The US dollar was hit by the Fed and then by GDP. And it could go further south:

Here is their view, courtesy of eFXnews:

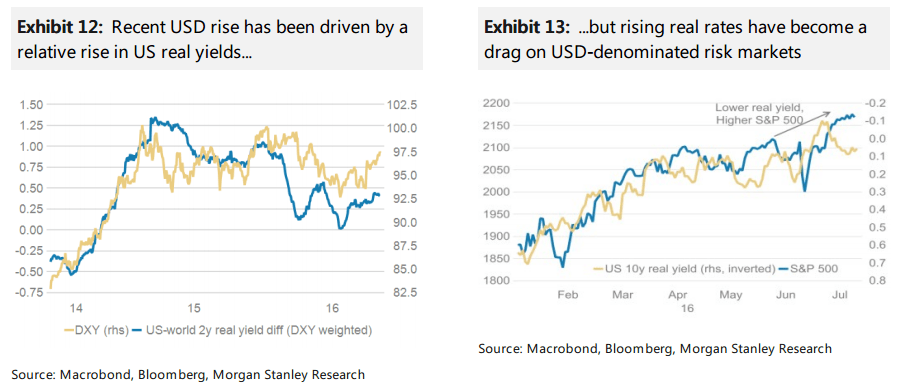

USD looking south: The Fed has little to gain by hiking rates early. Hence, we regard the recent rise in real US yields that has supported the 4% USD rally seen since May as unsustainable. Our long-held framework suggesting a combination of high global debt, capacity overhangs and resulting low returns on investment should keep deflationary pressures intact. The impact that this environment will have on financial markets via a flattened yield curve and subdued inflation expectations should further support our weaker USD view, even though there have been recent upside surprises in US economic data.

Lower US real yields: Over recent weeks markets have re-priced the front end of the US yield curve. For now, the Fed has no incentive to disagree with the market probability of a 50% chance of a 25bp rate hike by the end of this year. However, US economic surprises have probably peaked and falling oil prices may no longer be a net support for the US as it has become the globe’s biggest oil reserve holder. When oil prices declined in 2014/15, the consumer’s oil dividend ended up going into higher savings while oil sector investment fell. Our in-house indicators predict US domestic demand weakening from here. Starting with momentum:

Accordingly, USD should trade lower from here, and with markets positioned long in USD we expect that, initially, relative positioning and not relative fundamentals will drive markets.

The FX trade: This leaves the question of which currencies to trade long when a decline in risk appetite is the most likely outcome. JPY, EUR and CHF are best positioned to rally. Unfortunately, it would be a pain trade for many.

Some investors thought JPY would weaken with the help of coordinated expansionary fiscal and monetary policies of Japan’s authorities. This trade has been called into question this week.

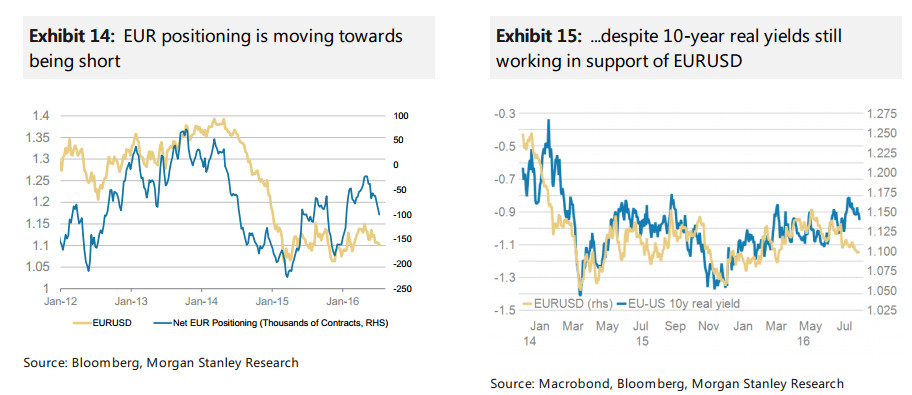

Some investors though the EUR would weaken,assuming that Brexit would weaken EMU economies by fuelling populism and increasing political uncertainties. However, EUR has remained stable. Domestic real money accounts have not developed an appetite for additional FX risk.

Consequently, EURUSD stayed above 1.09, with EUR-bearish positioning creating an ideal springboard for EUR to move significantly higher.

The stable EURCHF despite improved risk appetite suggests more CHF stability going forward, with Switzerland’s 10% current account surplus generating commercial CHF buying needs.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.