The Canadian dollar was almost unchanged last week, with USD/CAD closing at 1.3480. This week’s key event is Employment Change. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

In the US, Nonfarm Payrolls was dismal, as the gain of 138 thousand was well below expectations. This reading was surprising, coming on the heels of an excellent ADP nonfarm payrolls. Canada’s GDP posted a strong gain of 0.5% in March, beating the forecast and giving the loonie some tailwind.

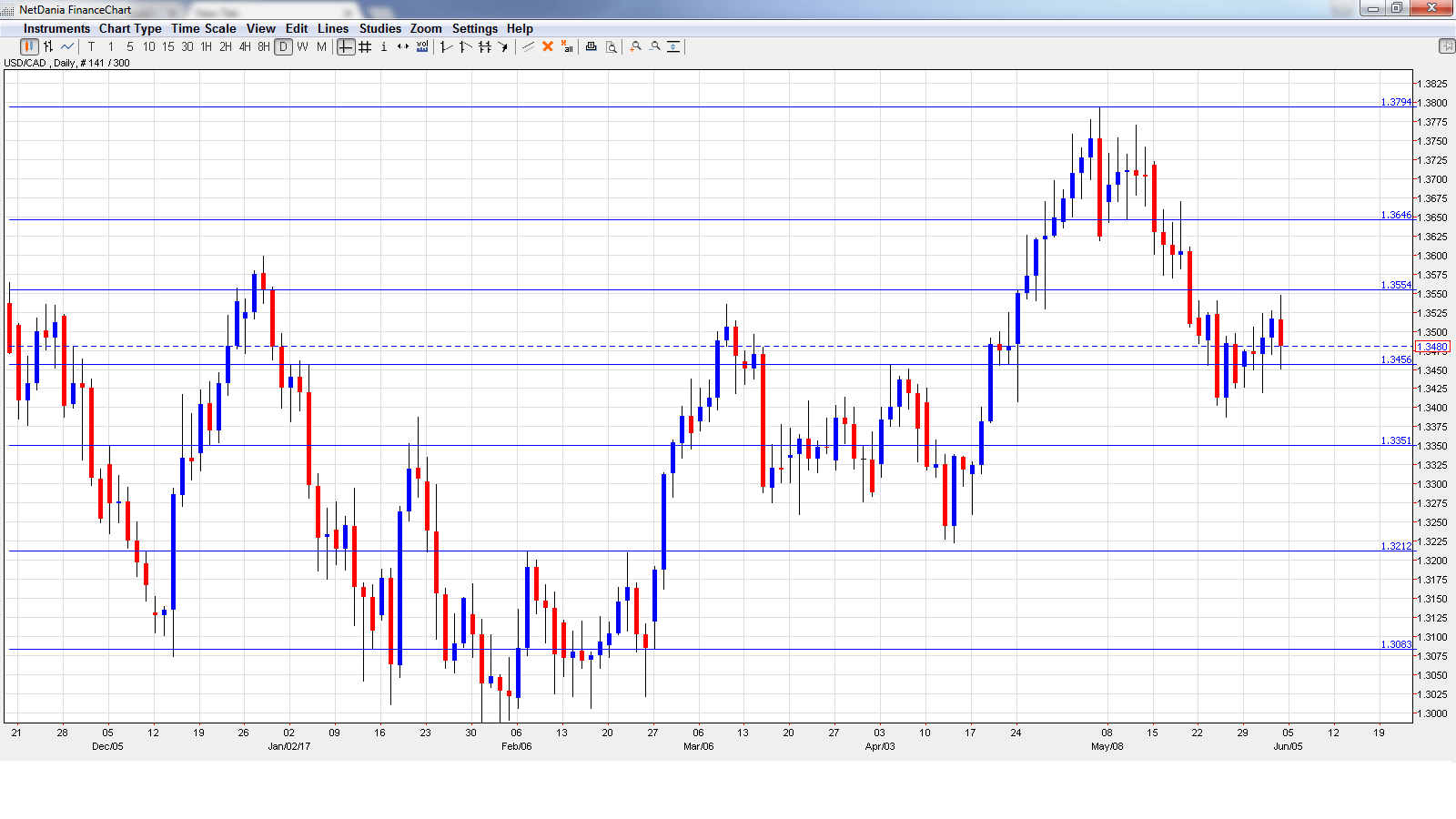

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Ivey PMI: Tuesday, 14:00. This indicator continues to show strong expansion and climbed to 62.4 in April. The markets are expecting another solid reading in May, with an estimate of 60.0 points.

- Building Permits: Wednesday, 12:30. The indicator has been struggling, with just one gain in the past five months. In March, the indicator came in at -5.8%, well below the forecast of +4.2%. Will we see an improvement in the April report?

- Housing Starts: Thursday, 12:15. The indicator dipped to 214 thousand in April, shy of the forecast of 220 thousand. The downward trend is expected to continue in May, with an estimate of 205 thousand.

- NHPI: Thursday, 12:30. This index is an important gauge of the strength of the housing sector. The indicator softened in March, with a forecast of 0.2%. The estimate for April stands at 0.3%.

- BoC Financial System Review: Thursday, 14:30. This report looks at the strength of the financial system, and analysts will be looking for clues as to future monetary policy.

- Employment Change: Friday, 12:30. After a string of strong gains, the economy added only 3.2 thousand jobs in April, well below expectations. The markets are expecting better news in May, with an estimate of 11.5 thousand.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3453 and touched a low of 1.3420. Late in the week, the pair climbed to a high of 1.3547, as resistance held at 1.3551(discussed last week). The pair was unable to consolidate at this level and closed the week at 1.3480.

Technical lines, from top to bottom

We begin with resistance at the round number of 1.39.

1.3794 was the high for the month of May.

1.3648 is next.

1.3551 held firm as USD/CAD posted gains late in the week before retracting.

1.3457 was a high point in September 2015.

1.3351 has held in support since mid-April.

1.3212 is next.

1.3083 is the final support level for now.

I am bullish on USD/CAD

The Federal Reserve is expected to raise rates next week, and even though the markets have priced in the move, it will mark a vote of confidence in the strength of the US economy. As well, oil prices are under pressure, and this could weigh on the Canadian dollar.

Our latest podcast is titled US labor market and UK’s Labour comeback

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.