The Canadian dollar continued to rally last week, as USD/CAD dropped 180 points. The pair closed the week at 1.2779, its lowest level since late April. This week’s key events are Manufacturing Production and Core CPI. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In Canada, employment numbers beat expectations. Employment Change improved sharply to 15.3 thousand, and the unemployment rate dropped to 6.9%. In the US, Janet Yellen gave a cautious speech and didn’t mention a timetable regarding a rate hike. US employment numbers bounced back after the awful NFP report, as JOLT Job Openings and Unemployment Claims beat expectations.

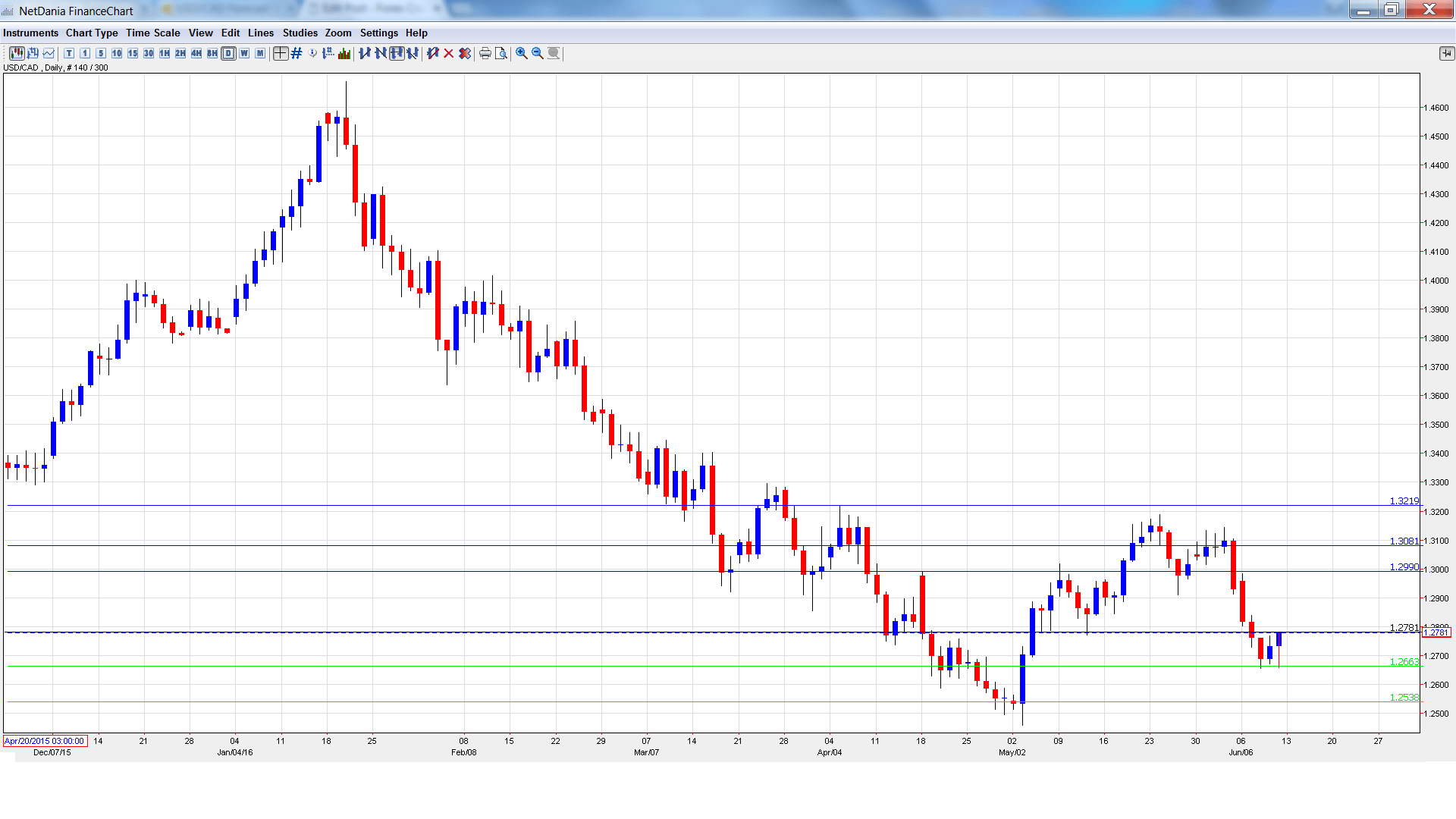

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Manufacturing Sales: Wednesday, 12:30. The week kicks off with this key event. The indicator has been struggling, posting two straight declines. Will we see a rebound in the April report?

- BoC Governor Stephen Poloz Speaks: Wednesday, 23:55. Poloz will deliver remarks in Ottawa regarding the Financial Systems Review. Analysts will be looking for clues as to future monetary moves from the BoC.

- Foreign Securities Purchases: Thursday, 12:30. This indicator is closely linked to currency demand, so a strong reading could boost the Canadian currency. The indicator climbed to C$17.17 billion in March, easily beating the forecast of C$10.35 billion.

- Core CPI: Friday, 12:30. This index is used by the BoC to measure inflation, and should be treated as a market-mover. The indicator fell to just 0.2% in April, its lowest level in four months.

- CPI: Friday, 12:30. Inflation levels remain very low and is a major concern for the BoC. The index dropped to 0.3% in April, shy of the forecast of 0.4%.

- Governor Council Member Carolyn Wilkins Speaks: Friday, 17:05. Wilkins will speak at an event in Whitehorse. A speech that is more hawkish than expected is bullish for USD/CAD.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.2957 and touched a high of 1.2982, as resistance held firm at 1.2990 (discussed last week). The pair then reversed directions, as the pair dropped to a low of 1.2653. USD/CAD then moved upwards and closed the week at 1.2779.

Live chart of USD/CAD: [do action=”tradingviews” pair=”USDCAD” interval=”60″/]

Technical lines, from top to bottom

1.3219 was a cap in April.

1.3081 remains a strong resistance line.

1.2990 held firm last week as the pair started the week with slight gains before retracting.

1.2900 has switched to resistance following strong losses by USD/CAD.

1.2780 starts the week just above the current level of USD/CAD. It will likely see action early in the week.

1.2663 has held firm in support since early May.

1.2538 is next.

1.2387 is the final support line for now.

I am neutral on USD/CAD

The Fed will keep the markets guessing about a rate hike, although a June move would be a huge surprise. US job numbers appear to have stabilized after a dismal NFP, and market sentiment towards the US economy remains positive. Canadian job numbers were a pleasant surprise last week, and the loonie could continue to improve if inflation numbers show some improvement.

Our latest podcast is titled Oil, Brexit and the Big Fed Preview

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.