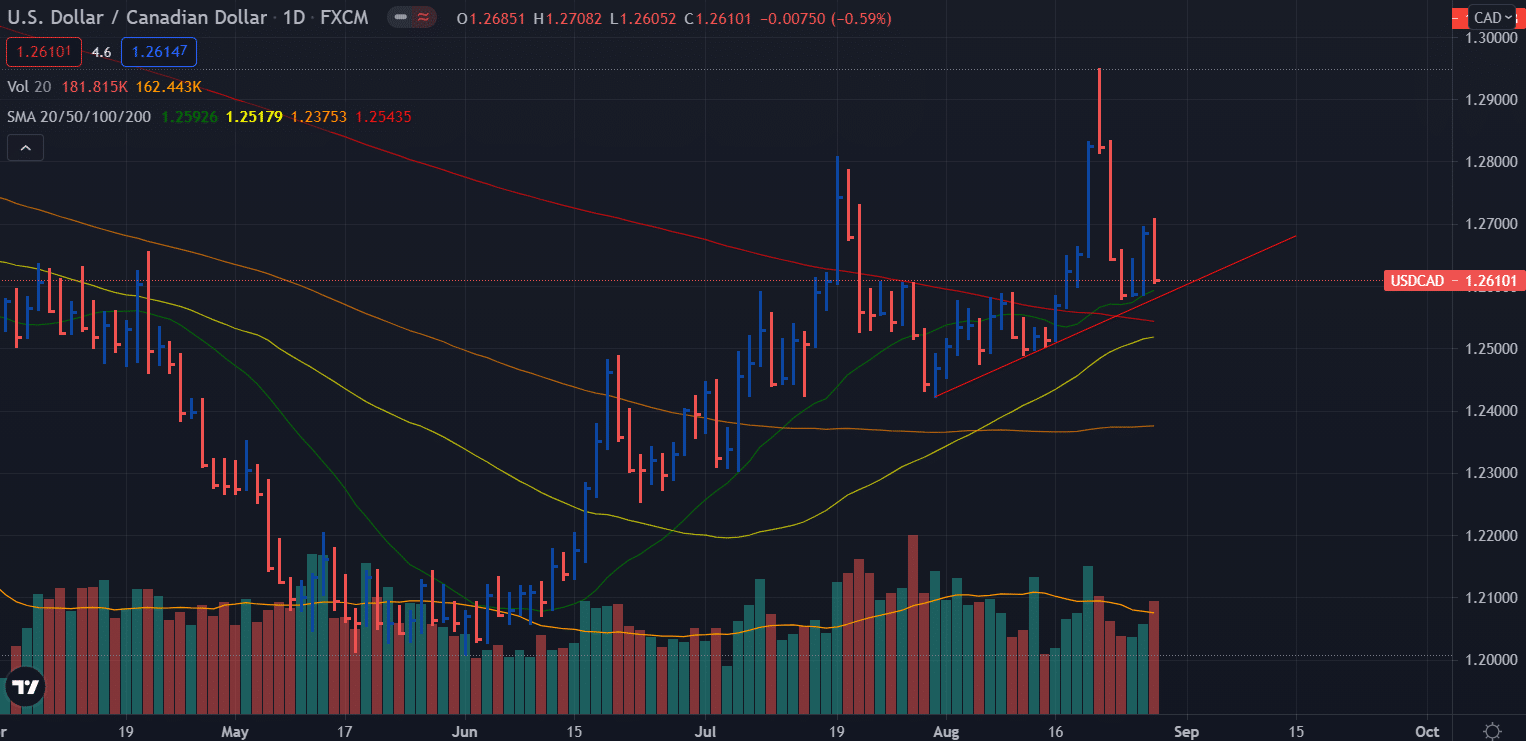

Key data from the US during August 30 – September 03

The most important event next week in US NFP which is expected to decline to 750k as expected to 943k jobs created in July. The ADP nonfarm employment numbers are expected to rise to 650k against 330k reading of July. ISM PMIs for manufacturing and services are also expected next week that may provide some impetus to the market.

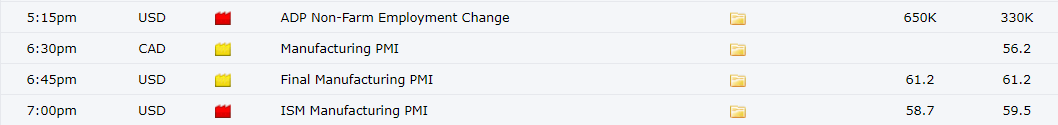

USD/CAD weekly technical analysis: Trendline to act decisively

The USD/CAD pair fell sharply on Friday. However, the price paused the bear run near the 20-day SMA. At the same spot, we can see 200-day SMA and support of ascending trendline. The trendline support could be decisive. We may see a reversal from here or a breakout. However, the chances of the breakout are lesser than the reversal because the Greenback strength can come back even as a correction instead of a bullish reversal. Another reason is a confluence of support that may pause the bears here. On the upside, 1.2700 can be the target for bulls while 1.2550 is the aim for bears.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.