- Kuroda stated that altering Japan’s YCC policy could be an option.

- Markets anticipate a policy change when Kuroda retires.

- The rate gap between Japan and the US continues to widen.

Today’s USD/JPY forecast is bullish, ahead of the Fed’s rate hike, widening the rate gap between Japan and the US. Haruhiko Kuroda, governor of the Bank of Japan, said on Wednesday that altering the Yield Curve Control policy of the central bank could be an option in the future but was not being considered.

-Are you looking for automated trading? Check our detailed guide-

The market will probably continue to anticipate a change to the central bank’s ultra-low interest rates when the dovish Kuroda’s second, five-year term expires in April next year.

According to the BOJ’s September policy meeting minutes, policymakers noted the rising inflationary pressure. One emphasized the need to communicate a departure from ultra-loose monetary policy.

Most of the nine-member board believed the BOJ needed to maintain an ultra-loose monetary policy to ensure enough wage growth and support the bank’s goal of 2% inflation. However, some noted that as more businesses raise prices, corporate pricing practices may alter, and one noted that price increases are likely to continue.

As markets pay attention to the contrast between the BOJ’s ultra-loose policies and US interest rate hikes, the yen has fallen significantly against the dollar. A shift in BoJ’s monetary policy is one of the few things that can reverse this.

USD/JPY key events today

Investors are preparing for the US Federal Reserve’s policy decision later in the day, with many watching for any indications that rate hikes may be slowing down in the future. They will also pay attention to the ADP nonfarm employment change report.

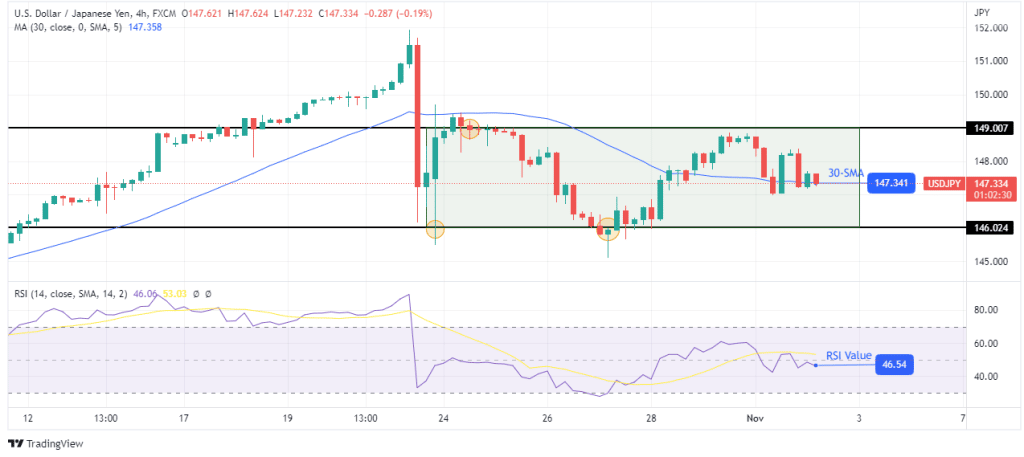

USD/JPY technical forecast: Consolidation at the 30-SMA

The 4-hour chart shows the price trading at 30-SMA and the RSI slightly below 50. There is indecision in the market, and neither bears nor bulls are committed to taking control of price movements. That is why the price keeps chopping through the SMA and the 50-mark in the RSI.

-If you are interested in forex day trading then have a read of our guide to getting started-

On a larger scale, the price consolidates with support at 146.02 and resistance at 149.00. If bulls take control, the price will retest the 149.00 resistance. On the other hand, if bears take over, it will retest the 146.02 support level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.