The Canadian dollar posted strong gains last week, climbing 160 points. USD/CAD closed the week at 1.2815, its lowest level since July 2015. This week’s key events are consumer inflation and retail sales reports. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

As expected, the Bank of Canada held rates at 0.50%. In the US, both retail sales and inflation reports missed expectations, which has likely taken an April rate off the table. As well, consumer confidence numbers were well short of the estimate.

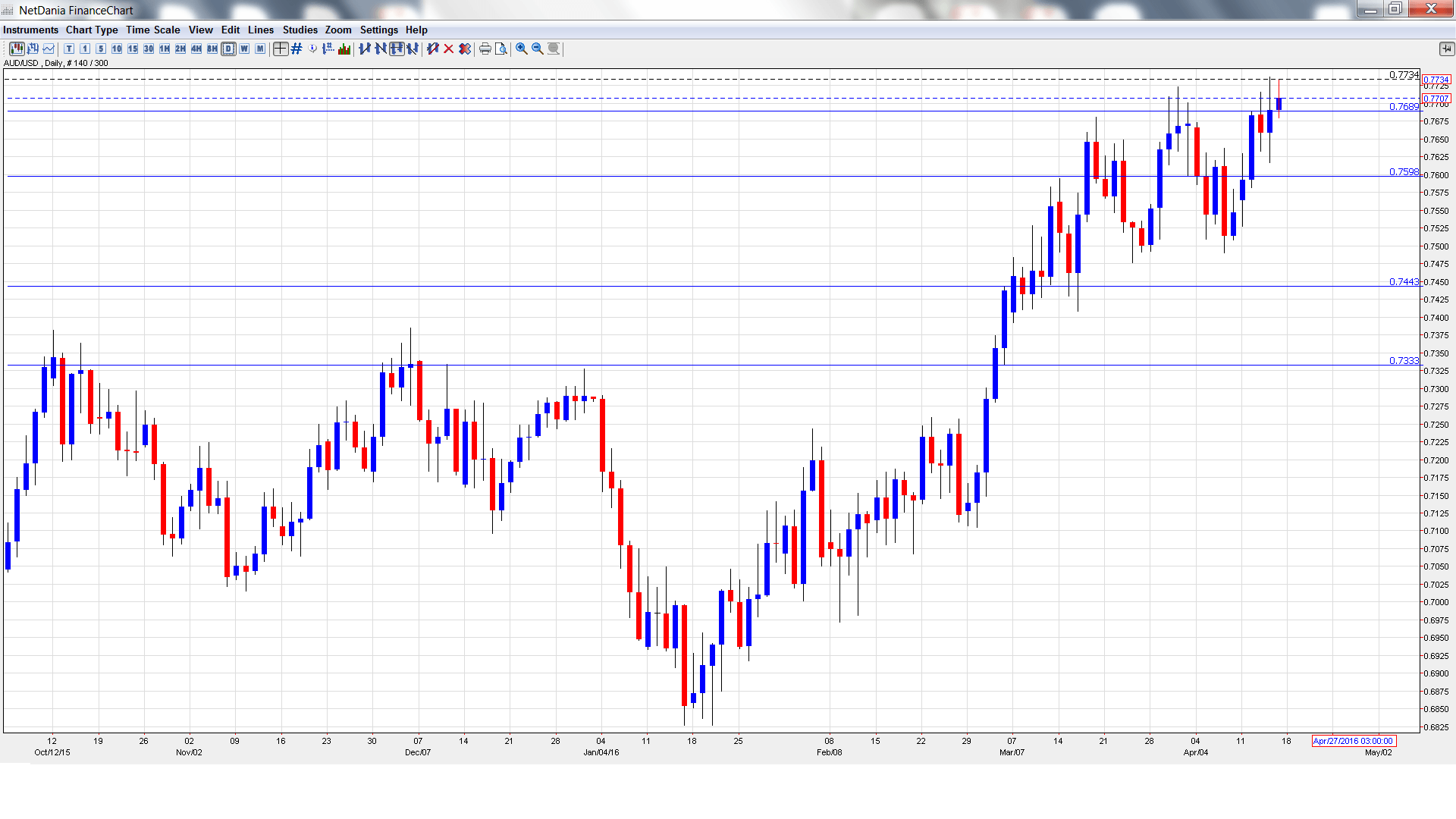

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- BOC Senior Deputy Governor Carolyn Wilkins Speaks: Sunday 14:00. Wilkins will deliver remarks at an IMF event in Washington. A speech which is more hawkish than expected is bullish for the Canadian dollar.

- Foreign Securities Purchases: Monday, 12:30. The indicator jumped to C$13.51 billion in February, easily beating the forecast of C$10.2 billion. A softer reading is expected for March, with an estimate of C$78.52 billion.

- BOC Governor Stephen Poloz Speaks: Tuesday, 15:00. Poloz will testify before the House of Commons Standing Committee on Finance in Ottawa. The markets will be looking for hints as to the BOC’s future plans regarding interest rate policy.

- Wholesale Sales: Wednesday, 12:30. This indicator slipped to a flat reading of 0.0% in January, short of the forecast of 0.3%. Will the indicator bounce back into positive territory in the February report?

- Core CPI: Friday, 12:30. Core CPI climbed to 0.5% in February, matching the forecast. This marked the index’s highest gain in 12 months. Another strong gain in March is be bullish for the Canadian dollar.

- Core Retail Sales: Friday, 12:30. The indicator rebounded a strong gain of 1.2% in February, well above the estimate of 0.6%. The markets are bracing for a downturn in March, with the estimate standing at -0.8%.

- CPI: Friday, 12:30. CPI posted a gain of 0.2% in February, unchanged from a month earlier. The index is expected to improve to 0.3% in the March report.

- Retail Sales: Friday, 12:30. Retail Sales is the primary gauge of consumer spending. The indicator jumped to 2.1% in January, crushing the forecast of 0.7%. However, the indicator is expected to reverse directions, with an estimate of -0.8%.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.2978 and quickly touched a high of 1.3016, as resistance held firm at 1.3064 (discussed last week). The pair then dropped sharply to a low of 1.2736. USD/CAD closed the week at 1.2815.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

With the pair posting sharp losses, we start at lower levels:

1.3457 has held firm in resistance since the first week in March.

1.3353 is the next line of resistance.

13174 was a cap in October 2015.

1.3064 is an immediate resistance line.

The round number of 1.2900 is providing support. This line was a cushion in October.

1.2780 is the next support level.

1.2646 has held steady in support since late June 2015.

1.2538 is the next support level.

1.2410 is the final support line for now.

I am bullish on USD/CAD

With an uncertain global economic environment, the safe-haven US dollar remains an attractive asset for many investors. The oil producers meeting in Doha is not expected to end with any significant agreements, and this could send oil prices lower, which would likely weaken the Canadian dollar.

In our latest podcast go on a Euro-trip

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.