Dollar/CAD continued experiencing upward pressure amid the top-tier figures from Canada. The upcoming week seems a bit calmer at least if we look at the calendar, but it provides a focus on the housing sector. Where will the C$ go next? Here are the highlights and an updated technical analysis for USD/CAD.

Canada’s GDP squeezed by 0.1% in August, putting further pressure on the loonie. In addition, the RMPI showed a drop in prices. But, the Canadian jobs report was great, showing a leap of 35.3K jobs, giving a much needed shot in the arm to the greenback. In the US, the Fed held its rates unchanged and Powell was nominated as the next Fed Chair. Both moves were expected and priced in.

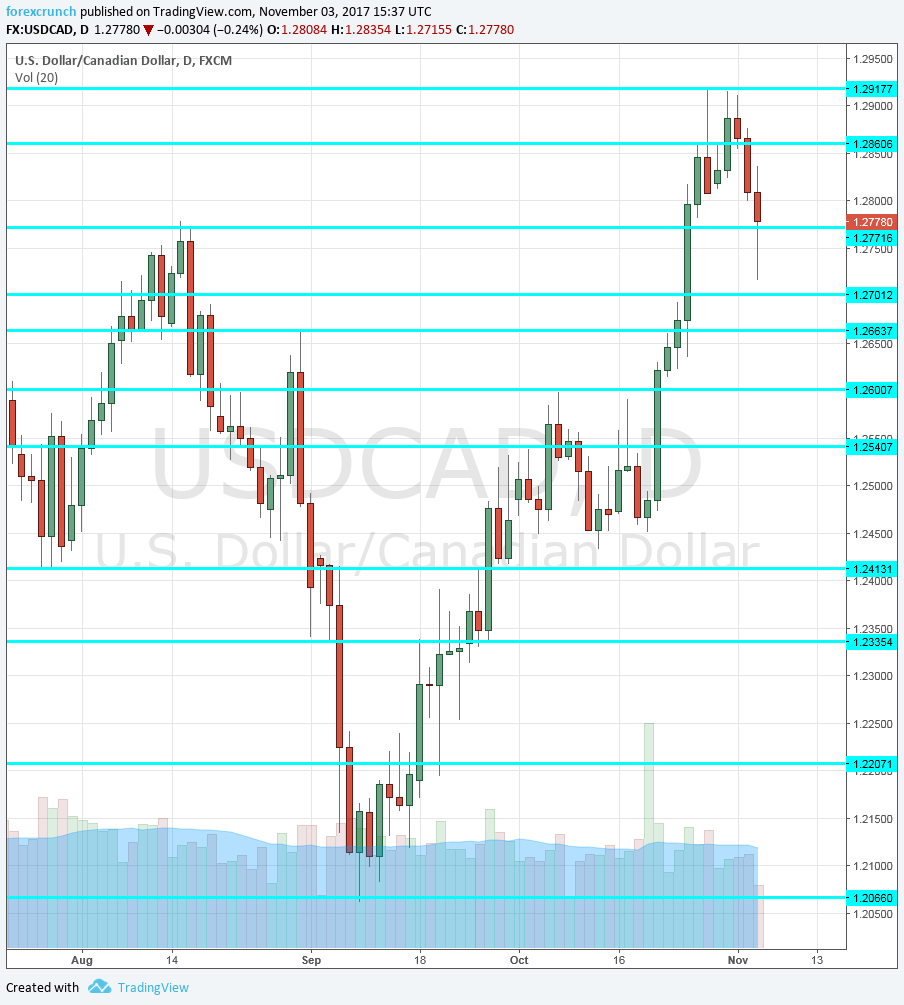

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Ivey PMI: Monday, 15:00. The Richard Ivey Business School has shown a rise in its survey of 175 purchasing managers: a level of 59.6 in September. We now receive data for October which is expected to show 60.2 points.

- Stephen Poloz talks: Tuesday, 17:45. The Governor of the Bank of Canada will speak in Montreal and may respond to the latest data: the jobs report and the GDP publications. He may hint about monetary policy in 2018.

- Housing Starts: Wednesday, 13:15. The level of housing starts has beat expectations in the past four months. A level of 217K was recorded in September. 220K is expected now.

- Building Permits: Wednesday, 13:30. Contrary to housing starts, the number of building consents is somewhat lagging in its publication and is also different in falling short of expectations. A drop of 5.5% was recorded back in August. The data for September is projected now.

- NHPI: Thursday, 13:30. The New House Price Index has ticked up by 0.1% in August, slightly slower than predicted. The last of the housing figures for this week could accelerate its gains now. A small gain of 0.2% is projected now.

* All times are GMT

USD/CAD Technical Analysis

Dollar/CAD started the week above the 1.2860 level mentioned last week.

Technical lines from top to bottom:

1.3160 provided support back in June. 1.3080 was a line of resistance to the pair in its recovery attempts in July.

1.2920 capped the pair in late October. It is followed by 1.2860 which worked as support back in July.

1.2770 capped a recovery attempt in August and is our top line for now. 1.2665 was a swing high of a move higher in early September. It is followed by 1.26, a round number that worked as resistance in October.

1.2540 capped the pair in early October when it traded in a narrow range. 1.2410 held the pair cushioned for some time but was eventually broken. 1.22 is a round number and also worked as support a few years ago.

1.22 is a round number and also worked as support a few years ago. 1.2065 is the (current) swing low of September 2017. It is followed by the obvious level of 1.20.

I am neutral on USD/CAD

The data coming out from Canada is not that great but the jobs report serves as a stabilizer. US data also looks mixed, with the known themes: low inflation and wages and growth in GDP and jobs.

Our latest podcast is titled New normal NFP, reluctant rate rise

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!