USD/CAD posted its largest weekly gain since January, gaining about 370 points. The pair closed at 1.3754, its highest levels since June 2004. This week’s key events are Manufacturing Sales and Core CPI. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, retail sales and inflation numbers met expectations late in the week. Expectations of a rate hike at the all important Fed policy meeting enabled the US dollar to rack up huge gains against its Canadian counterpart.

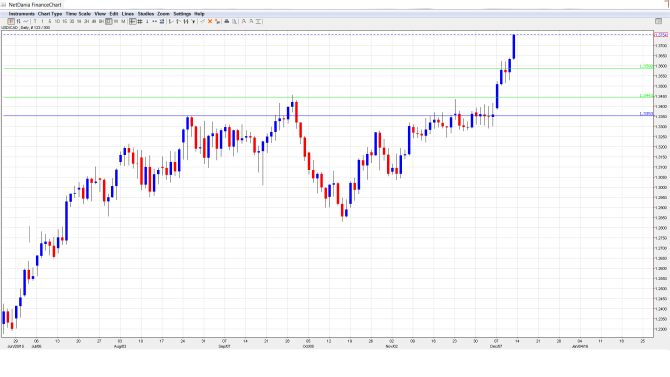

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing Sales: Tuesday, 13:30. The week kicks off with this key release, which should be treated as a market-mover. The indicator has posted two straight declines, with a reading of -1.5% in the September release. This was well off the market forecast of +0.3%.

- BOC Financial System Review: Tuesday, 16:00. This report examines conditions in the financial system and potential risks to financial stability. Analysts will be looking for clues as to the BOC’s future monetary policy. BOC Governor Stephen Poloz will host a follow-up press conference.

- Foreign Securities Purchases: Wednesday, 13:30. This indicator is closely linked to currency demand, as foreigners must purchase Canadian dollars in order to buy Canadian securities. The indicator has recorded gains in the past two releases, and came in at C$3.35 billion last month, short of the estimate of C$4.12 billion.

- Core CPI: Friday, 13:30. Core CPI excludes the most volatile items which comprise CPI. The index improved in October with a gain of 0.3%, marking a 5-month high.

- CPI: Friday, 13:30. CPI remains at weak levels. The index came in at 0.1% in the October report, matching the forecast.

- Wholesale Sales: Friday, 13:30. Wholesale Sales is a leading indicator of consumer spending. The indicator has struggled, posting declines for most of 2015. In September, the indicator came in at -0.1%, missing the forecast of +0.2%.

* All times are GMT.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3390 and touched a low of 1.3384. The pair then surged to a high of 1.3757, as resistance held firm at 1.3759 (discussed last week). USD/CAD closed the week at 1.3754.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

With USD/CAD posting sharp gains, we begin at higher levels.

141.57 was an important cushion in April 2003.

1.4003 follows, just above the psychologically important 1.40 level.

The round number of 1.39 is next.

1.3759 held firm but remains under pressure after last week’s huge surge by USD/CAD.

1.3587 was a cap in March 2004.

1.3443 has held firm since late September.

1.3353 is the final support level for now.

I am bullish on USD/CAD

With the markets expecting that the Federal Reserve will press the rate trigger next week, market sentiment will likely remain positive regarding the US dollar. The US economy continues to outperform that of Canada, and monetary divergence will continue to weigh on the Canadian dollar.

Our latest podcast is title Get Ahead of the Fed

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.