- Manufacturing PMI: Monday, 13:30. The PMI has pushed to higher levels for 6 consecutive months. The index climbed to 55.5 points in March. Will the upward trend continue in April?

- Trade Balance: Thursday, 12:30. Canada’s posted a trade deficit of C$-1.0 billion in February, following three straight surpluses. The markets are expecting a small surplus of C$0.3 billion in the March report.

- BoC Governor Stephen Poloz Speech: Thursday, 20:25. Poloz will speak at an event in Mexico City. The markets will be looking for clues regarding future monetary policy.

- Employment Change: Friday, 12:30.This is one of the most important indicators and should be treated as a market-mover. The indicator posted has posted strong job gains in Q1, and the trend is expected to continue in April, with an estimate of 20.0 thousand. The unemployment rate is expected to remain unchanged at 6.7%.

- Ivey PMI: Friday, 14:00. The indicator climbed to 61.1 in March, its highest level since January 2016. The upward trend is expected to continue, with the estimate for April standing at 62.3 points.

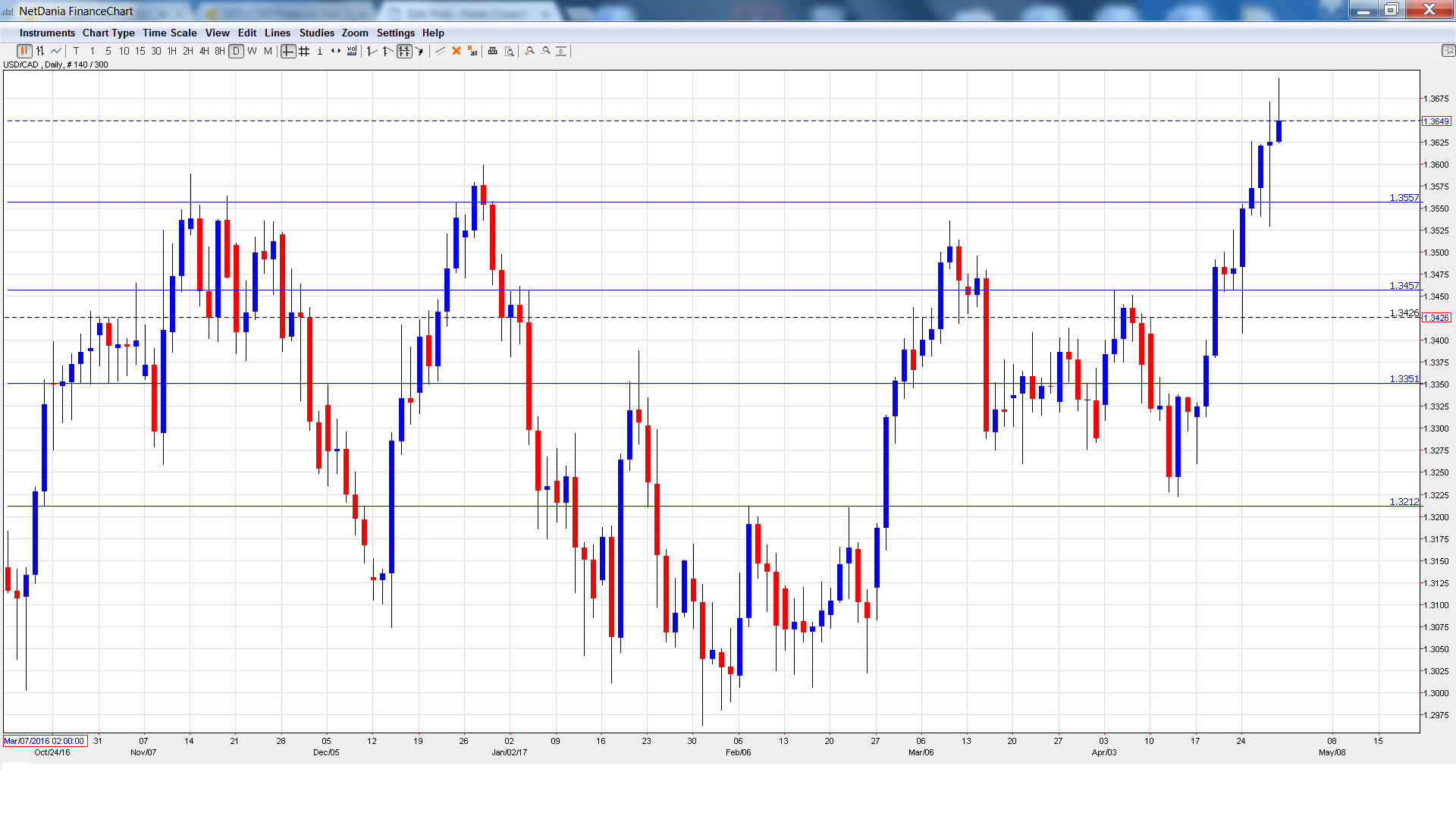

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3483 and quickly dropped to a low of 1.3408. The pair then reversed directions and climbed to a high of 1.3697, as resistance held firm at 1.3757 (discussed last week). USD/CAD closed the week at 1.3649.

Technical lines, from top to bottom

We start with resistance at 1.4019. This line has held since February 2016.

The round number of 1.39 is next.

1.3757 held firm as the pair posted strong gains last week.

USD/CAD starts the week just above 1.3648.

1.3551 has switched to a support role.

1.3457 was a high point in September 2015.

1.3351 is the next support level.

1.3212 is the final support level for now.

I am bullish on USD/CAD

Although Trump’s first 100 days have not impressed, the US economy remains stronger than that of Canada. The soft Canadian GDP reading last week means that the BoC is unlikely to entertain any thoughts of raising interest rates.

Our latest podcast is titled No more dovish Draghi and diagnosing the Donald

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.