The Canadian dollar surged last week, as USD/CAD dropped 240 points. The pair closed at 1.3212, its lowest level since late February. There are four events on the calendar this week. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

The Canadian dollar jumped following hawkish remarks from BoC Governor Poloz, who said that rate cuts had “done their job” as the economy continued to improve. In the US, the Fed raised rates as expected, but the rate statement was more hawkish than expected, as policy makers were upbeat about the economy and shrugged off lower inflation.

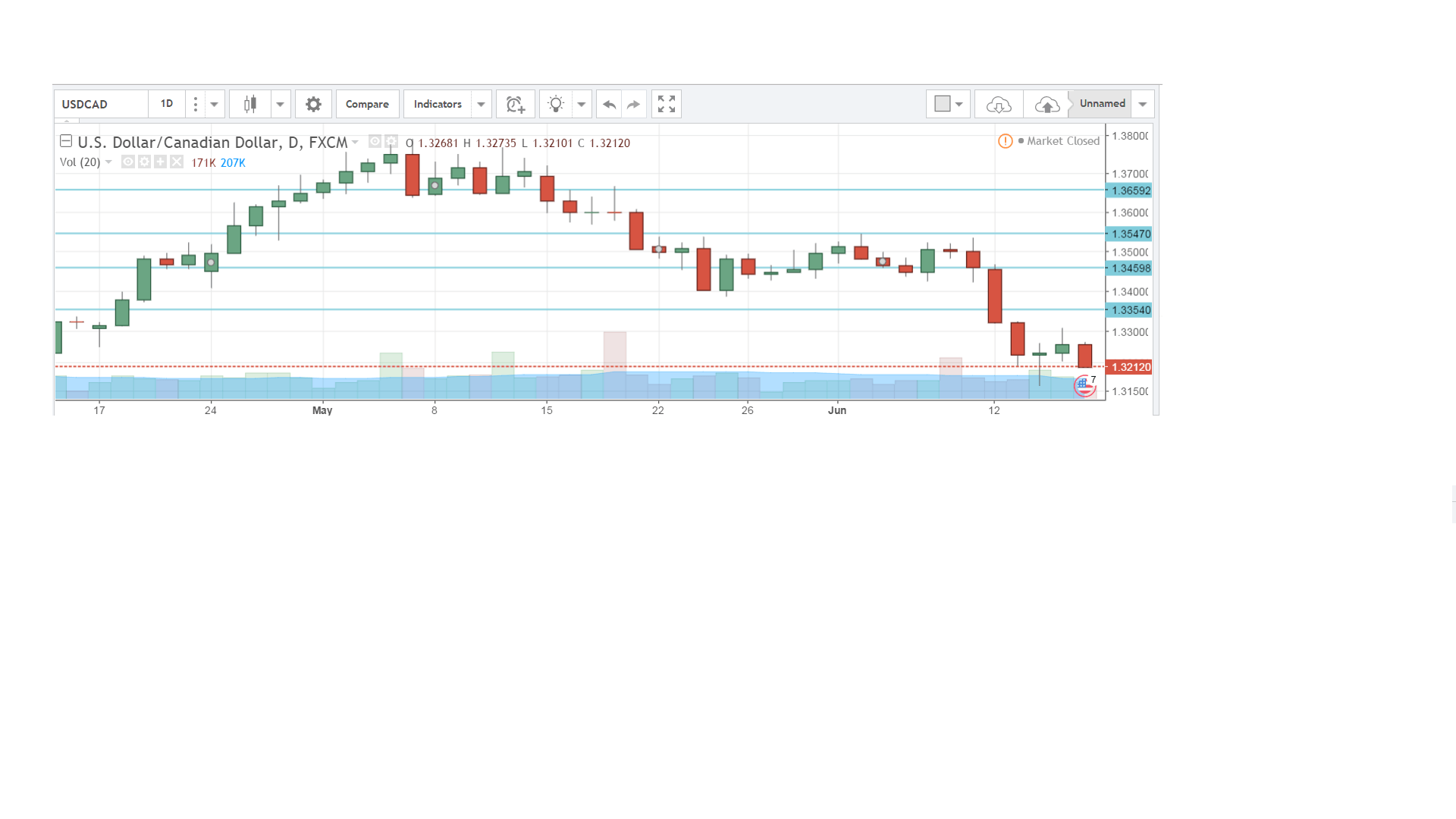

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Wholesale Sales: Tuesday, 12:30. Wholesale Sales rebounded In March with a strong gain of 0.9%. However, this was short of the forecast of 1.1%.

- Core Retail Sales: Thursday, 12:30. This key event should be treated as a market-mover. The indicator has struggled, posting three declines in the past four months.

- Retail Sales: Thursday, 12:30. Retail Sales rebounded in April with a gain of 0.7%, above the estimate of 0.4%. Will we see another gain in the May report?

- CPI: Friday, 12:30. CPI is the primary gauge of consumer inflation, and an unexpected reading can affect the movement of USD/CAD. In April, the indicator improved to 0.4%, just shy of the forecast of 0.5%.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3456. The pair quickly climbed to a high of 1.3470, testing resistance at 1.3457 (discussed last week). The pair then dropped sharply to a low of 1.3165 and closed at .13212.

Technical lines, from top to bottom

With USD/CAD recording sharp losses, we start at lower levels:

We start with resistance at 1.3648.

1.3551 has some breathing room in resistance.

1.3457 was a high point in September 2015.

1.3351 has switched to a resistance line following strong losses by USD/CAD.

USD/CAD starts the week at 1.3212, which was tested in support last week.

1.3083 has held in support since February.

1.2980 is the final support level for now.

I am bearish on USD/CAD

With the Fed rate out of the way, investors could focus on the Trump administration, which could continues to flounder. The Canadian economy has been improving, and the loonie’s impressive rally could continue.

Our latest podcast is titled Fed faking it until they make it? + a Brexit brawl

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.