USD/CAD posted strong gains last week, as the pair climbed 160 points. The pair closed at 1.3122. It’s a very quiet week, highlighted by the GDP release. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, housing numbers were steady and continued the positive trend. Over in Canada, Core CPI dropped to 0.0%, its lowest level in five months. Core Retail Sales softened in May, posting a gain of 0.9%. Still, this beat the forecast of 0.3%.

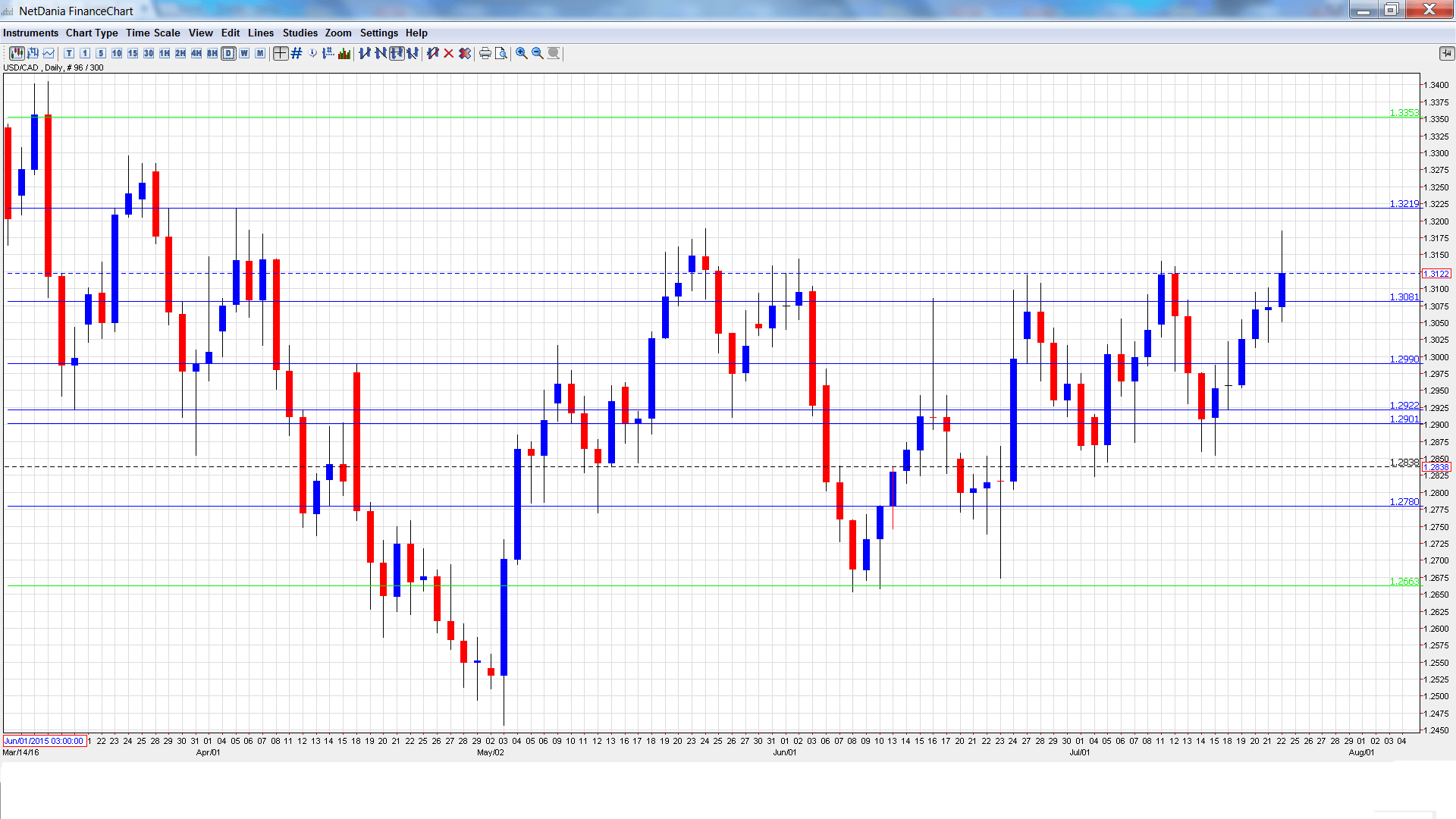

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- GDP: Friday, 12:30. GDP is one of the most important economic indicators, and an unexpected reading can have a strong impact on the movement of USD/CAD. In April, GDP posted a small gain of 0.1%, matching the forecast. The markets are braced for a downturn in the May report, with an estimate of -0.5%.

- RMPI: Friday, 12:30. RMPI measures inflation in the manufacturing sector. The index jumped 6.7% in May, well above expectations. The estimate for the June report stands at 3.2%.

USD/CAD opened the week at 1.2957 and quickly touched a low of 1.2922, as support held firm at the round number of 1.2900 (discussed last week). It was all uphill from there, as the pair climbed to a high of 1.3185. USD/CAD closed the week at 1.3122.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

We start with resistance at 1.3457.

1.3353 is next.

1.3219 was a cap in April.

1.3081 is a weak support line and could see further action early in the week.

1.2990 has switched to a support role following strong gains by USD/CAD last week.

1.2900 held firm as the pair dipped lower early in the week before climbing higher.

1.2780 is next.

1.2663 has held firm in support since early May. It is the final support line for now.

I am bullish on USD/CAD

With the US posting solid data, speculation has risen that the Fed will raise rates in 2016. A July move is very unlikely, but if next week’s Fed meeting is hawkish, the greenback could move higher.

Our latest podcast is titled Oil down, gold up and the upcoming Fed-fest

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.