The Canadian dollar improved for a second straight week, as USD/CAD dropped 170 points. The pair closed at 1.3974, its lowest level in 4 weeks. This week’s highlight is Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Federal Reserve was cautious in its policy statement, lowering the chances of a hike in March, and US durables looked awful last week. Canadian GDP posted a gain of 0.3%, matching the forecast.

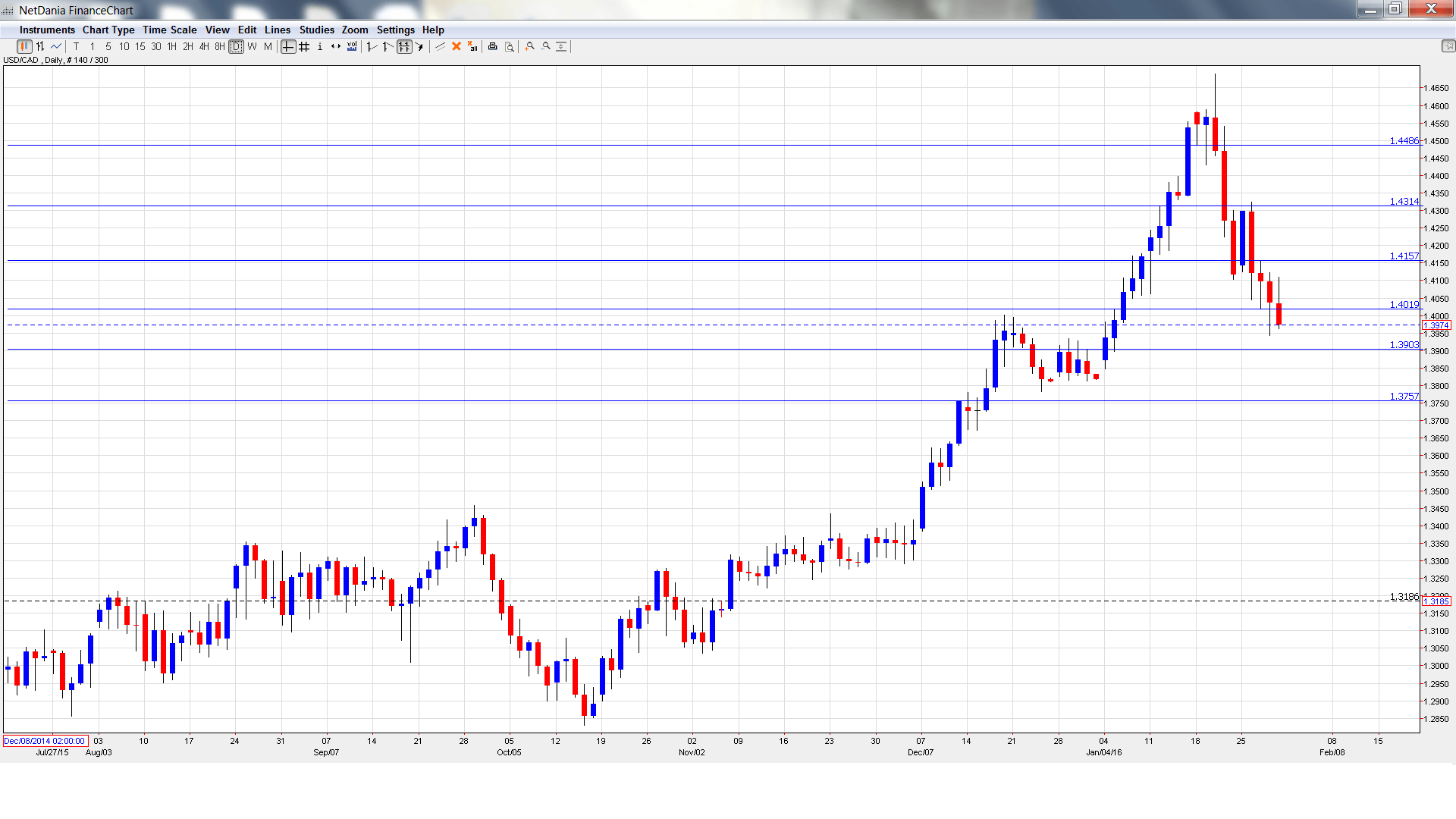

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- RBC Manufacturing PMI: Monday, 14:30. This PMI has posted five straight readings below the 50 point-level, indicative of ongoing contraction in the manufacturing sector. Will the index push above the 50 line in the January report?

- Employment Change: Friday, 13:30. This key indicator can have a sharp impact on the movement of USD/CAD. The indicator rebounded in December with an excellent gain of 22.8 thousand, crushing the estimate of 10.4 thousand. The unemployment rate has been steady, coming in at 7.1% in the past two months.

- Trade Balance: Friday, 8:30. Canada’s trade deficit narrowed to C$-2.0 billion, better than the forecast of C$-2.6 billion. Will the deficit continue to drop in the December report?

- Ivey PMI: Friday, 15:00. The index plunged in December to 49.9 points, compared to 63.6 points a month earlier. This weak figure missed expectations and marked a 9-month low. The markets are expecting a slight improvement, with the estimate standing at 50.3 points.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.4143 and quickly climbed to a high of 1.4325. The pair reversed directions and dropped to a low of 1.3943, breaking below support at 1.4019 (discussed last week). USD/CAD closed the week at 1.3974.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

We start with resistance at 1.4480. This line was an important cushion in April 2000.

1.4310 is the next line of resistance.

1.4159 has strengthened as USD/CAD trades at lower levels.

1.4019 has switched to a resistance role. It is a weak line and could see further action early in the week.

The round number of 1.39 is the next support line.

1.3757 was a cap in December.

1.3587 is the final line for now.

I am bullish on USD/CAD

The Canadian dollar has posted strong gains in the past two weeks, but is still vulnerable, trading close to the 1.40 line. The US economy continues to outperform the Canadian economy, and the markets will be speculating about a March rate hike in the US, a move which would bolster the greenback.

In our latest podcast we make sense of turbulent markets

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.