The historic victory of Donald Trump has already caused ruptures in financial markets, eventually helping the dollar. Can it continue forward? Here is the view from Morgan Stanley:

Here is their view, courtesy of eFXnews:

We expect Trump’s win to impact the FX market in three major ways, all likely to be USD bullish.

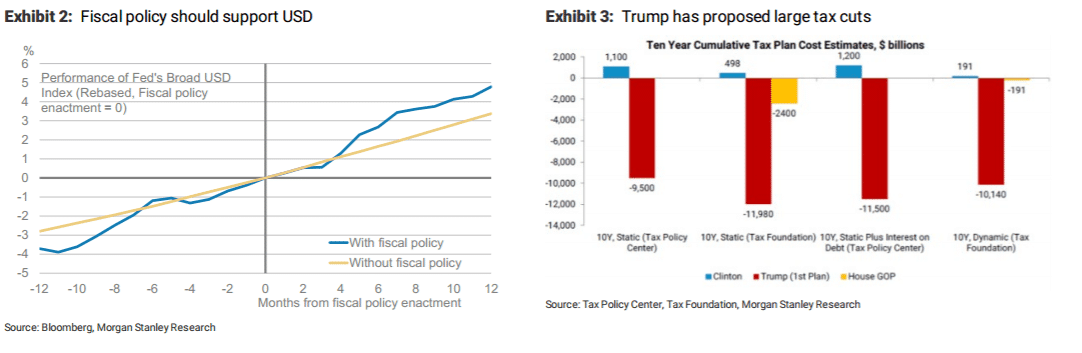

1) Fiscal stimulus: Trump’s focus on boosting infrastructure (one of the few policies mentioned in his victory speech) and cutting taxes suggest a fiscal stimulus boost to growth. After years of seeing fiscal expenditures growth declining, leaving the Fed with the main burden of ensuring economic recovery, we may be finally seeing fiscal policy pick up the slack. Ironically,neo-Keynesian claims by liberal economists reaching from Stiglitz to Krugman may find implementation via a Republican President Trump. It remains to be seen how Congress will deal with Trump’s fiscal proposals. Congress is now running Republican majorities in the House and the Senate. The past overreliance on monetary policy, which has not only been witnessed in the US,helped nominal and real bond yields fall towards historical lows. A better mix of US fiscal and monetary policy suggests yield differentials working increasingly in favour of the USD.

2) Trade: Trump has made trade protectionism an important pillar of his platform. Following through on his proposals to exit NAFTA or impose tariffs on select countries could lead to an economic shock and hit risk appetite. Currently, the market appears to be discounting the risk as more idiosyncratic (as evidenced by the outsized move in MXN) but it remains unclear what trade policy changes we can expect. Nonetheless, the ultimate impact would likely be USD positive. Trump has suggested thathigher tariffs would be directed against more open economies (for example, Mexico and China), implying bilateral USD strength.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

3) Corporate Tax Reform: Comprehensive tax reform stands out as one of Trump’s few detailed policy proposals and we think passage of a bill is likely given similar interest from the Republican Congress. Corporate tax reform would likely include a repatriation taxholiday (a one-time reduced tax rate on corporate profits broughthome) which would incentivize repatriation of foreign currency into USD. As we discussed previously, (US Election 2016:Fighting the Fear of the Unknown, July 12,2016) this reform will likely provide modest support for USD. While a large amount of offshore earnings are already in USD and it’s difficult to say how much of the foreign currency holdings are hedged, there should nonetheless be some amount of USD buying and foreign currency selling. The last repatriation tax holiday (the Homeland Investment Act) resulted in $300bn of retained earnings brought back in 2005 (nearly 5x increase over previous years). With a much larger pile of offshore earnings today, there is scope for even larger repatriation, but the inherentuncertainty around the size and timing of these flows imply a moderate long-term USD tailwind.

The impact of the above three factors is clearly USD bullish.