Dollar/CAD gradually slips to lower ground but the lows seen a few months ago are still far. What’s next? The pair faces the all-important inflation and retail sales releases. Here are the highlights and an updated technical analysis for USD/CAD.

The price of oil continued advancing after the big break, keeping the loonie bid. Canada’s Ivey PMI came out at 63.8 points, well above expectations and also building permits and housing starts came out above the forecasts. The US tax reform is suffering some bumps on the road and this hurts the greenback.

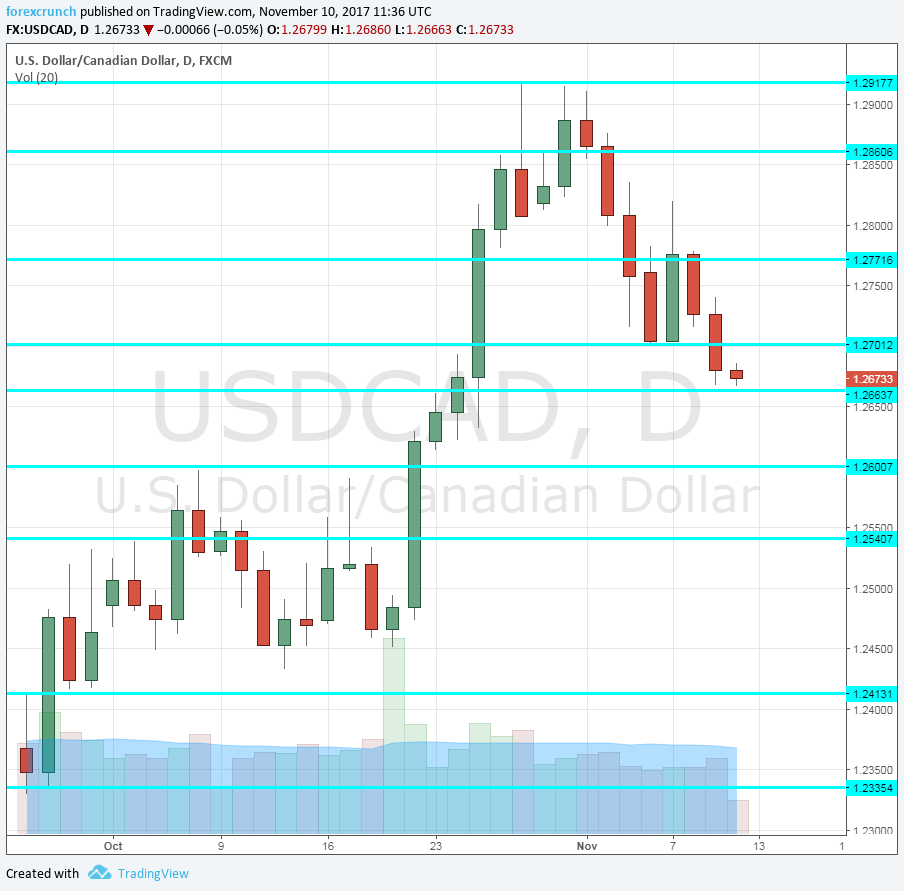

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Carolyn Wilkins talks Wednesday, 23:45. The BOC Senior Deputy Governor was the first one to hint about rate hikes earlier this year. Her speech in New York may contain further hints as the topic is “monetary policy under uncertainty”.

- Foreign Securities Purchases: Thursday, 13:30. Purchases of foreign securities reflect inflows into Canada. These have been positive in the past two months, standing at 9.85 billion in August. The data for September is released now.

- Manufacturing Sales: Thursday, 13:30. Sales at the manufacturing level jumped by 1.6% in August, beating expectations after two disappointing months. A drop is forecast now: 0.4%.

- Inflation report: Friday, 13:30. The Bank of Canada was wary about inflation and the figures for September certainly proved it. CPI rose by 0.2% and so did core CPI. Other measures of inflation also look weak: Common CPI is at 1.5%, the median at 1.8% and trimmed CPI at 1.5%. Another unimpressive report could keep the BOC on hold for a long time. Headline monthly CPI is estimated to rise by only 0.1%.

- Retail Sales: Friday, 13:30. The retail sales report competes with the inflation data but lags in terms of timing. The volume of sales slipped in August by 0.2%. Core sales took a dive of 0.7%. A rebound is likely now.

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD kicked off the week below resistance at 1.2770, discussed last week. From there, it slipped to lower ground.

Technical lines from top to bottom:

1.3160 provided support back in June. 1.3080 was a line of resistance to the pair in its recovery attempts in July.

1.2920 capped the pair in late October. It is followed by 1.2860 which worked as support back in July.

1.2770 capped a recovery attempt in August and is our top line for now. 1.2665 was a swing high of a move higher in early September. It is followed by 1.26, a round number that worked as resistance in October.

1.2540 capped the pair in early October when it traded in a narrow range. 1.2410 held the pair cushioned for some time but was eventually broken. 1.22 is a round number and also worked as support a few years ago.

1.22 is a round number and also worked as support a few years ago. 1.2065 is the (current) swing low of September 2017. It is followed by the obvious level of 1.20.

I turn from neutral to bullish on USD/CAD

After the loonie consolidated its losses and even recovered, the inflation report could serve as a reminder that the BOC is not likely to raise rates anytime soon.

Our latest podcast is titled Yield curve blues and sparks in oil

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!