The Canadian dollar flexed some muscle during the week, climbing to its highest levels since early December. USD/CAD closed the week at 1.3915. This week has just three indicators. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Canadian dollar posted strong gains following a weak US Services PMI. USD/CAD bounced higher on Friday, due to soft employment numbers in the US and in Canada.

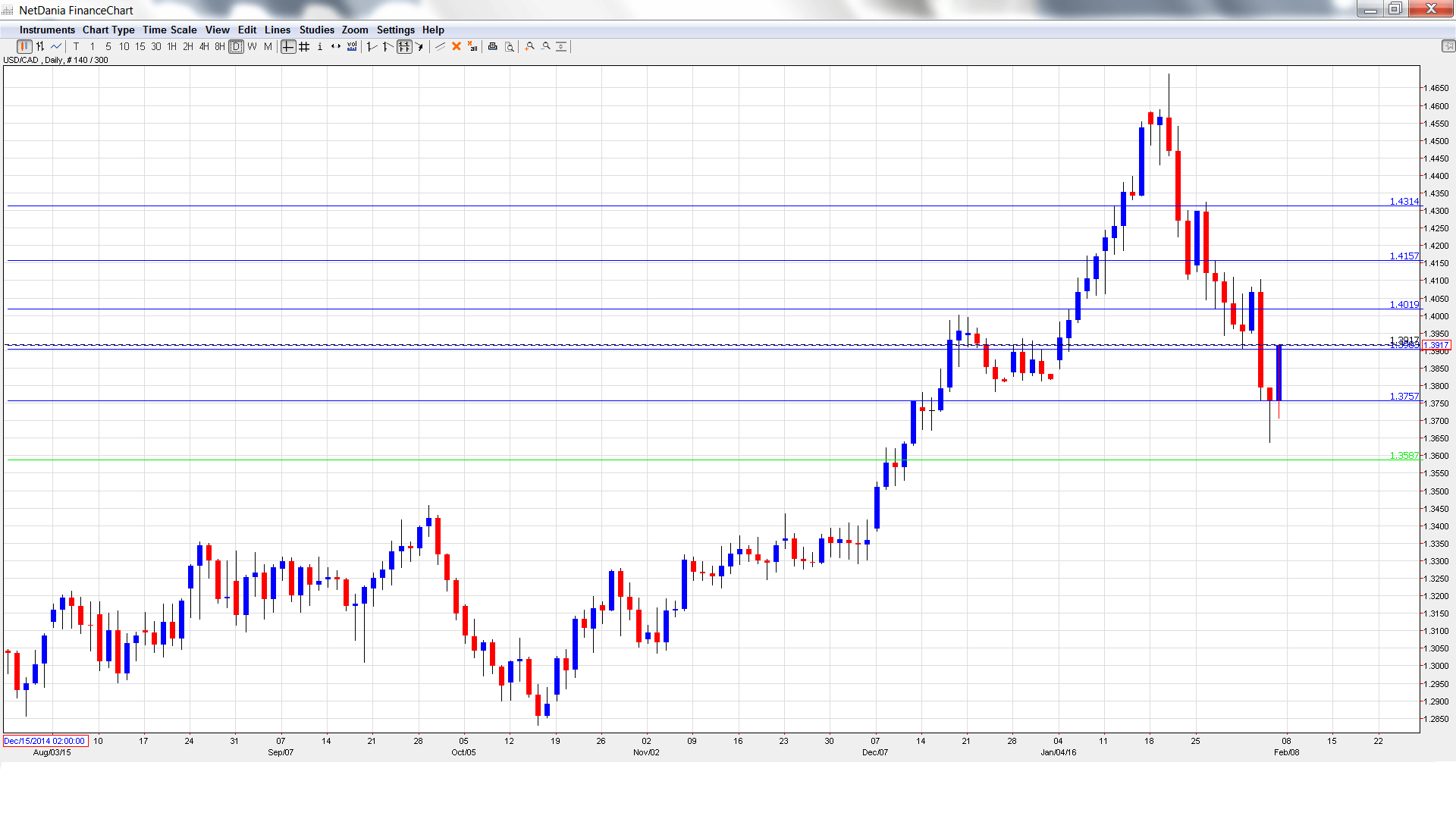

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Building Permits: Monday, 13:30. This indicator has struggled, posting three declines in the past four readings. The November release was particularly weak, with a huge decline of 19.6%. This was much worse than the estimate of -3.2%.

- BOC Deputy Governor Timothy Lane Speaks: Monday, 17:05. Lane will deliver a speech in Montreal. The markets will be listening for clues regarding the BOC’s future monetary policy.

- NHPI: Thursday, 13:30. The housing price index continues to post modest gains. The November release came in at 0.2%, matching the forecast. The forecast for the December report stands at 0.3%.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3973 and climbed to a high of 1.4103. The pair then reversed directions and dropped to a low of 1.3638, as support held firm at 1.3587 (discussed last week). USD/CAD closed the week at 1.3915.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

We start with resistance at 1.4310, which has held since late January.

1.4159 is the next line of resistance.

1.4019 has some breathing room as the Canadian dollar lost ground last week.

The round number of 1.39 is the next support line.

1.3757 was a cap in December.

1.3587 is the final line for now.

I am bullish on USD/CAD

The Canadian dollar has posted strong gains in the past two weeks, but is still vulnerable, trading close to the 1.40 line. The US economy continues to outperform the Canadian economy, and the markets will be speculating about a March rate hike in the US, a move which would bolster the greenback.

Our latest podcast is titled Americans get a raise, negativity in Japan, Gas Naturally Low

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.