- Housing Starts: Monday, 12:15. The indicator provides a snapshot of the level of activity in the housing sector. In March, the indicator jumped to 254 thousand, crushing the estimate of 212 thousand. The April estimate stands at 220 thousand.

- Building Permits: Tuesday, 12:30. Canada’s posted a trade deficit of C$-1.0 billion in February, following three straight surpluses. The markets are expecting a small surplus of C$0.3 billion in the March report.

- NHPI: Thursday, 12:30. In February, this inflation index climbed 0.4%, above the forecast of 0.2%. The estimate for March stands at 0.3%.

- BoC Review: Thursday, 14:30.This minor event is released twice a year. The report includes articles about the economy and the Bank of Canada.

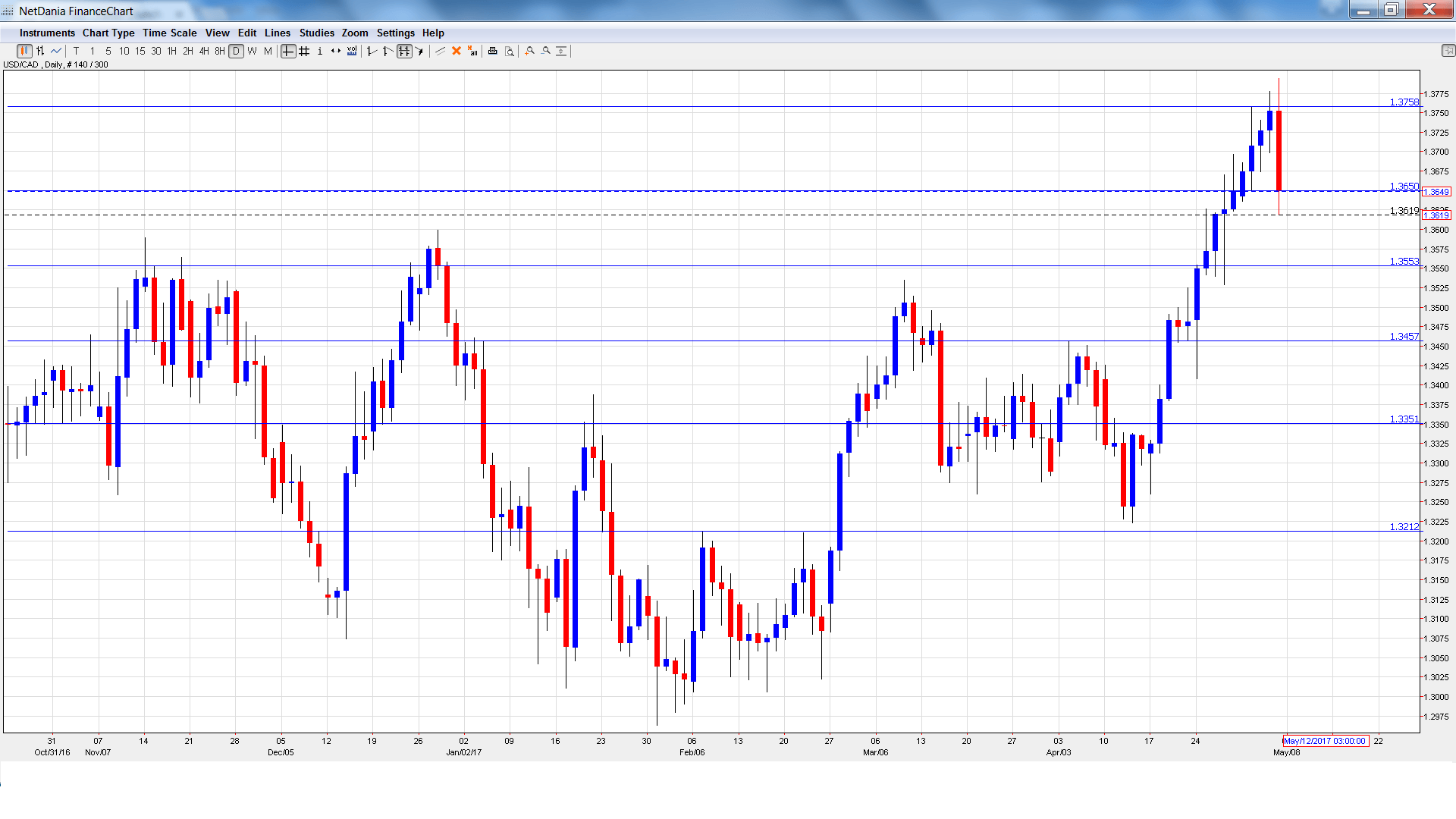

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3642 and climbed to a high of 1.3794. Late in the week, the pair reversed directions and dropped to a low of 1.3619. USD/CAD closed the week at 1.3649, just above support at 1.3648 (discussed last week).

Technical lines, from top to bottom

We begin with resistance at 1.4019. This line has held since February 2016.

The round number of 1.39 is next.

1.3757 is an immediate resistance line.

USD/CAD starts the week just above support at 1.3648.

1.3551 is next.

1.3457 was a high point in September 2015.

1.3351 has held in support since mid-April.

1.3212 is the final support level for now.

I am bullish on USD/CAD

The Fed statement was more hawkish than expected, increasing the likelihood of a June rate hike. The US economy remains strong, despite a disappointing Q1, and weak oil prices are weighing on the Canadian dollar.

Our latest podcast is titled US economic unease and slippery oil

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.