The Canadian dollar sparkled last week, as USD/CAD plunged 210 points. The pair closed the week at 1.3509. There are just four events this week. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

Canadian data was mixed, as CPI met expectations but Core Retail Sales disappointed with a second straight decline. Still the Canadian dollar jumped thanks to stronger oil prices. The US dollar was broadly lower as the Trump administration was racked by more scandals. Trump has been accused of interfering in an investigation by FBI director James Comey, raising suspicion of obstruction of justice by Trump. The US dollar fell on market concerns that growth-friendly policies such as tax reform and increased fiscal spending could be stalled. As well, US construction numbers were soft.

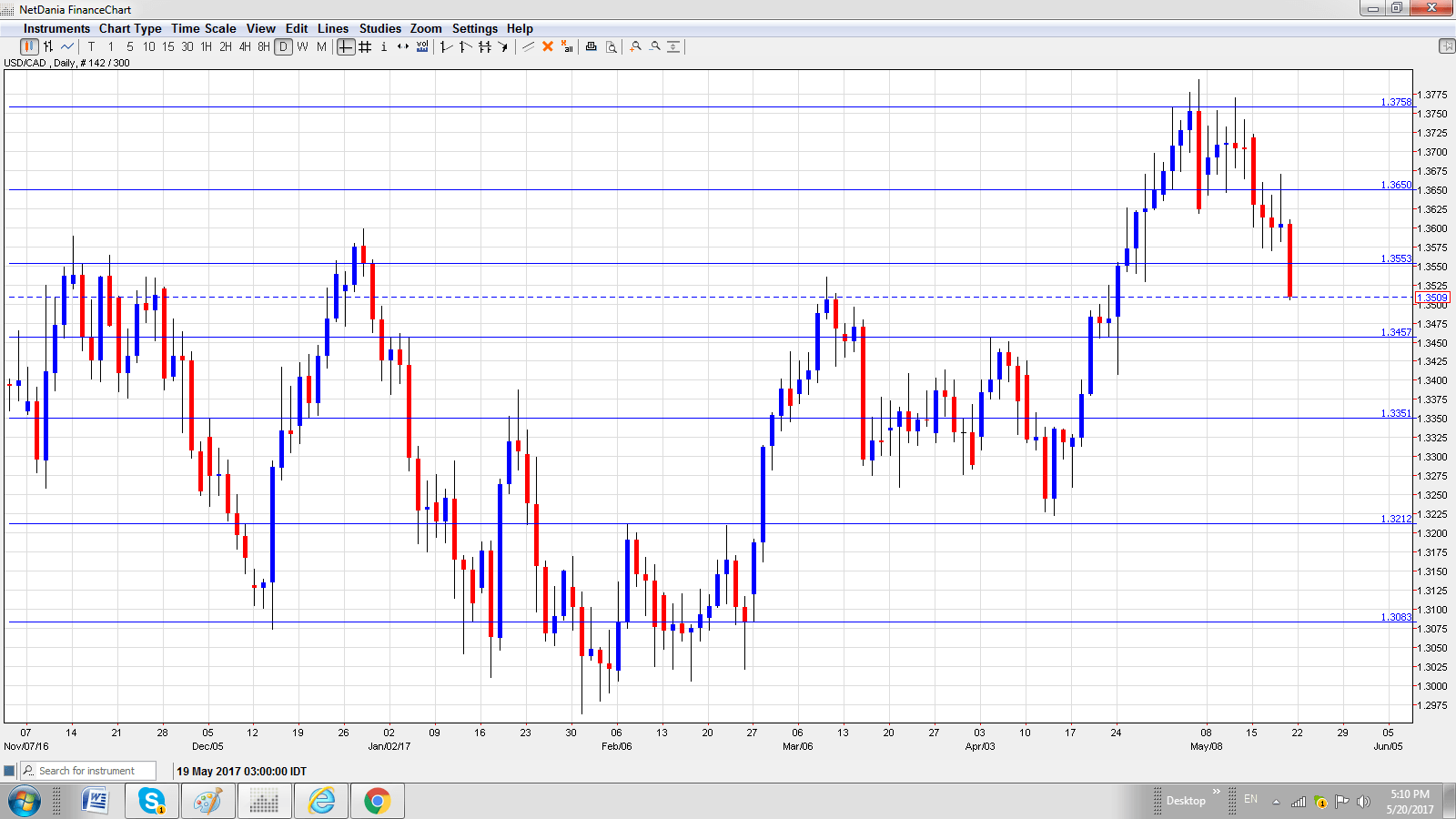

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Wholesale Sales: Tuesday, 12:30. Wholesale Sales is a leading indicator of consumer spending. The indicator posted a decline of 0.2% in February, well off the forecast of 2.1%. Will the indicator rebound in the March release?

- BoC Rate Statement: Wednesday, 14:00. The BoC is expected to maintain rates at 0.50%, where they have been pegged since July 2015. A dovish rate statement would likely send the Canadian dollar to lower levels.

- Corporate Profits: Thursday, 12:30. Corporate Profits has improved, having posted gains for two consecutive quarters. Will we see another gain in Q1?

- BoC Deputy Governor Sylvain Leduc Speaks Thursday, 16:00. Leduc will speak at an event in Toronto. A speech that is more hawkish than expected is bullish for the Canadian dollar.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3718 and quickly touched a high of 1.3722. Late in the week, the pair touched a low of 1.3505, breaking below support at 1.3457 (discussed last week). USD/CAD closed the week at 1.3509.

Technical lines, from top to bottom

We begin with resistance at the round number of 1.39.

1.3757 is next.

1.3648 has switched to resistance following sharp losses by USD/CAD.

1.3551 is next.

1.3457 was a high point in September 2015.

1.3351 has held in support since mid-April.

1.3212 is next.

1.3083 is the final support level for now.

I am bullish on USD/CAD

The political turmoil in Washington has decreased investor appetite for risk, and this could hurt the Canadian dollar. If oil prices fail to consolidate last week’s gains, the currency could reverse directions.

Our latest podcast is titled Brexit bites the BOE, volatility evaporates

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.