USD/CAD gained 50 points last week, as the pair closed at 1.3264. This week’s key event is GDP. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

Canadian consumer spending was sharp, as core retail sales jumped 1.5%, beating expectations. In the US, some policymakers reiterated the hawkish bend of the recent rate decision, although other members expressed concern about low inflation levels.

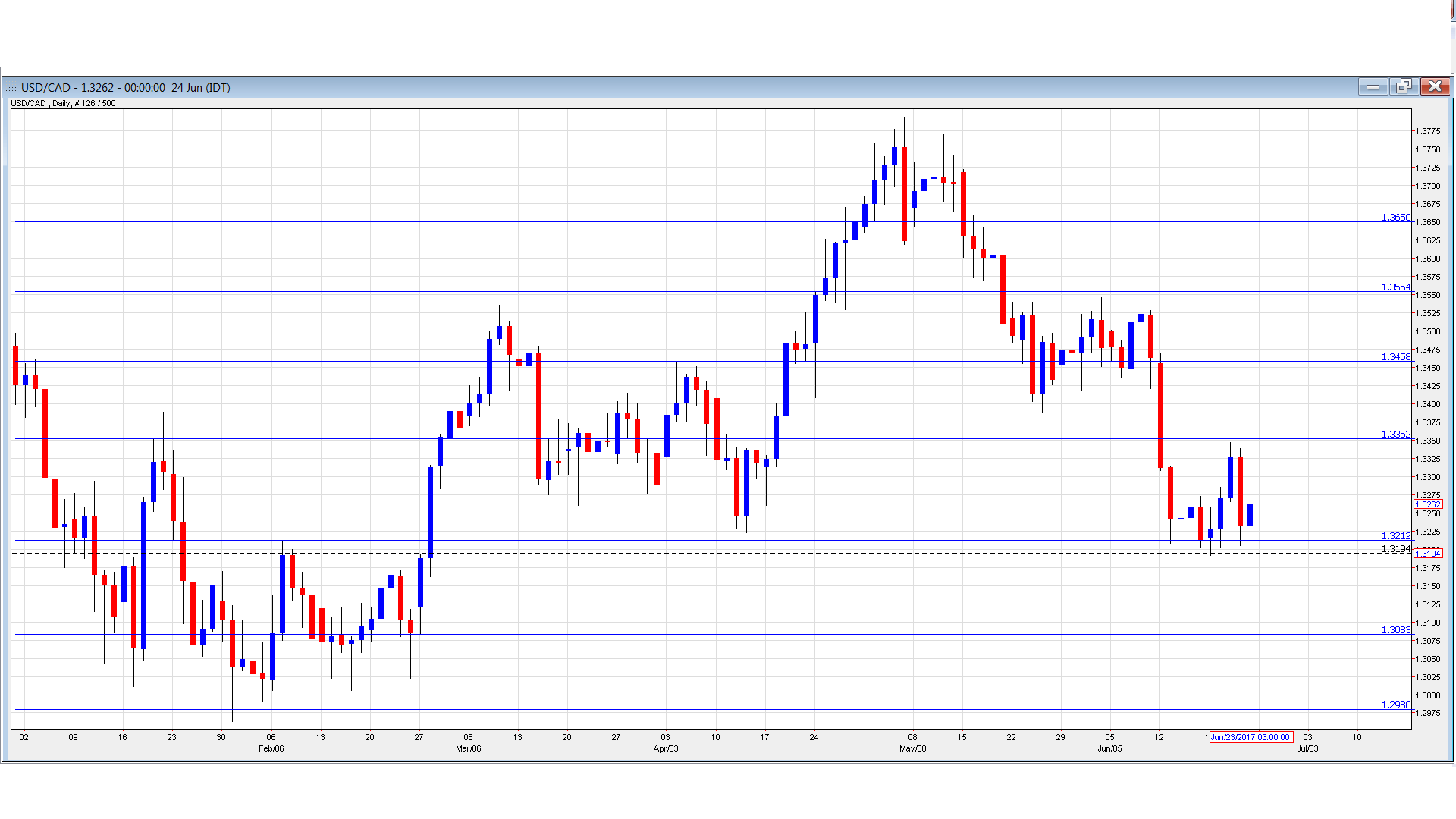

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- BoC Governor Stephen Poloz Speaks: Wednesday, 13:30. Poloz will speak at an event in Portugal. A speech which is more hawkish than expected is bullish for the Canadian dollar.

- BoC Deputy Governor Lynn Patterson Speaks: Wednesday, 18:15. Patterson will speak at an event in Portugal. The markets will be looking for clues regarding future monetary policy.

- GDP: Friday, 12:30. Canada releases GDP on a monthly basis. In April, GDP jumped to 0.5%, above the forecast of 0.3%. Will the upswing continue in the May report?

- RMPI: Friday, 12:30. This inflation indicator rebounded in April with a gain of 1.6% but this was well short of the forecast of 3.8%.

- BoC Business Outlook Survey: Friday, 14:30. This report is released every 6 months, and helps analysts gauge the strength of the business sector. The survey asks business about their plans regarding hiring, spending and investment.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3214 and quickly dropped to a low of 1.3191. The pair then reversed directions and climbed to a high of 1.3347, as resistance held at 1.3351 (discussed last week). The pair closed the week at 1.3264.

Technical lines, from top to bottom

We start with resistance at 1.3648.

1.3551 is next.

1.3457 was a high point in September 2015.

1.3351 held in resistance as the pair posted strong gains before retracting.

1.3212 is an immediate support line.

1.3083 has held in support since February.

1.2980 is next.

1.2823 is the final support level for now.

I am neutral on USD/CAD

A Fed rate hike in December is priced in at 50/50, as consumer spending and inflation remain soft. The Canadian dollar is linked to oil prices, which have been dropped sharply in June. If this trend continues, the loonie could lose ground.

Our latest podcast is titled Fed faking it until they make it? + a Brexit brawl

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.