The Canadian dollar posted modest gains this week, as USD/CAD closed at 1.3085. This week’s key events are Core CPI and Core Retail Sales. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Fed continues to remain mum about a rate hike, so the guessing game on the part of the markets continues. Retail Sales were strong, but employment and consumer confidence numbers were slightly lower than expected. In Canada, Manufacturing Sales posted a lower gain than anticipated, and this pulled the loonie lower late in the week.

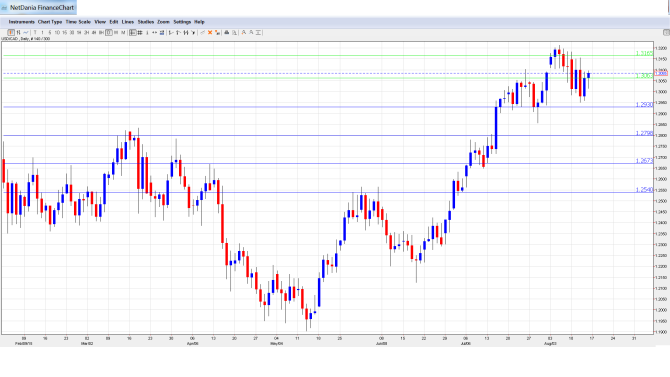

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Foreign Securities Purchases: Monday, 12:30. This indicator disappointed in the May reading, posting a decline of C$5.45 billion. This was nowhere near the forecast of a gain of C$8.21 billion. It also marked the indicator’s first decline in 2015.

- Wholesale Sales: Thursday, 12:30. Wholesales Sales is the first key indicator of the week. In May, the indicator came in at -1.0%, well of the estimate of 0.1%. The markets are expecting better news in June, with the estimate standing at +0.2%.

- Core CPI: Friday, 12:30. Core CPI excludes the most volatile items which are included in CPI and tend to distort the underlying trend. The index continues to slip, falling to 0.0% in June, which was within expectations.

- Core Retail Sales: Friday, 12:30. This indicator excludes automobile sales, which tends to be quite volatile. The indicator rebounded in June with a strong gain of 0.9%, beating the forecast of 0.7%. Will we see another strong reading in the July report?

- CPI: Friday, 12:30. CPI is the primary gauge of consumer inflation. The index softened in July, with a reading of 0.2%, which matched the forecast.

- Retail Sales: Friday, 12:30. Retail Sales is one of the most important indicators, and an unexpected reading can quickly affect the movement of USD/CAD. The indicator rebounded in June with a excellent gain of 1.0%, easily beating the estimate of 0.4%.

* All times are GMT.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3147 and quickly climbed to a high of 1.3182. The pair then reversed directions and touched a low of 1.2951, as support held firm at 1.2924 (discussed last week). USD/CAD moved higher late in the week and the pair closed at 1.3085.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

We start with resistance at 1.3587.

1.3443 was a cap in December 2003.

1.3346 has held firm since August 2004.

1.3165 was tested during the week and is an immediate resistance line.

1.3063 is protecting the symbolic line of 1.30. It is a weak support line and could see further action early in the week.

1.2924 held firm for a second straight week as the Canadian dollar showed some strength before retracting.

1.2798 is the next line of support.

1.2673 saw a lot of action in July.

1.2541 is the final support level for now.

I am bullish on USD/CAD

The US economy continues to outperform its Canadian counterpart, and the some strong numbers this week out of the US could translate into a more enthusiastic Fed regarding a rate hike. Canada will have to post some strong inflation and retail sales numbers if the Canadian dollar is to hold its ground against the greenback.

In our latest podcast we discuss predictable currencies vs. unpredictable central banks.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.