Donald downed the dollar in his first post-victory press conference. What’s next for the greenback ahead of the inauguration?

Here is their view, courtesy of eFXnews:

We believe near-term USD pullbacks represent a buying opportunity but see investors becoming more selective with respect to entry levels and positioning

As the inauguration day approaches, the first steps of the new administration are also likely to be scrutinised more closely. As we argue in this week’s editorial, optimism about fiscal stimulus is now somewhat moderated by concerns over rising protectionism and whether President Trump will be able to form a successful partnership with Congress. For example, while recent press reports suggested that the Trump team is favouring a 10% tariff on imports from China, Speaker Ryan and Congressional Republicans are instead aiming to overhaul the corporate tax code to the advantage of exporters.

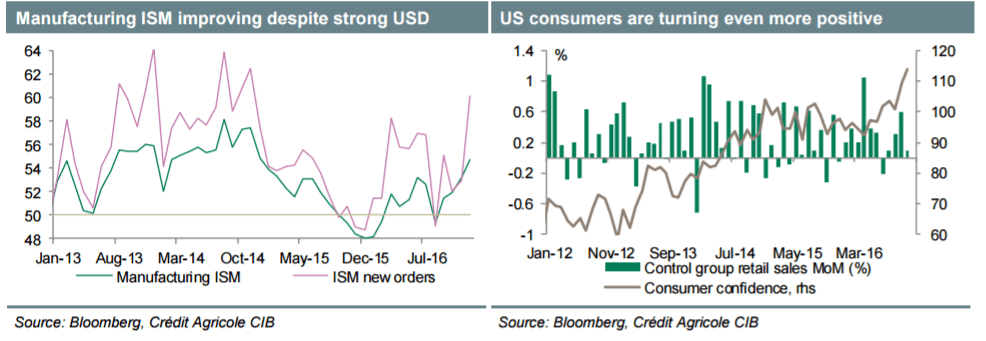

In terms of of US data, focus will be on Friday’s December retail sales. Consumer confidence surged in December to the highest level since the dot-com boom, and auto industry sales beat expectations. This bodes well for the headline retail sales reading, which our economists expect to show a gain of 0.9% MoM. For the core measure, we expect a more moderate but still robust 0.4% gain.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.