- The more significant risk for the Federal Reserve remains entrenched inflation.

- Investors will see how the Fed’s policy has affected the US labor market when the nonfarm payrolls are released.

- The Bears have been halted at the 0.95004 level.

Next week’s USD/CHF weekly forecast is bullish as an aggressive Fed stokes the dollar’s rally. Rising inflation remains a key concern for the Fed.

-Are you interested to find high leverage brokers? Check our detailed guide-

Ups and downs of USD/CHF

The pair closed the week slightly higher, with the highlight being Powell’s comments on inflation that drove investors to the safe-haven pair.

“The Federal Reserve will not let the economy slip into a “higher inflation regime” even if it means raising interest rates to levels that put growth at risk,” Fed Chair Jerome Powell said on Wednesday.

These and many more comments emphasized the bank’s commitment to taming sky-high inflation. Powell said the more significant risk was not a slowed economy but rather the failure to restore price stability.

Consumer confidence in the US went down more than expected in June, and investors ran from risky assets toward the safer dollar as the economy faced a looming recession.

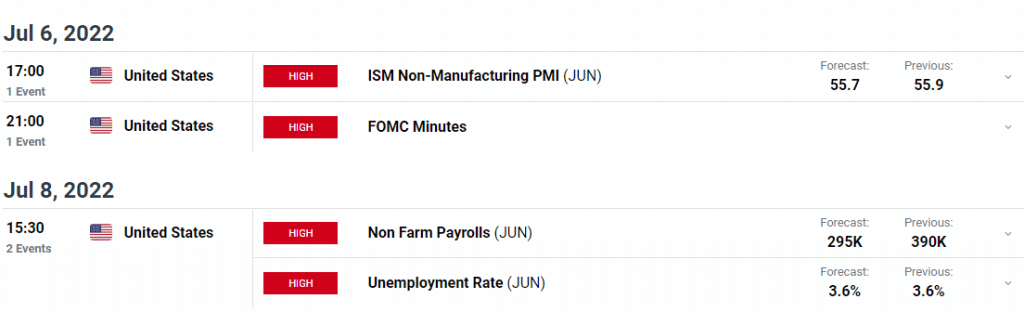

Next week’s key events for USD/CHF

USD/CHF will be at the mercy of the dollar in the coming week as the most important news releases will come from the United States. These releases will include the nonfarm payrolls. With jobless claims hovering at five-month highs, investors expect a payroll contraction. Recession fears have fueled layoffs in the technology and housing sectors as the Fed further tightens its monetary policy.

The unemployment rate is expected to hold at 3.6%. A higher-than-expected rate would show a tight labor market which could send USD/CHF lower.

-Looking for high probability free forex signals? Let’s check out-

USD/CHF weekly technical forecast: Bears found support at 0.9500

On the daily chart, bears pushed the price to 0.95004, where it found support. The week had been choppy for the pair until the last day when the price increased impulsively. The choppiness is a sign of weakness in the bearish move. Bulls have come in to test the waters and see if it is possible to start a bullish move. However, bears are still in charge since the price is trading below the 22-SMA and the RSI is below 50.

The trend will only change if the 22-SMA fails to act as resistance and the RSI starts trading above 50.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money